The Government will also remove the service premium from congressmen.

Within the framework of the economic emergency, the Government of President Gustavo Petro presented a broad package of tax measures with which it seeks to collect 11.1 billion pesosto balance public finances and meet the fiscal needs of the State.

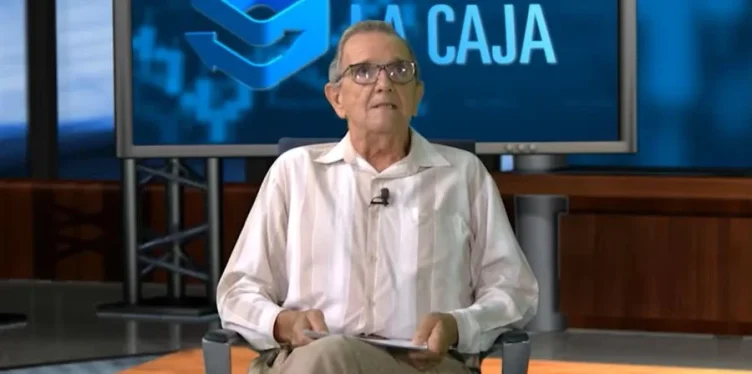

The announcements were made by the Minister of Finance, German Avilawho defended the progressivity of taxes and assured that the greatest effort will fall on the sectors with the highest income and assets.

You may be interested in: Government announces new taxes: who does they impact?

The measures include increases in the wealth tax, new taxes on the financial sector, changes in VAT and non-consumption, healthy taxes, adjustments to low-value imports and higher tax burdens on the hydrocarbon and mining sectors.

Wealth tax and greater burden on the richest

One of the central axes of the package is the increase in the wealth tax, with a more progressive approach. As explained by Minister Ávila, the base to start paying taxes is reduced from 3,600 million to 2,000 million pesosand the rate increases in stages until reaching the 5% for assets greater than 100,000 million pesos.

“This is a taxation that has very little progressivity and the Government considers that there should be a greater effort on the part of those with high net worth”said the official.

With this adjustment, the Government estimates that around 102,000 taxpayers With greater assets they will assume an additional burden to finance the needs of the State.

Added to this is the increase in the tax for the normalization of assets not declared abroad, or not legalized in the country, which will maintain a rate of 19%. Only with this set of measures, the Executive calculates an income of 3.6 billion pesos.

Financial sector, VAT and luxury products

Another of the key announcements has to do with the financial sector, which the Government considers one of the great beneficiaries of recent economic growth. For this reason, the income tax surcharge for legal entities in this sector will be increased, which will go from 5% to 15%.

“The financial sector has had very significant levels of profit and benefits, and that justifies a greater tax effort”Ávila explained.

In terms of VAT, the rate of the 19% for games of luck and chance, taking into account a tax base that discounts the prizes awarded.

In addition, the Government announced a strong adjustment to the VAT on liquor, which will go from 5% to 19% for products such as spirits, rum, whiskey and brandy. Beer was excluded from this increase due to its high social consumption.

Likewise, non-consumption of luxury products will rise 16% to 19%and the exemption for low-value imports through digital platforms, known as minimiswhich will now only apply up to 50 dollars.

Healthy taxes, oil, coal and total collection

The package also contemplates an increase in the consumption tax on liquor and tobacco, under the approach of the so-called healthy taxeswhose objective is to discourage the consumption of products that affect public health.

In the mining-energy sector, the Government will create a special tax on the first sale or export of crude oil and coal, a figure that had already existed during the internal upheaval. In addition, the non-deductibility of royalties in the calculation of income tax for companies in these sectors was established.

According to the Ministry of Finance, these measures will allow additional collection of 3.2 billion pesoswhich join others 2.5 billion projected through administrative and control actions by Dian, for an estimated total of 11.1 billion pesos.

“All these measures are aimed at balancing the financial situation of the Government and public finances”concluded Ávila.

Government will also remove the service premium for congressmen

At the close of the economic announcements, the Government confirmed that it will eliminate the service bonus for congressmen, a decision that was defended by the Minister of Labor, Antonio Sanguinoas an act of social justice.

“It is not taking away, it is doing an act of justice and reducing a bonus that was a gift from the past. Today it is calculated at close to 11 million pesos, and it is a decision that the Colombian people will applaud”said Sanguino.

More information: Colombia registers a historical minimum of unemployment at the end of 2025

With this package of measures, the Executive seeks to send a political and fiscal message: greater collection, greater progressivity and a more equitable distribution of tax burdens.

Source: Integrated Information System.