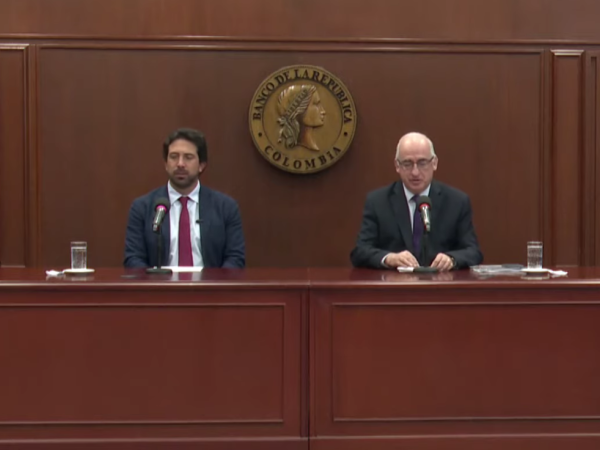

He Minister of Finance and Public Credit, Diego Guevaraafter his first meeting with the Board of Directors of the Bank of the Republicassured that the portfolio will continue to insist on reducing monetary policy interest rates in a more accelerated manner.

It is worth mentioning that the entity announced this Friday a reduction of 25 basis points in this indicatorthus leaving it in 9.50% for December.

(Continue reading: Banco Agrario: what are the service channels to consult about Citizen Income?).

At a press conference, the new Minhacienda recognized “the effort that has been made this year to lower inflation; However, a very important real interest rate persists, that is, a monetary policy difference between the Bank of the Republic and inflation that we believe would make significant room for a monetary policy rate that allows the economic cycle to continue in an accelerated manner. positive economic growth this year, with the monetary policy rate being one of the fundamental macroeconomic prices“.

Diego Guevara, new Minister of Finance

Private file

He also highlighted that the rate reduction has been very useful to help the inflation decline in the country (5.2% in November, according to Dane), however, he mentioned that “there is still some room to increase that speed“.

(Besides: The dollar in Colombia rose 33 pesos in the week, but remained below $4,400).

“Its fall has been key to the reactivation, for 2024, in which economic growth will be more than three times what it was in 2023.“he added.

Guevara, in addition, assured that this indicator remains on track towards the 3% goal, despite “recent exchange rate pressures“, in the local and international context, in reference to the situation of the Colombian peso against the dollar.

Interest rate

iStock

The new Minister of Finance also spoke about the direction of the Colombian economy, ensuring that the three most important indicators (inflation, unemployment and GDP growth) have had a “good behavior“.

“Banrep highlights the good performance of the three main macroeconomic indicators, with good GDP growth, an unemployment rate that ranges around 9.5 and 10% this year, which has been a fairly standard rate for Colombian macroeconomic conditions. and, of course, falling inflation, which allows for that better interest rate data“, said.

About the tax rule

Later, the minister spoke about the possibility of complying with the tax rule for this year, about which he explained that it is key for all sectors to reach an agreement on fiscal sustainability issues “and the strategies of this common medium and long-term asset“.

(You can read: What pension corresponds to someone who has been a housewife all her life in Colombia?).

“This strategy of technical parameters of the fiscal rule has been a debate for 2024, not for 2025. The debates on 2025 always start from an assumption that is fiscal sustainability“, he mentioned.

tax rule

Bank of the Republic

He also said: “We are aware that this is a year of great challenges, but we also have a strong institutional framework that allows us to move forward, as we have shown with this year’s adjustments that no government has made in history.”.

And he added: “The fiscal rule in Colombia is constitutional and we are complying with it and the technical debates around it are valid. The rules are not static nor are they the ‘Holy Grail’ of economics“.

PORTFOLIO