Petrobras has reached the unprecedented milestone of one million individual shareholders on the Brazilian stock exchange. In five years, there has been a 170% increase in the number of people who own shares in the company.

Furthermore, the percentage of individual investors in the company’s share capital is currently higher than that of Brazilian institutional investors. This fact demonstrates the growth of the capital market in Brazil, which has been increasingly democratized, and Petrobras is following this growth.

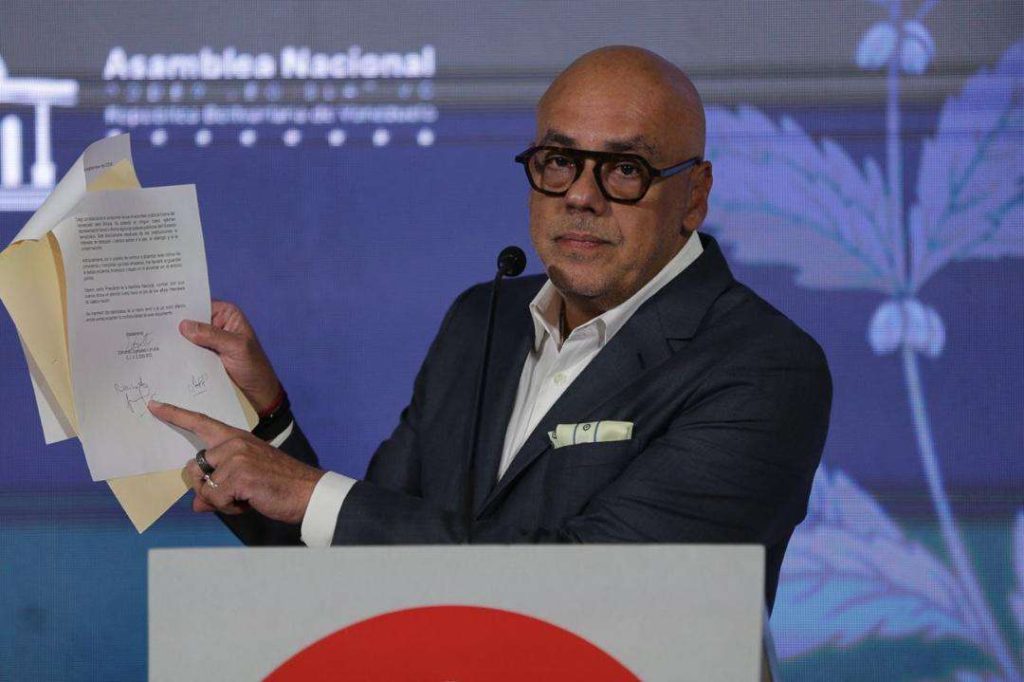

“The increase in the number of shareholders adds to a series of good news that the company has been receiving in the market and reflects investors’ confidence in the company’s potential and in the generation of value from its projects and results,” the company reports.

In the year, the return to the company’s preferred shareholders (appreciation + dividends) is 11.4%, while Brent crude oil, a benchmark in the international market, depreciated 4.1% and the Ibovespa index appreciated 0.6%. In addition, 12 of the 16 large banks (75%) that cover Petrobras recommend buying the company’s shares.

Individual Investors

Individual investors are individuals or legal entities that invest their own money in certain assets, such as shares in publicly traded companies. Institutional investors are organizations, such as investment funds, pension funds, banks or insurance companies, that invest on behalf of third parties.