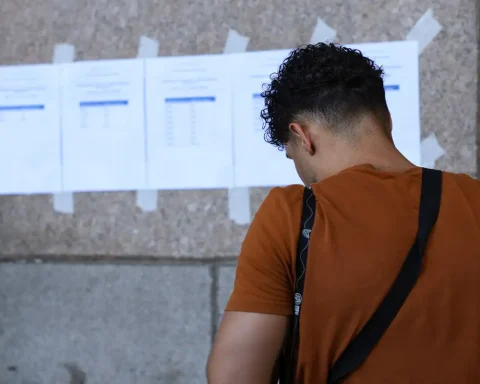

The Federal Revenue announced this Monday (27) the rules for delivering the 2023 Income Tax (IR) declaration, which is based on the year 2022. The delivery period will be between March 15 and May 31 . To facilitate the delivery of the document, the Revenue made some changes this year, such as making the pre-filled declaration available from the first day of the delivery period.

Revenue expects to receive up to 39.5 million declarations by the end of the term, of which 25% are pre-filled.

The payment of refunds begins on May 31st and was divided into five monthly groups until September 29th, according to the date of delivery of the declaration. Priority in receiving refunds is given to seniors aged 80 years or over, seniors over 60, the disabled and people with serious illnesses and taxpayers whose main source of income is teaching.

The novelty this year is that those who use the pre-filled model or choose to receive the value through the Pix key will also have priority in receiving the refund, provided that the key is the citizen’s CPF. According to the Revenue, the two new priority modalities are intended to reduce errors in the declaration. When opting for Pix, for example, you don’t need to report any more bank details, just the CPF itself.

“Are given [em] that, historically, citizens make mistakes, and end up being a complicating factor,” said tax auditor José Carlos da Fonseca, responsible for the 2023 Income Tax program, at a press conference this Monday.

Completion and delivery can be done through the Declaration Generator Program for the year 2023, which will be available for download at the site from the IRSor through the My Income Taxwhich can be accessed by site of the Revenue, by e-CAC portalor through the app to tablets and cell phones. My Income Tax now has a new visual identity, in line with the graphic pattern of other federal government systems.

For citizens who have tax to pay, the single quota expires on May 31. For the others, the due date is the last day of each month until the eighth installment on December 28th. Anyone interested in opting for automatic debit in the first installment, or in the single installment, must deliver the statement by May 10.

Whoever submits the document after the deadline pays a fine of 1% per calendar month or fraction of the delay, calculated on the total tax due. The minimum fine is BRL 165.74 and the maximum amount corresponds to 20% of the tax due.

who must declare

This year, citizens are required to declare that they had, in 2022, taxable income worth more than R$ 28,559.70. In the case of income considered “exempt, non-taxable or taxed exclusively at source”, it is mandatory to declare who received an amount greater than R$ 40 thousand.

Anyone who had a capital gain on the sale of assets or rights subject to the levy of the tax, as well as those who, on December 31, 2022, owned assets or rights, including bare land, above BRL 300 thousand; and people who, in rural activities, received taxable income above R$ 142,798.50.

People who have traded on stock exchanges in the last year must also declare the IR. But this year, the Revenue established two limits. Those who sold shares for amounts above BRL 40,000, regardless of the volume of purchases, and those who carried out operations and had net gains subject to the incidence of taxes, above the exemption limit of BRL 20,000, must present income.

Fonseca recalled that there are other mandatory criteria and that the recipe’s normative instruction with all the rules for filing the IR should be published this Tuesday (28) in the Official Diary of the Union.

According to Fonseca, data from B3, the Brazilian stock exchange, point to an increase in people investing money on the stock exchange. In 2022, the number of investors in B3 grew by 17.5%, and 80% started with very low values, up to R$ 1 thousand. “We believe that, with these limits, a portion of the people who would declare only for movement in the stock market will be dismissed”, he said.

pre-filled statement

The pre-filled declaration has been available for some time, but in 2023, unlike previous years, it can be done from the first day of delivery of the declarations. The model is for exclusive use by taxpayers with accounts at Poratl Gov.br at the gold or silver levels.

In this model, the taxpayer starts filling out the information already available. The Revenue warns, however, that it is everyone’s responsibility to check and correct, if necessary, the imported information, in addition to including data that is not in the system.

The information that appears on the pre-populated form is based on data from the previous year’s statement; of income and payments informed in the Withholding Income Tax Declaration (Dirf), in the Declaration of Information on Real Estate Activities (Dimob), in the Declaration of Medical Services (Dmed) and in the Carnê-Leão Web; and in private pension contributions declared in e-Financeira.

For 2023, another novelty is that the pre-filled declaration will also include information on the purchase of properties from the Declaration of Real Estate Operations (DOI), on donations made and reported by institutions in the Declaration of Tax Benefits, on crypto assets declared by Exchanges (entities that sell cryptocurrencies) and on bank and investment fund balances.

The Revenue will also include new bank accounts or investment funds, or those that were not informed in the 2022 declaration. It is mandatory to inform accounts with balances above R$ 140. Finally, the income from income tax refund received in the previous calendar year.

Another novelty for this year is the access authorization for third parties to have access to My Income Tax and be able to make the IR declaration using the pre-filled declaration and other Revenue services. The resource is different from the electronic power of attorney given to accountants and is aimed at small family groups, in which one person makes the declarations of other family members, for example.