The Spanish fintech Payflow, which allows companies to offer salaries to their employees when it suits them best, has just launched its “a la carte” salary services in Peru. Payflow currently allows more than 200,000 employees in Europe and Latin America in companies such as Telefónica, Webhelp and Pernod Ricard, to receive their salary when it suits them best and without having to wait for the end of each month.

The Spanish fintech aims to reach 150 Peruvian companies by 2023 and be able to offer its salary collection and financial welfare flexibility services to some 100,000 Peruvians.

Expansion in Latin America

Payflow was part of the Y Combinator acceleration program, and landed in Latin America in the Colombian market at the end of 2021.

After the success in Colombia, where in just over a year they have already served more than 100 companies and more than 25,000 Colombians, Payflow enters Peru to support Peruvians in their financial well-being, since more than 70% of Peruvian families have suffered from financial stress in 2021.

For this reason, the solution proposed by Payflow allows establishing modern and flexible salaries without the worker having to wait to collect the payroll, helping them to improve their financial health. In this sense, Benoit Menardo, co-founder of Payflow explains that “the fintech was born with the very clear objective of bringing financial well-being to millions of collaborators. We are very proud to see how we are fulfilling this mission and very happy to invest in Latin America to make it our number 1 focus.”

The first steps in LATAM on the right track

As has already happened in Spain, Payflow wants to become the real-time salary leader in all of Latin America, starting with Colombia and Peru. At the moment, the Spanish fintech has already invested more than a million dollars in Latin America with its launch in Colombia, and now it will invest 2 million dollars for Peru, an investment that will increase if the expected results are achieved

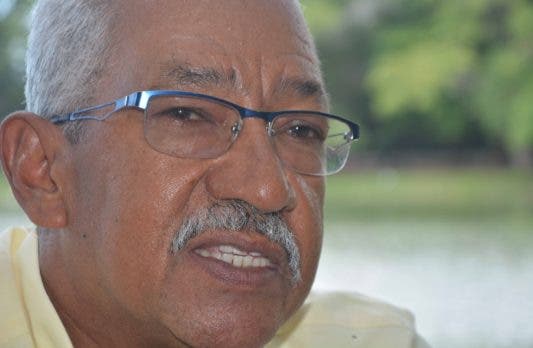

Leading the project in Peru is Sergio Zuzunaga who has experience working at McKinsey & Company, one of the most prestigious international consulting firms and in the strategy area of important companies in the Peruvian market. Sergio launched a fitness company, and has an MBA from INSEAD.

Zuzunaga himself highlights that “the beginning of Payflow’s expansion in Latam is being a complete success and we seek to benefit more than 100,000 Peruvians in 2023

“We have seen that in Colombia more than 60% of workers download and use our app, awakening the interest of the most prestigious companies in the country. We expect something similar in Peru and we are ready to serve as we can integrate with the main payroll software such as SAP, Meta4 and many more in a few weeks” he points out Avinash Sukhwani, Co-Founder of Payflow.

The salaries of the future for the Peruvian financial well-being

Zuzunaga comments that the arrival of Payflow in Peru has a clear objective: “With Payflow we want to change the way in which Peruvians receive their salary. many Peruvians find themselves adjusted days before receiving the payment at the end of the month or even fortnightly, which leads to the fact that on many occasions they end up in debt. This is an alternative that companies offer so that workers can get out of trouble for free and not resort to predatory practices such as quick loans or salary advances.”

Payflow’s business model is unique in the on-demand salary market: employees have access to part of the salary worked completely free, privately and quickly, and companies pay a fixed fee to provide access to their collaborators.

“The wage-on-demand model is very common. In the US, 20% of the population already uses it and in Peru we are the first solution benefiting employees”, explains Zuzunaga

“Payflow is a benefit of the company. The company hires him to help their workers, but he always maintains control and visibility. That is why you can set usage limits, to help the worker without affecting their ability to meet monthly expenses such as rent.

It’s very easy for the company because their cash flow is not affected and they can configure the tool to suit their payroll dates and calendars”, adds Avinash Sukwani, co-founder of Payflow.

Sergi Tomas (VP Operations) Benoist Menardo (Co-Founder) Sergio Zuzunaga (CM Peru) Avinash Sukhwani (Co-Founder) Javier Iglesias (VP Strategy and Finance).