The rains marked the week and had their influence on the mood of the livestock marketwho expects to see the impact on values reflected in the short term. In the agricultural area of the west coast, the rains were less generous, although they had arrived late to save crops that the heat wave had finished defeating.. The banking crisis increased the risk in the markets and negatively affected the wool.

The markets.

The price of the pasture steer was confirmed in the last week. The best-trained, special, and volume animals are trading at US$4.40 per kilo carcass and even a few cents more, industry operators said. There is still very little supply in this category.

The average is at US$ 4.25. The fat cows show a significant price gap with respect to the fat one, with values between US$3.80 and US$3.90 per kilo.

The significant increase in the supply of cows in recent weeks due to the drought could begin to slow down and, as a consequence of the rains, balance the values.

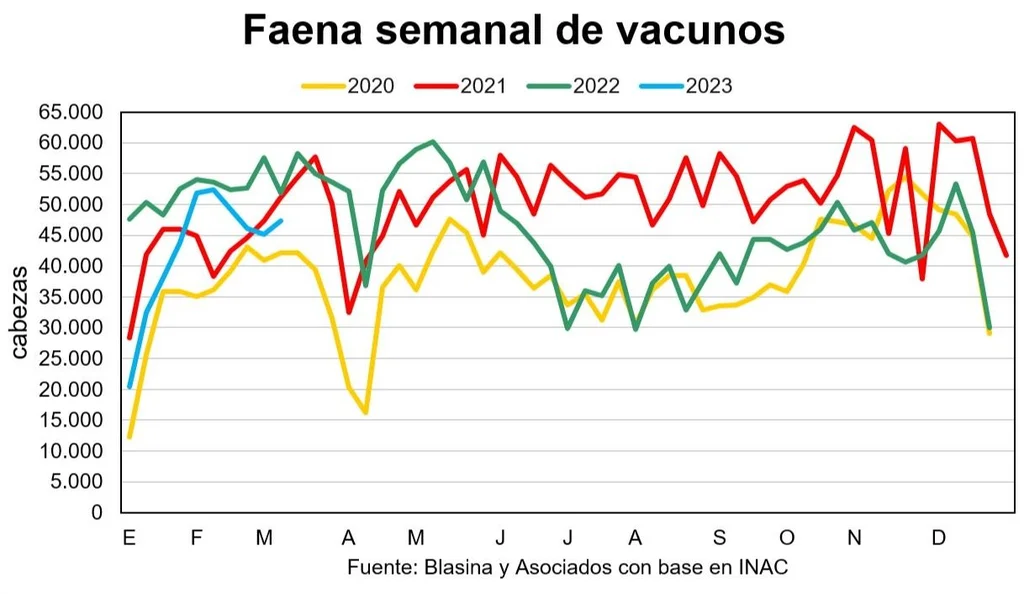

Demand from slaughterhouses continues to be interesting, with slaughter levels above 45,000 heads for six weeks. In the last week the industry slaughtered 47,347 animals, an increase of 5% after three weeks of decline.

The rise in fat cattle prices and the stable values that the replacement maintains are allowing feedlots to reactivate their activity, slowed down since the second half of 2022.

In turn, the industry lowered the requirement for free-range cattle from 280 to 300 kilos of carcass weight, bringing it up to 240 and 250 kilos, something that has been reflected in the drop in the average slaughter weight in recent weeks.

The markets.

With a weekly average of US$4,471 per ton and US$4,413 for the last 30 days, the price of exported meat remains 10% above the values at the beginning of February. In the last week, the rise that had been going on for four consecutive weeks came to a halt.

This week It emerged that in China the cases of African swine fever are growing, which are beginning to affect the production of pork and cutting the forecast for this year. This would be reflected in a price increase, favoring the competitiveness of beef, as happened in 2018 and 2019.

Significant rains in almost the entire country improve the positioning of livestock producers and will begin to balance the offer, especially in the replacement categories. The abundance of calves in the market brought forward the harvest.

The voluminous offer was reflected in the almost 50 thousand cattle that went on sale in the auctions of Plaza Rural, Screen Uruguay and Lot 21 of the last 10 days.

Screen Uruguay dispersed 83% of the catalog in an auction where buyers favored wintering cows and steers of more than 350 kilos destined for corrals, and were interested in calves. Both wintering cows and steers over 3 years old corrected their February prices upwards, while calves averaged US$2.34, 4% less.

In Lot 21, this Friday at Expoactiva, the calves averaged US$ 2.35 per kilo, marginally lowering compared to the previous auction, and the steers improved the averages between 2% and 5%. The trend of greater dynamics in trained animals was maintained than in the intermediate and light categories.

John Samuelle

Ration cattle, an alternative when the supply of pastures is low.

The slaughter of sheep continues at a very good pace and set a weekly record for 2023 with 40,736 heads between March 4 and 11, a figure that almost doubles that of the same week of the previous year.

This month the activity tripled compared to the first 10 days of March 2022, with 72,454 head compared to 24,575 a year ago.

In the accumulated annual figure, 308,998 sheep were slaughtered until March 10, 21% more than the previous year and 15% more than in 2021.

In the foreign market, sheep meat rises slowly, from a lower floor than that of beef. The price for the last 30 days stands at US$3,882, about US$300 above its floor at the end of January.

In the last week the average was US$4,066 and in the annual accumulated it is US$3,823, a figure 24% lower than that of 2022.

The exported volume has grown 24% so far this year, from 4,4320 to 5,349 tons.

The firmness of the market persists with very good demand to supply a slaughter that is reaching record levels, heavy lamb at US$3.33, sheep US$2.94 and US$3.06 for capons.

Grains: losses worsen

The biggest catastrophe of Uruguayan summer agriculture was confirmed during Expoactivawith the loss of around 80% of soybean production compared to 2022: between 500,000 and 600,000 tons against almost 2.8 million tons.

The drought has even affected irrigated crops, which will noticeably lose productivity. Much of the agricultural area of the southern coast has not even received rain in the last week.

“It is the biggest event in history, but by far,” said Andrés Grunert, supervising agronomist engineer of the State Insurance Bank (BSE) on the Rural radio program Tiempo de Cambio. The BSE, which has 60% of the rural market, will have to pay between US$70 million and US$90 million in crop and yield insurance policies.

In soybeans and corn, the bank has 390,000 insured hectares and 180,000 of them with yield insurance, which covers drought, deficit and excess water.

The markets.

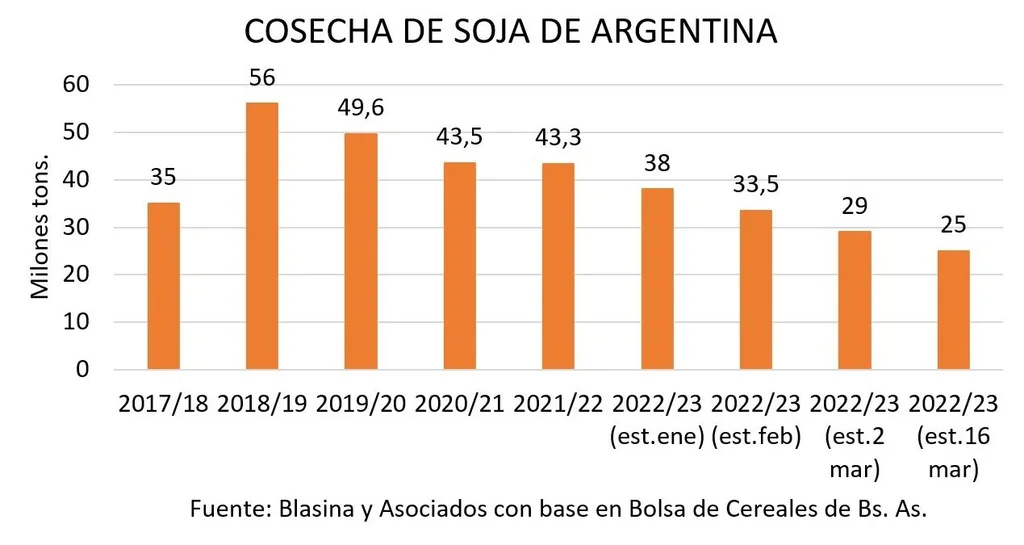

In Argentina, the Buenos Aires Grain Exchange (BCBA) once again revised downward estimates of soybean and corn production, cut four million tons (-14%) to soybean production in the current harvest, taking it from 29 to 25 million tons.

It is a drop of 42% compared to the previous campaign (43.3 million tons) and 48% less than the first estimate for this year: 48 million tons.

This is the lowest level of production in 23 years, only above the 20.1 million tons produced in 1999/2000.

For corn, the reduction was 1.5 million tons (-4%), taking it from 37.5 to 36 million tons and marking a drop of 31% in relation to the previous season. The scarcity of the grain worsens both for the Argentine and Uruguayan markets.

This bullish data for international prices was not reflected in the Chicago market, where the value of a ton of soybeans fell US$5 this Friday compared to the previous day and US$11 after the week. Soybeans closed the May position at US$542 and US$537 for July.

The banking and financial crisis that hit the stock markets and took oil from US$83 to US$72 in less than a week, increased the volume of soybeans on the market: investment funds divested of assets, and sellers from Brazil very active and gaining competitiveness with the drop in the real.

Corn and wheat were supported by strong demand for US grains and the state of their crops, as the Black Sea grain corridor for Ukraine’s production continued to be traded.

The May position wheat broke a four-week downward trajectory and accumulated a 4.6% rise in the week in Chicagogoing from US$249.5 to US$261 a ton.

For corn, the rise of almost 3% in the week, from US$ 243 to US$ 249.7 per ton, was sustained by the demand for corn exports from the United Stateswith four consecutive daily sales announcements totaling 2.1 million tons.

Although the market was also affected by the financial situation and the drop in oil prices, the cut in the Argentine harvest was another bullish factor.

The markets.

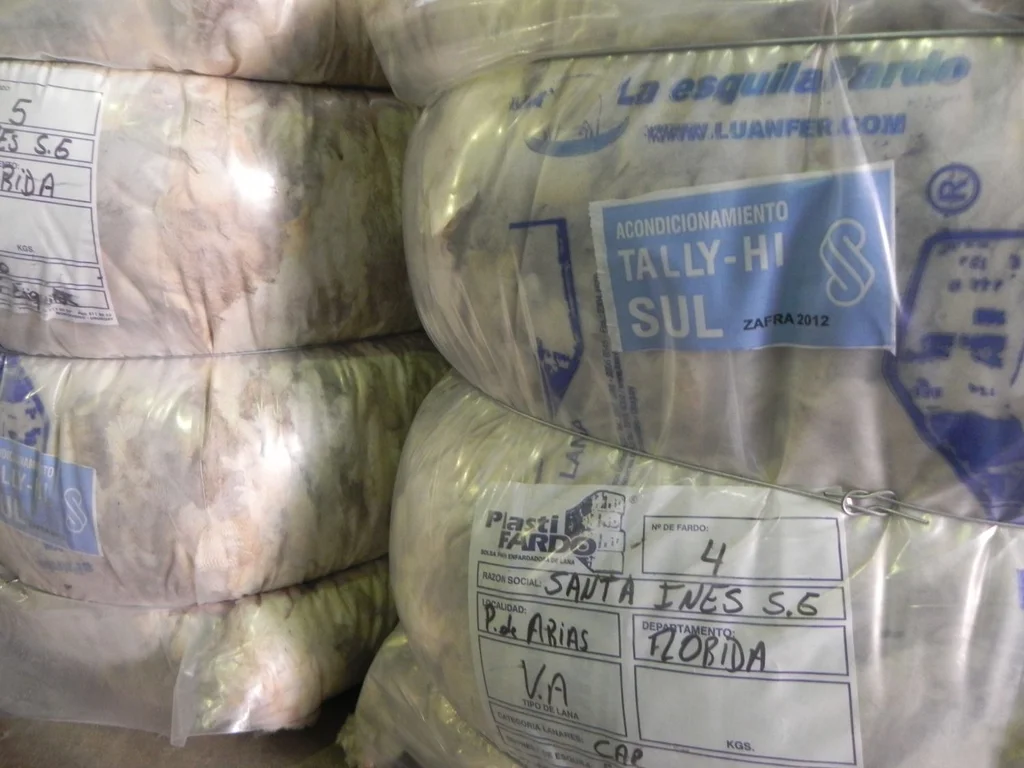

Wool hit by uncertainty

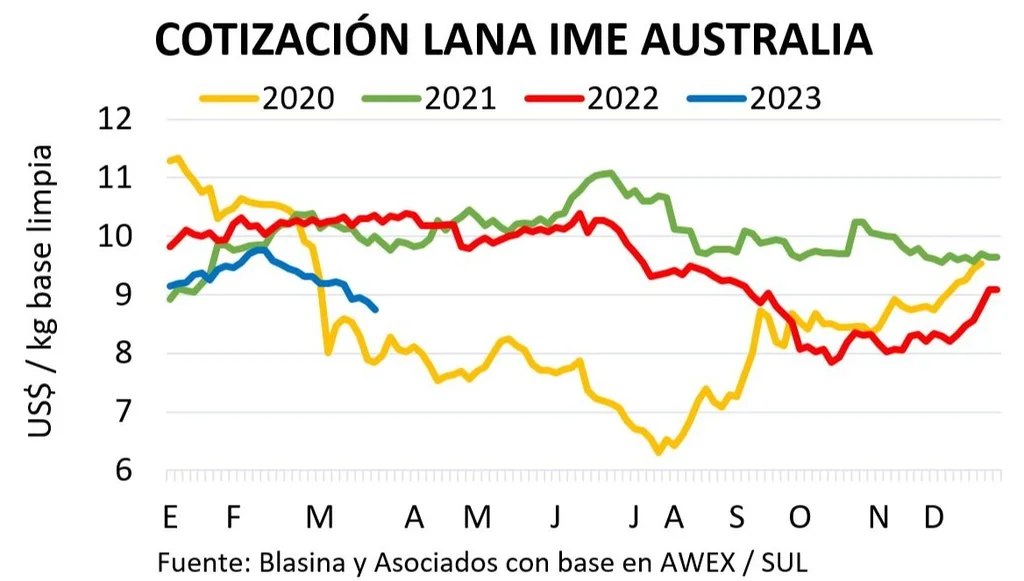

The wool market was affected by the financial turbulence of the last week, which increased the perception of riskalong with the new rate hike in different countries and the prospects of a decrease in consumption, which is clearly expressed in the fall in the price of oil.

This impact was reflected in the Uruguayan market with a virtual stoppage of businesswith a retracted offer that does not validate current prices.

The Eastern Markets Indicator (IME) in Australia, which has been falling since mid-February, fell to its lowest value since December 8, 2022. It closed at US$ 8.74 and lost 21 cents from the previous week with a drop of 2.3%. The 3% drop in Australian dollars was more pronounced, as a result of the rise in the local exchange rate against the dollar.

The sharp drop in prices since the start of operations led to 20% of the offer remaining unsoldin addition to the 8% withdrawn before the beginning of the auctions.

All the wool categories suffered drops, which were more noticeable in the Merino offer from 19 to 22 microns and the 28 micron crossover wools. Only a few specific lots of superfine wool, certified and of excellent quality, generated intense bids and obtained similar values to those of the previous week, paid by Italian buyers.

The leading topista in the Chinese industry led purchases of both Merino and cross-breed wool, taking advantage of the price situation and the lack of competition in fine wool from Chinese buyers.

Wool market, still far from the ideal moment.