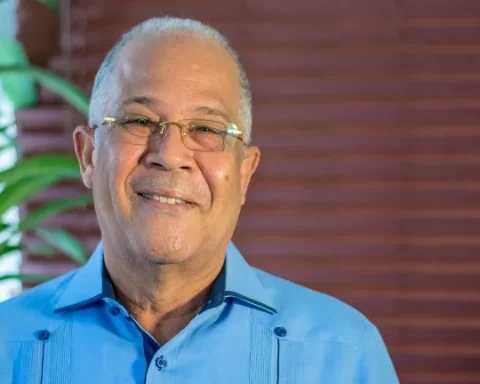

The tax reform project with which the government of Gustavo Petro expects to collect $25.9 billion next year has faced various opinions for and against. The president of the economic studies center Anif, Mauricio Santamaríapresented in the framework of the forum ‘Economic Perspectives of Colombia against the new government’, the pros and cons that the institution sees in the articles established by the Government.

(Read: They launch a campaign for churches to pay taxes in the tax).

Santamaría assured that the main concern that the entity has is the fiscal issue, and that the Medium-Term Fiscal Framework presented by the last government envisages a ‘very optimistic’ path of debt reduction and adjustment of the fiscal balance.

“If the reform were to pass as it is, we would have a significant adjustment in the next three years, but combining a 2.5 point increase in revenue with a 2.5 point reduction in spending. It’s difficult, and in a situation of external deficit like the one we have, it becomes even more difficult, and with the spending priorities announced by the government, I don’t know where this issue comes from.Santamaria said.

The positive

Faced with the reform initiative, he assured that it is a good message that a reform had been presented quickly, because it shows commitment to address the fiscal deficitbut assured that it has “several points to highlight and others that are worth discussing.”

Among the positive, Santamaría mentioned that seeks a greater collection of natural persons. “That is the big problem in Colombia, we economists have been saying for years that we put a lot of taxes on companies and not on individuals, and we have lost that fight. That’s positive.”

He also said that there is a simplification of the system and a greater collection is sought for the creation of the ‘single card’, but he explained that this also has a negative side. The elimination of exemptions was another element that he described as positive, since he said that “there are many exemptions without justification and it is good to put teeth into everything,” but said that he did not know how successful the government would be in eliminating them in Congress. Santamaría also highlighted the efforts that the project brings to deepen the simple regime.

the negative

On the other side of the coin, according to Santamaría, he proposed, for example, make an effort so that more natural persons pay taxes. “It is very good to try to collect more from natural persons, but we should make an effort to increase the base of natural persons, who pay the middle part of the distribution, with very low effective rates.”

In relation to the single identity card, although he described it as something positive, he said that it is ‘worrying’ about dividends and windfalls, as it can generate double taxation. Santamaría also criticized that there would be a significant increase in the effective rate for legal entities with taxes on occasional profits, dividends and reduction of deductions, and that “the creation of the single identification card and reduction of exempt income up to 1,210 UVT increases the effective rate for natural persons in a considerable way”.

(Also: ‘Another reform may be needed in about two years’: Santamaría).

Regarding hydrocarbons, and taxes on extraordinary exports, Santamaría assured that it is an issue that should be reviewed “because they are a hard blow for the sector”, at a time when the iIncome generated by the sector is required.

Santamaría also criticized that exemptions are being eliminated, but not in terms of VAT. “I know that it is an issue that is not going to be touched, but where the greatest fiscal cost is in VAT,” said the president of Anif.

Laura Lucia Becerra Elejalde