The National Assembly, dominated by the Sandinista Front, approved on Tuesday a loan with the Central American Bank for Economic Integration (CABEI) for 200 million dollars, to reduce the impact of the increase in fuel prices. This millionaire loan will be added to Nicaragua’s external debt, which at the end of 2021 reached 14,308 million dollars, the highest peak during the 15 years of Daniel Ortega in power.

The decree of the loan contract, sent urgently by the Executive, was approved with the vote of 90 of the 91 deputies. One was present and did not vote. On June 29, the Ministry of Finance and Public Credit (MHCP) signed the loan contract with CABEI to finance the implementation of the “Temporary Support Program for the Fuel Crisis in Nicaragua”—as part of a fund of 800 million dollars arranged by CABEI for its partners—, states the decree.

For 14 consecutive weeks, the Ortega regime has maintained frozen fuel prices and its derivatives without explaining which budget item they affect. The only thing that Ortega revealed in the act for the National Dignity, on May 4, is that the subsidies for super, regular, diesel gasoline and Liquefied Petroleum Gas (LPG), imply an average amount of four million dollars. per week, which would add up to 56 million dollars until last week.

Rubén Arriola, from the Consumer Manager Consultancy, describes the measure as “Solomonic”, but clarifies that it does not solve the underlying problem, which requires an evaluation of Law 277 or the Hydrocarbons Supply Law and a tax reform, to reduce fuel prices through taxes.

“We believe that a more technical, deeper study should be carried out to benefit the final consumer. At least, of the four (taxes applied to fuels) eliminate two, and in this way the benefit would be greater, they would drop considerably, not keep it frozen with prices still high, ”he explained to CONFIDENTIAL.

Arriola does not deny that the freezing of the price of fuel and its derivatives, sustained by the Government for a little over three months, has a positive impact on the population. However, it is “very slow” because the prices of the basic basket have skyrocketed, estimating a total cost of 17,500 córdobas and by the end of this year it may close at 18,000, he said.

Last May, the average price of the ‘food’ component in the basic basket was 10,026.61 córdobas, and rose by 2,036.11 córdobas, to be quoted at 12,062.72 córdobas at the end of May 2022, indicates a report published by CONFIDENCIAL about the impact of these high costs on the lives of Nicaraguan families.

An economist who agreed to speak on condition of anonymity sees the regime’s move as “a political move”, ahead of the municipal votes next November, and warns that once the subsidy ends, a “drag effect” which implies that the population assumes the cost of petroleum derivatives.

He adds that these loans systematically increase the external debt, which in the long term “will generate higher levels of poverty, less allocation of social spending”, because the payments are made with funds from the public treasury.

Ortega deputies defend indebtedness

The indebtedness with CABEI was pointed out by the Liberal deputy, Walter Espinoza, who described the measure as a “small breath”, “a little relief” in the face of the fuel crisis, but in the end “It is one more loan that we will have to pay”.

In that sense, he specified that the MHCP has contracted so far this year “three loans with the same CABEI, which add up to 605,580,372 million dollars”. He recalled that Nicaragua has a debt limit this year of up to 1,046 million dollars.

Ortega deputy Wálmaro Gutiérrez defended the approval of the loan, pointing out that Nicaragua’s debt policy is healthy and responsible, and that its resources are directed to social projects.

The new loan acquired with CABEI “it is not a tiny or insignificant patch, on the contrary, it is a support to all sectors of the economy”assured.

In the initiative, the Executive indicated that starting this year “international tensions and geopolitical conflicts accelerated the upward trend” of fuel prices, which began a year earlier due to the economic improvement registered in the world economy.

Ortega attributed the current rise “due to the theoretical risk of interruptions in the supply chain due to the multiple economic and financial sanctions imposed by the United States on one of the largest producers of natural gas and oil in the world”in reference to Russia, a country that the Sandinista leader has openly supported in his invasion against Ukraine.

In Nicaragua, since October 2021, super and regular gasoline exceeded 40 cordobas per liter, and diesel did so in mid-February of this year, both cases occurred when there was no war that triggered the international price of oil. Reports of CONFIDENTIAL have revealed that, until the beginning of 2021, Nicaraguan consumers have paid about 30 million dollars for an overpriced fuel.

The instability of black gold

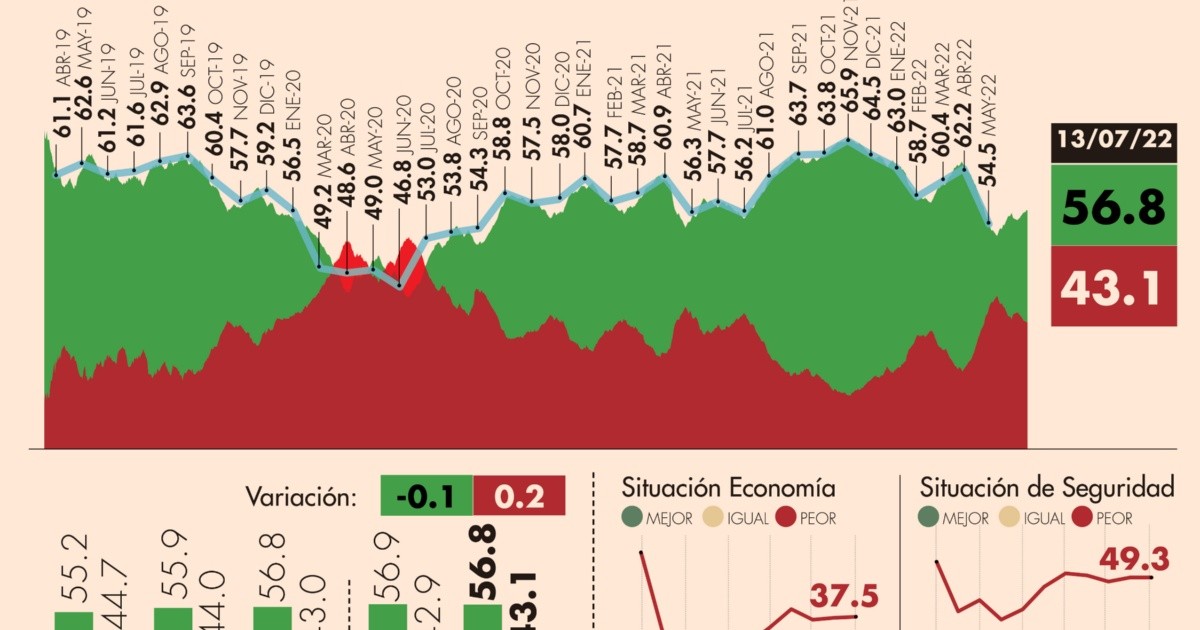

The price of Texas Intermediate Oil (WTI) —a reference for Nicaragua— fell 7.9% this Tuesday and closed at 95.84 dollars due to the strength of the dollar and the prospect of weaker demand, once again losing the psychological barrier of 100 Dollars.

At the end of operations on the New York Mercantile Exchange (Nymex), WTI futures contracts for delivery in August lost 8.25 dollars compared to the previous close.

Last week the price of black gold was also marked by volatility and fell below the psychological barrier of 100 dollars, although it ended the week close to 105 dollars.

“The markets remain divided between fears of a recession in the US, Europe and China, which are hindering growth and, consequently, oil consumption, and the reality that supply and demand for oil are still very tight. market”pointed out this Tuesday the analyst of the firm Oanda Jeffrey Halley.

*With information from Efe