April 6, 2023, 1:40 PM

April 6, 2023, 1:40 PM

The Public Pension Manager allocates Bs 20 million a year to pay salaries to 200 officials. Starting in May, the state company will assume the management of US$ 23,000 million that today are under custody of the Pension Fund Administrators (AF) Futuro de Bolivia and Previsión BBVA.

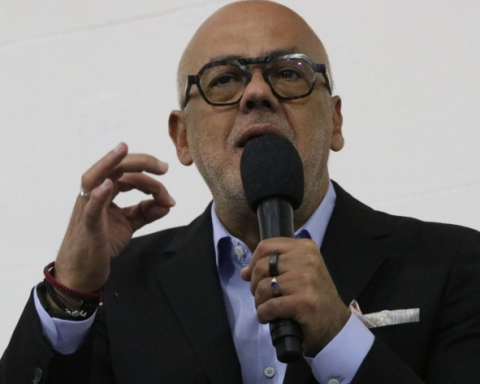

Jaime Durán, general manager of the Pension Manager, in an interview with Red Uno, said that the total cost of the payroll is Bs 20 million (annual), of the total of Bs 100 million they have as income, so salaries represent 20%. Thus, it came out of the complaints of the leaders who questioned the form.

He said that he earns Bs 35.00 a month and pointed out that he receives that salary “because it is a specialized entity and the experts earn this salary because they handle money and are well paid like the pilots. “If you trust one person with the lives of 200 people, then you must earn well. We are going to manage a portfolio of $23,000 million, so this salary level is justified, according to the responsibility and specialty that one has”.

Regarding the possibility of having AFP personnel, he maintained that the people they need to serve the public will effectively be absorbed. “It is not an employment agency, but we must have the technical staff. We are going to work with 400 people, currently we are 200”, he added.

The official denied that politicians will manage the entity because it is a technical and specialized company, the norm, the Constitution, decrees and regulations are complied with. “Is a technical entity that applies pension and investment regulations. Everything is regulated. I want to completely rule out that they manage politicians, and that is why we managed to generate profits and greater profitability compared to other operators, ”he said.

Asked about how they will prevent it from becoming politicized or becoming an employment agency, Durán said that there is a high degree of institutionality because the labor regime is within the framework of the General Labor Law and there are technical personnel.

“The instruments that allow the hiring of personnel establish technical profiles for the management of social and financial security. Our staff is highly technical and the entity is subject to the supervision of the board of directors, so the Manager will maintain a high technical profile,” he said.

But who is going to supervise the Manager? On the subject, the official said that he is in charge as general manager and has the academic profilewhich allowed him to carry out a positive management of the entity.

“Law 065 is demanding in terms of requirements, workers must have extensive experience in pensions and the financial sector, but I clarify that it does not mean that the social sectors cannot be present. They can participate, but the goal is for the board to be technical and independent,” he said.

Asked if the contributor can audit, Durán said that the current system has a personal pension account, which is available to everyone the insured that is obtained from the web page or platforms with the history of contributions, payments of risk premiums and others. “In addition, the contributions are reported on the returns on capital, which now has 3.5%, so it is a document with which the AFPs are required to retire and in the future it will be done with the Manager.”

Regarding the questioning of resource management, Durán affirmed that there is audit reports that will be made with specialized companies with extensive experience who review account by account, transaction by transaction that the resources are made transparently and everything is done through the financial system. “And the investments are made through the Bolivian Stock Market, so I want to give the population complete peace of mind that the resources will be well managed,” he said.

Do the ‘padlocks’ also serve to prevent pension resources from being used to pay salaries? she was consulted, to which he replied: “It is false, we have 30,000 insured who contributed Bs 34 million, this fund has been invested and generates returns of more than 4%, the Manager survives on the Universal Old-Age Income that is paid to 1.5 million people,” he emphasized.

To provide certainty, the official indicated that “Bs 7.8 million in profits have been generated in 2021 and Bs 17.23 million in 2022, which shows that we are an efficient company.”

He regretted that lies and fallacies are spread about the Manager. “I invite the leaders look at our financial statements to see that we are an efficient company, which increased its equity with a growth rate of 82% and has Bs 34 million of equity. So, what they are going to find is efficiency in this state-owned public company, ”he concluded.