Venezuela hopes that Washington will renew the license that protects Citgo from creditors after it expires on July 19, as a way to encourage the completion of payment negotiations. The US Treasury has given its approval for the refinery’s share auction, but said individual companies would have to obtain a license to take possession of any assets.

Negotiators representing Venezuela held talks to reach a payment agreement with bondholders and creditors, who are owed billions of dollars in defaults and expropriation claims, he told Reuters the head of a board that oversees the country’s foreign oil assets.

The talks have gained urgency as a federal court judge will decide in August whether to start a share auction that could lead to the spin-off of Citgo Petroleum, Venezuela’s most important foreign asset. The United States has for years protected the PDVSA subsidiary from seizure under a license that will expire next month if not renewed.

Some $2.6 billion in claims approved by the courts of Crystallex International, ConocoPhillipsSiemens Energy and Red Tree Investments could be applied to auction proceeds.

Holders of a defaulted PDVSA bond backed by a 50.1% stake in one of Citgo’s parent companies are separately claiming hundreds of millions of dollars in a court case in New York.

*Read also: US to auction Citgo assets to meet creditor demands

Arrangement of the parties

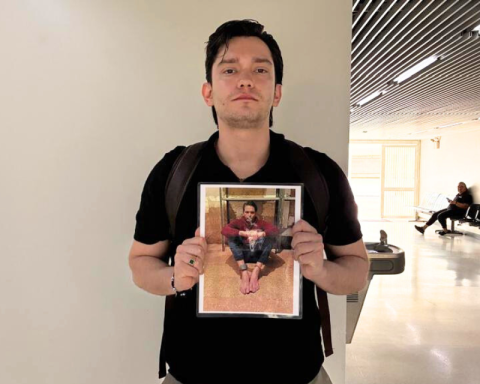

“We have made progress with the bondholders and Crystallex since party representatives first officially met late last year and in February, respectively. Offers and counteroffers have been presented,” said Horacio Medina, head of the ad-hoc board that oversees the management of Petróleos de Venezuela and foreign subsidiaries.

A negotiating team representing Venezuela also held talks with ConocoPhillips, but they did not exchange financial proposals. “The parties have shown good faith and willingness. We hope to be able to start the negotiation phase with them soon,” Medina said about the discussions with Conoco.

Talks with Siemens Energy and Red Tree Investments, the other two creditors in the Delaware case, they have not started.

Conoco, which is seeking to collect $1.3 billion from one of the arbitration awards linked to the expropriation of its oil projects in Venezuela, declined to comment. But Chief Executive Ryan Lance said in May that it saw “the light at the end of the tunnel” for the claims of the acquisition of its Venezuelan assets in 2007. A representative for Crystallex declined to immediately comment. Citgo did not respond to a request for comment.

race against the clock

The US District Court judge overseeing the Crystallex lawsuit said this week he plans to start regular meetings next month with a court official who has set up an auction schedule, a sign the process could begin as early as September.

It’s unclear how that judge would view the settlements after allowing what started with a single Crystallex claim to expand to include other creditors who conditionally link their claims to the case.

Venezuela hopes that Washington will renew the license that protects Citgo from creditors after it expires on July 19, as a way to encourage the completion of payment negotiations. The US Treasury has given its approval for the auction, but said individual companies would have to obtain a license to take possession of any assets.

*Read also: Opposition recovers 49.9% of Citgo shares that were held by the Russian Rosneft

Citgo’s profits have risen sharply in the past two years. It posted a $937 million profit for the first quarter of this year and a $2.8 billion profit in 2022. It reduced debt by $1.1 billion last year and $473 million so far in 2023.

Venezuela-related expropriation claims in US courts pursuing Citgo’s assets exceed $20 billion, while the company’s 769,000 barrel-a-day refining network and other assets have been valued at around $13 billion.

With information from Reuters

Post Views: 764