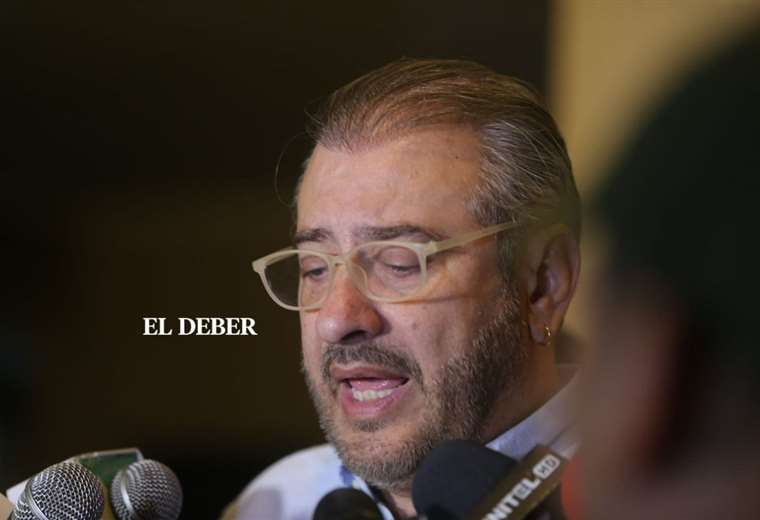

Petrobras’ CFO and Investor Relations Officer, Rodrigo Araujo, said today (4) that the company acted completely within the scope of the shareholder remuneration policy and that the policy establishes the payment of dividends every 3 months.

According to him, Petrobras did not have access to the representation of the Federal Public Ministry (MPF) at the Federal Audit Court (TCU), which asks for the immediate suspension of the distribution of dividends anticipated by the company. But he added that, “as it always does”, the company is at the disposal of the TCU to provide all the information.

The third quarter marked the payment of taxes in the order of R$ 73 billion, accumulating this year, up to September, over R$ 222 billion. According to the director, almost 55% of operating cash generation returns to society in payment of taxes and dividends.

The financial director also recalled that the payment of quarterly dividends is not an exclusive practice of Petrobras, but of all large companies in the oil and gas sector with similar dividend policies. And he said that this practice does not compromise the solidity of the company.

Profit

According to Araujo, the net profit of US$ 8.8 billion, obtained by Petrobras in the third quarter, is “very solid and expressive, both on the operational and financial side”. “In many metrics, it’s the second best result in the company’s history, preceded only by the second quarter result of this year, which was the company’s biggest”, he said.

According to the 60% free cash flow formula, dividends will be paid to shareholders totaling R$3.35 per share, in two installments. The first is scheduled for December 20, and the second, on January 19, 2023, in the order of R$ 1.67 per common and preferred share. Third-quarter dividends reach R$43.7 billion