For four weeks the special steer in Uruguay has been above US$ 5 per kilo of carcass. Nothing on the horizon suggests that the firmness scenario will change, estimate market operators consulted. The war, for now, does not greatly affect the meat market and international demand continues to push.

Although the vertiginous rise in prices that it had brought since mid-January stopped last week, there is full firmness for the fat man. Prices tend to stabilize. A year ago the steer was at US$ 3.58. In the new livestock normality, going back below US$4 is not seen as a close possibility.

Some plant proposed values below US$5 last week and the market did not validate it. In recent days, business continued to be done above that reference for special export steers, and the average sales for the category are on that axis, with loads ranging from one week to 10 days.

The rains and the fodder boost improve the producer’s position, which he takes advantage of to give the cattle a good finish. The supply of good and heavy lots is low. And those are the ones that tip the balance above US$5.

The special fat cow is around US$4.75 per kilo, with a wider range of prices based on weight and quality.

The slaughter continues well above 50 thousand heads a week.

The work does not loosen

Last week’s slaughter was the highest so far this year and supports the firmness of the fat ranch. There were 57,609 cattle slaughtered in the week, which brought the annual accumulated to 470,132 heads, 18% more than the start of 2021.

The global appetite for beef remains. International demand is sustained. For now, the war between Russia and Ukraine has not greatly affected the meat market, beyond the specific shipments that go to Russia, mostly offal in the case of Uruguay.

In China, the main destination for Uruguayan meat, operations have remained agile after the lunar new year –in February–, with outstanding prices.

Beef at US$ 4,938/ton

The weekly export price fell for beef, but the average of the last four moving weeks is US$ 4,938 per ton, according to preliminary data from the National Meat Institute (INAC). In the annual accumulated value is 30% above the 2021 average, with US$ 4,859 per ton.

This year China is expected to increase its imports of beef and live cattle, according to estimates from the Beijing office of the United States Department of Agriculture (USDA) published last week. The rate of increase would slow down, which will be around 3% year-on-year.

EO

Replacement with record values

The signals that come from outside, extraordinary work and fat prices never seen before have pushed the values of the replacement and have stimulated the appearance of supply at the gates of the calf harvest.

In this week’s virtual auctions, calves averaged US$3.12 per kilo in Uruguay Screen and US$2.81 in Lot 21, a record in each of the consortiums. The difference between one and the other lies mainly in the weight of the lots, in both auctions with high bulk averages.

Solid market in sheep

The sheep market is following the same line as cattle: solid. The supply has been balanced, with a higher volume of sheep and capons. Demand is sustained and prices are on the rise. Heavy categories are fluidly placed with eager demand.

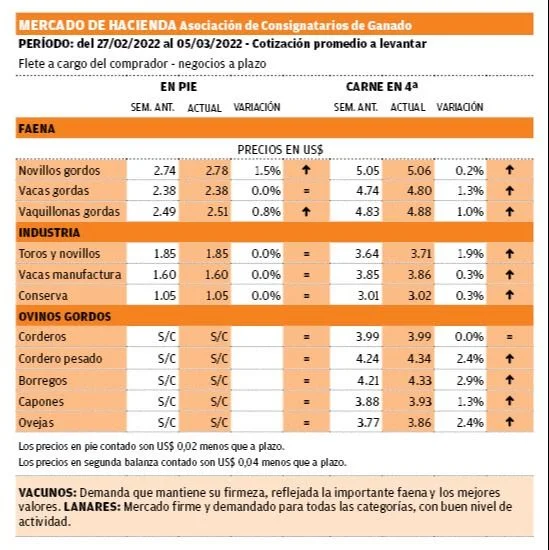

Lamb is priced at US$4.25 per kilo, lamb at US$4.33, capon US$3.93 and sheep US$3.86.

The slaughter fell last week to 24,284 sheep, but in the accumulated annual figure it has already crossed 250,000 heads, 4.4% more than in the same period of 2021.

The export price for sheep meat is at US$ 5,123 per ton so far this year, that is, 7.6% above the US$ 4,760 per ton for the same period last year, always based on data of the INAC.