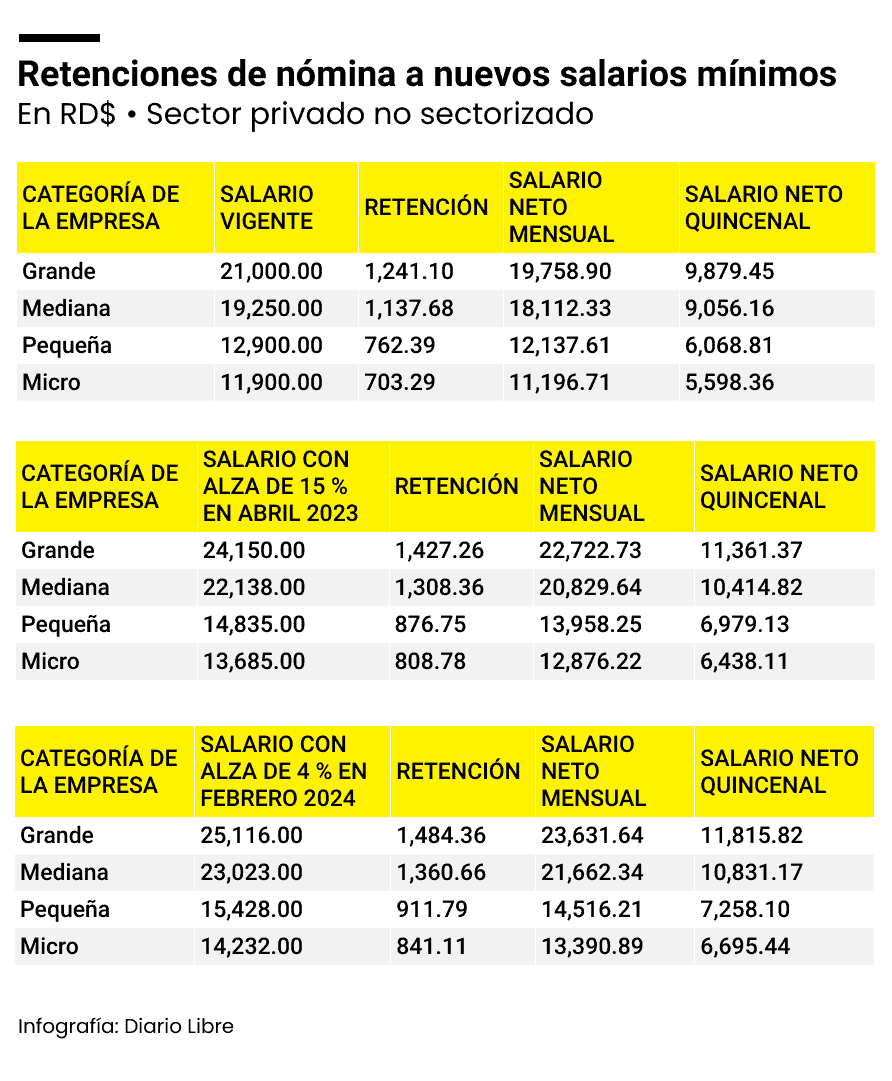

A salary increase is positive, but it also entails more withholdings. And that will be the case of the new minimum wages approved for the non-sectorized private sector whose increase will be gradual: 15% next April and 4% in February 2024.

If the company complies with the standards, each salary must be deducted 2.87% for the pension plan and 3.04% for Family Health Insurance (SFS).

Since none of the new minimum wages approved on March 8 reaches the current minimum amount to discount the income taxThey are exempt from this tax.

Anyway, how much will the new ones be? withholdings of the minimum wage approved by the National Committee for Wages? We present them below, based on an employee who does not have dependents in the SFS and current labor regulations.

For the private security guardswhich are also included in the recently approved increase, the withholding will be 1,172.37 pesos, when their minimum salary rises to 19,837 pesos in April, and 1,219.29 pesos when it increases to 20,631 in February 2024.