Although more than three-quarters (76%) of Dominicans said they were optimistic about their household’s economic situation for the next 12 months, they remain cautious due to macroeconomic concerns, and more than half (54%) said they had cut back on discretionary spending in the past three months. Nearly two-thirds (63%) said inflation was their main concern, while 52% said they were worried about employment and 51% about housing prices.

These are some of the conclusions of the Study Consumer Pulse TransUnion’s Q2 2024 report, which explores how consumers’ personal finances have changed and what changes they expect in the future.

Despite their optimism about the future, nearly half (46%) of Dominicans said they expect to be unable to pay at least one of their current obligations in full. Among them, nearly a third (31%) said they would use money from their savings to pay their obligations, while 22% said they planned to borrow money from a friend or family member to do so.

The majority (98%) of Dominican consumers believe that access to credit is important, and half of consumers plan to apply for a new loan, or refinance an existing loan, in the next 12 months. However, just over a third (36%) believed they had sufficient access to credit products.

Consumer Pulse Details

Despite some optimism, financial difficulties are causing many Dominicans to act with caution

Eighty-two percent of consumers surveyed said they expect their income to increase over the next 12 months, and nearly a third (32%) said their household income had increased in the previous three months. The remaining consumers’ incomes either stayed the same (35%) or decreased (34%). In addition, nearly half (45%) said their household’s financial situation was worse than expected, although this figure was lower among higher-income households.

Among Dominicans who experienced changes in their household income, just over a quarter (27%) said someone in their household had lost a job, while 17% said someone in their household had seen their income reduced and 8% said their work hours had been reduced. On the positive side, 15% said they had started a new business or job, and 10% said someone in their household had had a raise in salary or wages.

In line with lower incomes, 32% said they planned to further reduce their discretionary spending on restaurants, travel and leisure, and the same number expect to see a decrease in in-store and online shopping over the next three months.

Identity and fraud

As consumers spend more time using online services, they are more concerned about protecting their identity. In the second quarter of 2024, around a quarter (27%) of consumers said they conduct more than half of their transactions online.

When asked about barriers they face when using digital technology in new ways, 33% of consumers reported concerns about identity theft, 32% cited connection quality as an obstacle, 29% were concerned about the cost of Internet services, and 27% expressed concern about cybersecurity threats.

Credit card/payment fraud, identity theft and data breaches were the cyberthreats that most concerned consumers surveyed, with 50%, 45% and 33% of responses, respectively.

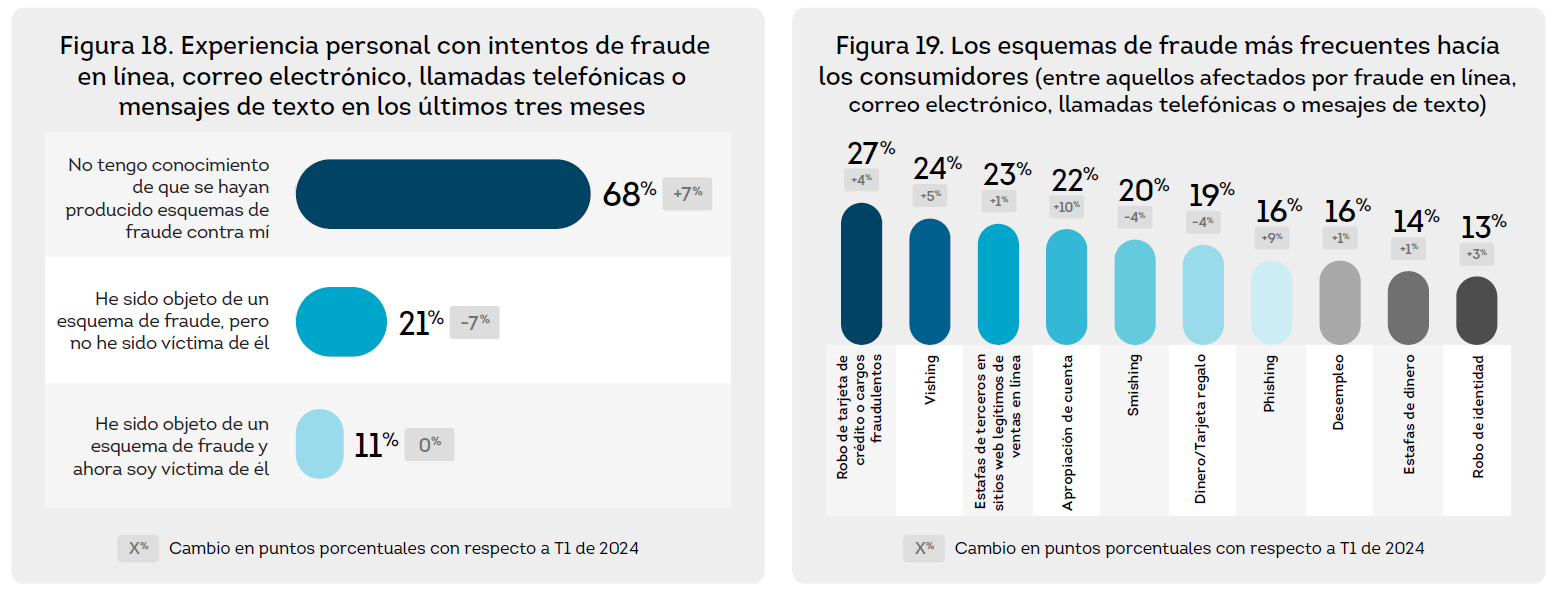

In the second quarter of 2024, 21% of consumers reported that they had been subjected to online fraud attempts, via email, phone calls or text messages, but had not been victims in the past three months—another 11% were targeted by fraud attempts and claimed to have been victims.

The most common scams reported by those targeted and victimized by fraud were credit card theft or fraudulent charges (27%), vishing (fraudulent phone calls intended to trick users into revealing data) at 24%, third-party seller scams on legitimate online retail sites (23%), and account takeover, using online accounts without permission—including unauthorized theft of funds from bank accounts (22%).

Personal information security remains a top concern for consumers: Four in five (81%) consumers surveyed expressed concern about sharing personal information. Reasons cited include not wanting their identity stolen (76%), fear of invasion of privacy (63%) and a desire to avoid receiving unsolicited commercial communications (34%). Despite these concerns, nearly two-thirds (63%) of consumers surveyed indicated that they have adequate access to credit information used about them.

Attitudes and behavior when making financial decisions

In the second quarter of 2024, 85% of Dominican consumers surveyed believed that monitoring their credit activity was at least moderately important, and 49% of those surveyed believed that monitoring their credit activity was at least moderately important. respondents said they monitored their credit activity at least once a month.

Millennials (86%) were most likely to believe that monitoring credit was at least moderately important, however, Gen Z had the highest percentage (63%) of respondents who checked their credit reports at least once a month.

The most common reasons consumers gave for checking their credit reports were trying to improve their credit score (37%), protecting themselves from fraud (36%) and learning about credit offers they might qualify for (28%). Additionally, 58% of consumers believe their credit score would increase if companies used information not listed on the standard credit report, such as rent payments, gym memberships and others.

Note: Generations are defined in this research as follows: Gen Z, ages 18 to 26; Millennials, ages 27 to 42; Gen X, ages 43 to 58; and Baby Boomers, ages 59 and older.

TransUnion’s quarterly survey explores how consumers’ personal finances have changed and what changes they expect in the future. The study measures consumers’ changing attitudes and behaviors based on income dynamics, debt and identity theft.

About TransUnion

TransUnion is a global information and knowledge company with more than 13,000 associates operating in more than 30 countries, including Colombia. We make trust possible by ensuring that every person is reliably represented in the marketplace. We do this by providing a carefully managed, multidimensional view of consumers.

Through our acquisitions and investments in technology, we’ve developed innovative solutions in areas such as marketing, fraud, risk, and advanced analytics. As a result, consumers and businesses can transact with confidence and accomplish great things. We call it Information for Good® – creating economic opportunity, great experiences, and personal empowerment for millions of people around the world.

For more information visit: https://www.transunion.do