Nicaragua obtained the poorest qualifications of the last three years in the global ranking of the fight against money laundering, according to the eleventh Basel Index Against Money Laundering (AML for its acronym in English), prepared by the International Center for the Asset Recovery at the Basel Institute on Governance, despite the fact that Daniel Ortega’s regime claims to meet its requirements.

The Report places Nicaragua as the second worst in America, (6.70 on a scale of one to ten, where ten is the maximum risk, only surpassed by Haiti, which closed at 8.16 points). Cuba and all of Central America fared better than Nicaragua. The country is also the nineteenth worst in the world, escorted by Nigeria, Tonga, Zimbabwe and China. The Democratic Republic of the Congo, with 8.30 points, occupies the last place on the planet.

The 2020 Basel Ninth AML Index, placed the country in the penultimate position of Latin America and the Caribbean(31 of 33 countries, only surpassing the Cayman Islands and Haiti), while the global scale placed us in position 125, (that is, it was 16 positions from the end of the list of 141 nations), being cataloged as a high-risk country for money laundering.

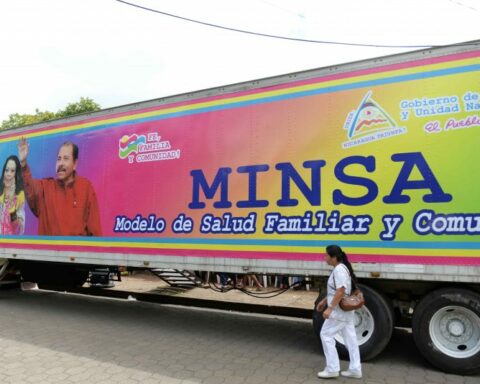

In recent years, the regime has passed a series of repressive laws, supposedly aimed at improving the legal framework to prevent money laundering and the financing of terrorism, as well as weapons of mass destruction. In practice, what you have done is strengthen the capacities of the Financial Analysis Unit (UAF), which employs against those whom he considers ‘enemies’either plausible economic blackmail.

While the 2022 Report does not focus on Nicaragua, it does make reference to the fact that “when it comes to tackling dirty money, most countries are taking one step forward and four steps back, and staying too many steps behind the criminals who seek to launder illicit funds…progress in the fight against money laundering and the financing of terrorism (AML/CFT) remains at a standstill.”

On a global scale, the average money laundering risk “is stuck at 5.25 out of 10”, detailing that a small decrease in risks related to the quality of anti-money laundering frameworks and the financing of terrorismhas been offset by increased risks in the other four areas: corruption, financial transparency, public transparency, and political/legal risks.

This is the case of Nicaragua, where the authorities can boast of progress in the legal framework, but not of an improvement in any of the remaining four areas.

The worst in Central America

“The good news is that governments, as well as financial institutions and other reporting entities, are generally getting better at assessing their money laundering risks and applying a risk-based approach to addressing them, but in areas where criminals are moving fast and innovating, the authorities are dragging their feet”, the Report states.

In general terms, he explains that the cryptosphere is one of those areas, specifying that “the average levels of compliance with international standards on the risks of virtual assets, are drastically decreasing as more countries are evaluated.”

After Nicaragua, Panama occupies the next lowest rating, with 5.81, which places it as the fifth worst in Latin America. Honduras, with 5.54, occupies the seventh position. Guatemala, with 5.29, qualifies in eleventh place, while Costa Rica, with its 4.58 points, closes the podium of the three best among Latin Americans, only surpassed by Uruguay and Chile.

There is no data for Venezuela, El Salvador, Bolivia, Paraguay, Brazil, Argentina, or the Cayman Islands, among others, because only jurisdictions with sufficient data to calculate a reliable risk score were included, based on data from publicly available sources such as the Financial Action Task Force (FATF), Transparency International, the World Bank and the World Economic Forum.

“Progress is important because money laundering weaknesses and terrorist financing provide an easy way for criminals and corrupt networks to launder money stolen from citizens, from massive fraud schemes to corrupt procurement deals that hinder a country’s sustainable development. Poor performance in those fields can seriously affect business and investment opportunities”, specifies the document.

Fighting money laundering and terrorist financing “is important, because…it’s more than just fighting financial crime. It’s about protecting people and the environment,” he details, explaining that this is why this year’s Index includes an indicator for environmental crimes.