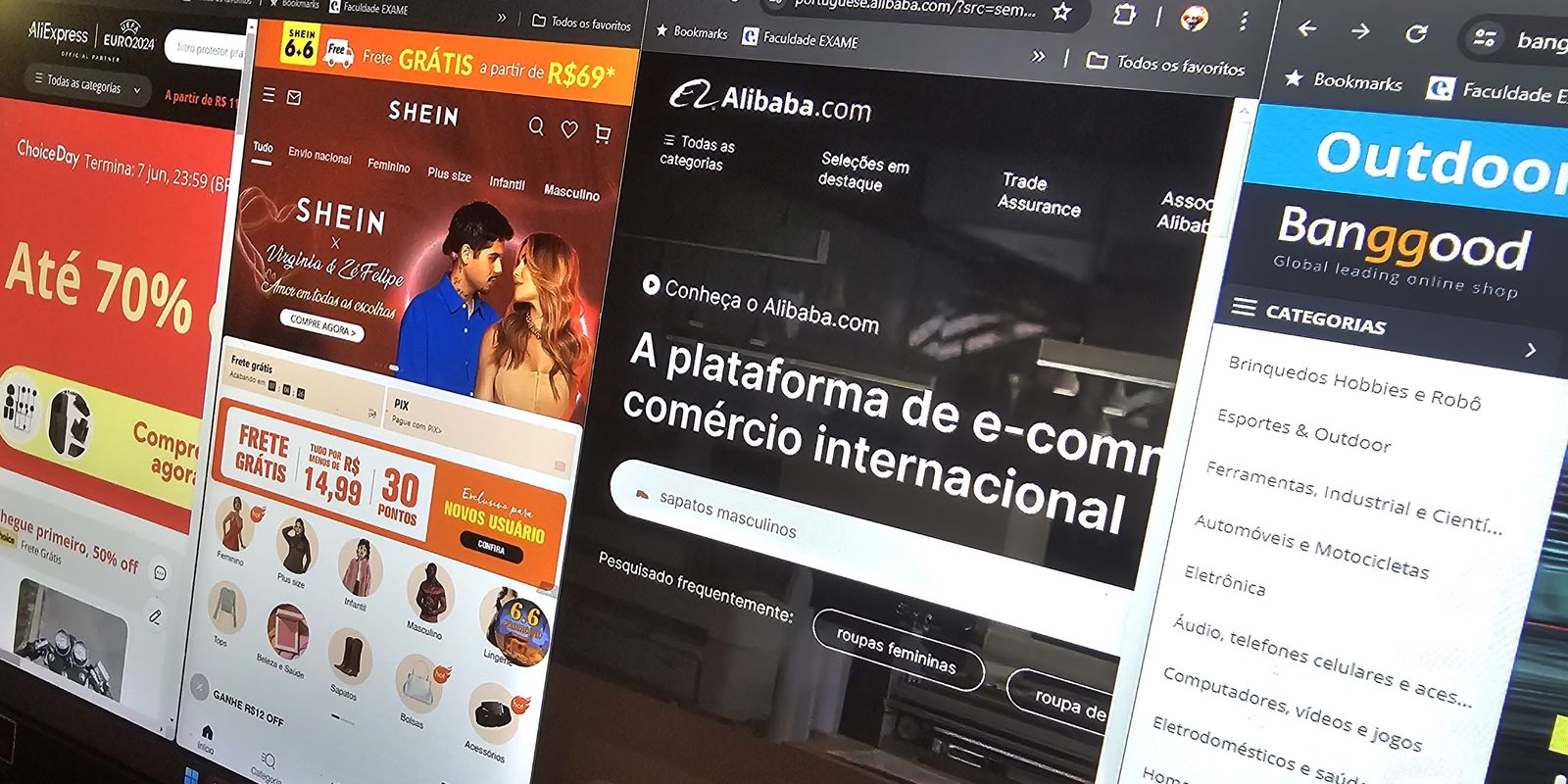

Online purchases of up to US$50 by individuals will start paying 20% Import Tax, starting this Thursday (1st). The fee will be added to the 17% Tax on the Circulation of Goods and Services (ICMS), charged by states since July 2023. Some online retailers, such as AliExpress and Shopee, started charging the fee last Saturday (27), but the legislation only establishes the start of the charge this Thursday.

Regarding Import Tax, purchases of up to US$50 will be taxed at 20%. Products valued between US$50.01 and US$3,000 will be taxed at 60%, with a fixed deduction of US$20 on the total tax amount.

According to customs rules, the 20% Import Tax will be levied on the value of the product, including shipping and insurance charges. The 17% ICMS will be charged after adding the purchase value and the Import Tax.

Established through a “jabuti” included by Congress in the law that created the Mover Program, the 20% tax was postponed to August 1 by Provisional Measure 1,236. The Federal Revenue Service requested the postponement of the charge to give the agency time to set up the charging system and define the regulations and to clarify that the purchase of medicines will continue to be exempt.

“The way the text was, it could raise doubts about whether there would be taxation on medicines imported by individuals. A provisional measure will be published this Friday, which makes it clear that the import of medicines by individuals is exempt from any additional taxation. It maintains the current exemption rules,” said Padilha.

According to Padilha, the MP will also establish the start of the collection of the 20% fee on August 1. He said that this deadline will give time for the Federal Revenue Service to make the necessary regulations and adapt the systems for the collection.

“The provisional measure makes it clear that it will come into effect on August 1st. This allows the IRS to organize itself and the platforms to adapt to this charge,” the minister added,” declared the Minister of Institutional Relations, Alexandre Padilha, after the signing of the law that instituted taxation.

During the law signing ceremonythe vice president and minister of Development, Industry, Commerce and Services, Geraldo Alckmin, also mentioned the need to keep medicines exempt. “What President Lula wants is to exclude medicines because there are individuals importing medicines for some types of illnesses, diseases. So you exclude medicines,” he said.

Historic

Since August of last year, purchases of up to US$50 on international websites were exempt from Import Tax, as long as the websites were registered in the Remessa Conforme Program, which guarantees accelerated release of the merchandise. The transactions, however, paid 17% of Tax on the Circulation of Goods and Services (ICMS), a tax collected by the states, with the guides being charged by the websites still abroad.

At the end of May, the Chamber of Deputies approved 20% federal tax as an amendment to the law that created the Mover Program, to encourage the automotive industry. The Senate approved the text in early June.

On the 22nd, the Secretary of the Federal Revenue, Robinson Barreirinhas, said that the Tax Authority is still waiting for the start of the collection for estimate how much the government should collect from taxation of purchases abroad. The projection, Barreirinhas reported, will be included in the September edition of the Bimonthly Revenue and Expenditure Report, a document released every two months that guides the execution of the Budget.