Pensioners and retirees receive just $6.9 per month when calculating the conversion with the parallel dollar rate, while the Family Food Basket stands at $366. Over the course of the last 30 days, the bolivar has lost 43% of its value

The fearful expectations regarding the updates of the Venezuela Dollar Monitor account once again justified the fear of a new increase in the US currency, since it reached Bs 18.26 for the closing of the day on Friday, December 9.

In just 24 hours, the currency increased its price by 12.7%, raising its price by 2 bolivars from Bs 16.20 to Bs 18.26. This increase ended up burying the integral minimum wage.

Although legally the salary must be calculated based on the official exchange rate dictated by the Central Bank of Venezuela (BCV), a large portion of trade —especially informal— is governed by parallel. Therefore, the Venezuelan observes how his bolivars are diluted with each update of this rate.

The comprehensive minimum wage was established on March 15, 2022 and has not changed since. At that time, the Bs 126 salary added to Bs 45 for food vouchers made up a minimum comprehensive remuneration of Bs 171, which was equivalent to $38.9 according to the parallel dollar rate in force at that time, at Bs 4.39.

Almost nine months later, the salary is still the same, but the dollar is four times as valuable as it was. Now that same remuneration translates into $9.36. The bolivars that Venezuelans receive for a month of work are not even enough to purchase goods and services worth 10 dollars.

In the case of pensioners and retirees, the situation is worse, since they do not receive the food bonus, but the net Bs 126 for salary. That means that they receive, in terms of the parallel dollar, about $6.9 per month.

In comparison, the Family Food Basket measured by the Venezuelan Finance Observatory (OVF) stood at $366 in December. This means that 39 full minimum wages would be needed to acquire all the necessary products to guarantee an adequate diet for a family of four people.

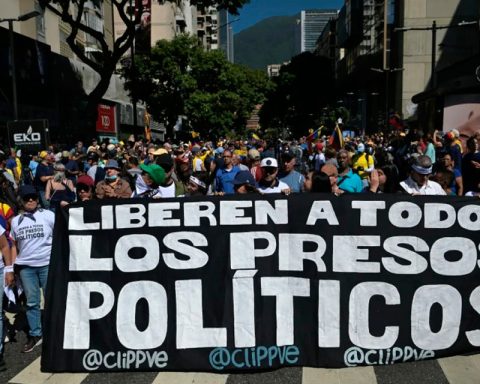

This differential has sparked criticism from NGOs and political leaders on social networks, who demand a higher salary for the Venezuelan worker, detached from the provisions of the Government, as Carlos Ocariz suggests when arguing that this payment should be defined between employers, unions and guilds.

We must eliminate the minimum wage, nobody lives with 130Bs. We must modernize the process for the payment of the working day of active workers, retirees and Venezuelan pensioners. Let it be the employer, unions and unions who discuss wages and salaries. pic.twitter.com/dDa6jy3y3p

— Carlos Ocariz (@CarlosOcariz) December 7, 2022

Minimum wage and pension in Venezuela: 130 Bs. per month.

Dollar in Venezuela:

-Official: 13.59 Bs. per dollar ($9.56 per month)

-Parallel: 17.62 Bs. per dollar ($7.3 per month)How do Venezuelan workers and pensioners survive with that income? Enough

— PROVE (@_Provea) December 9, 2022

With today’s minimum wage of $8.5 per month, it is impossible to buy a food basket of $490. It is urgent to review the salary of workers, the income of retirees and pensioners. The humanitarian crisis worsens. pic.twitter.com/ieSqnuw79Q

— Henri Falcon (@HenriFalconLara) December 9, 2022

Bolívar loses against the parallel dollar

Every day that the bolivar passes, it loses its value against the dollar. In the last 24 hours, the price of the dollar increased by 12.7%, but by extending the period of time, the figures are increasingly worrying.

The collapse of the dollar began in December. At the beginning of the week, the currency was at Bs 13.63 and after seven days, from Friday to Friday, it increased by 33.9%.

If an entire month is taken into account, the contrast is greater. The parallel dollar closed last Wednesday, November 9, at Bs 10.36. A month later, it increased 9.90 bolivars, 76.2%.

This means that, in the last 30 days, the bolivar has lost 43.2% of its value against the US dollar.

These figures confirm the forecasts of analysts and economic experts, who affirmed that the monetary interventions of the BCV in the exchange market did nothing more than delay the variation of the exchange rate, therefore, when the issuing entity stopped its injections of money, the dollar was going to resume its course.

“With interventions, you make the exchange rate ignore inflation. When you stop intervening, it will react very violently and you will probably generate even higher inflation. This stability that you promote will probably generate higher future inflation to the extent that the exchange rate adjusts to prices,” economist Luis Bárcenas warned TalCual at the beginning of September.

*Read also:The exchange rate will stop “ignoring” inflation when the BCV cannot intervene

Post Views: 1,098