Despite the economic crisis, the main executives of the BHD Leon Bank report good news: 76% of its clients’ transactions are not in branches because there are alternative channels, the entity has reserves for contingencies due to the war between Russia and Ukraine, its credit portfolio increased by 11.9% and soon it will be called only Bhd Bank.

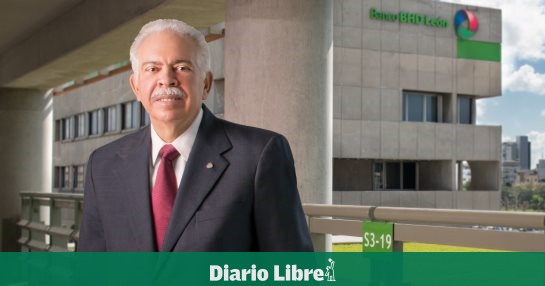

“The bank’s solvency is high, it remains very high, it is more than 17 percent; this measures the degree of capitalization that we have, when what is required is 10 percent”, said Steven Puig, executive president of the BHD Leon Bankduring a virtual meeting with media directors, editors and commentators.

The president of the BHD León Financial Center and the bank’s Board of Directors, Luis Molina Achécar, stressed that the pandemic taught them the importance of financial entities having a reserve for unexpected losses.

He said that this year, half of the profits, instead of being distributed, go to a capital reserve. “And from there we already have 6,000 million (pesos), which is 3 percent of the portfolio, plus the additional provisions we have,” he explained.

“That is -he added-, that we have in provisions and in reserves more than the capital, and in excess of provisions 4,000 million, plus this reserve; because it shields us for situations such as, for example, the one that is occurring now in Ukraine”. However, Molina did not rule out changes in interest rates.

“More than 800,000 customers used digital channels last year and it is a very significant number for us”Executive President of Banco BHD León

The increase in digital tools and other alternative channels such as bank sub-agents and ATMs has led to 76% of the transactions made with the bank not being in its branches.

Only digital transactions increased 35%. “More than 800,000 customers used digital channels last year and it is a very significant number for us since we have approximately 1.3 million customers,” reported Puig.

He added that the branches are becoming a counseling center for clients on issues that are more important to them.

The BHD Leon Bank plans to soon remove the surname León from its name and go on to be called only Banco BHD, once approved by the shareholders’ meeting to be held on March 24.

The change process is expected to begin on July 1 – the month when the bank turns 50 – and would last for about a year, due to the changes implied by the official adoption of the new name in its logo and financial products such as credit cards. credit and debit of clients, checkbooks and others.

Molina Achécar explained that when the BHD and León banks merged in 2014, it was agreed to keep both names to guarantee financial security and peace of mind to customers and shareholders. The agreement covered using León for five years, which could be extended, as was done.