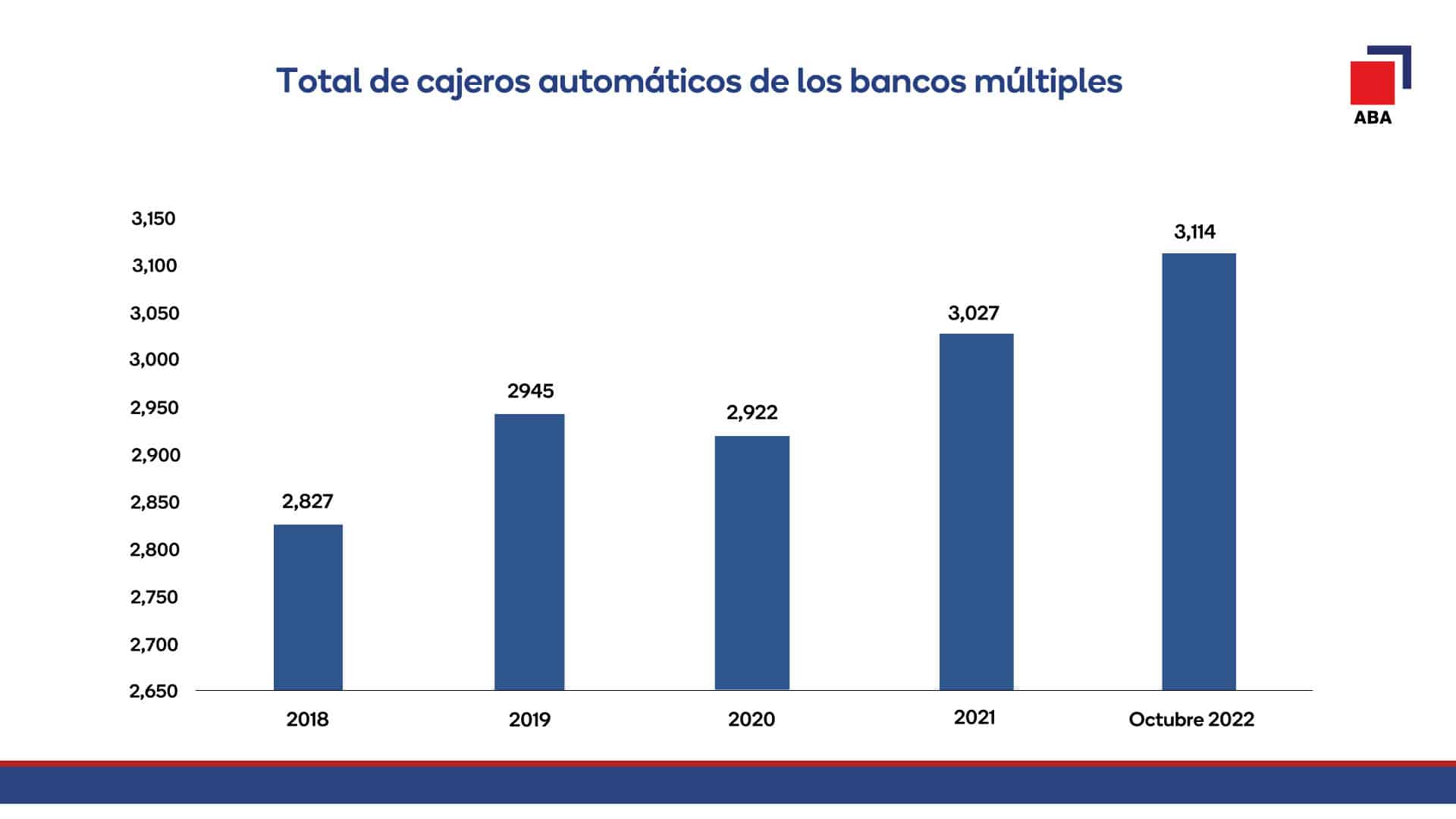

Commercial banks have expanded their network of ATMsconcentrating as of October 2022 some 3,114 units disseminated throughout the national geography, reported today the Association of Commercial Banks of the Dominican Republic (ABA).

The union commented that, through this expansion, multiple banking has managed to penetrate different locations in the country in order to provide coverage and access to customers residing outside the Metropolitan areawhere the 49.5% of the total number of ATMs of multiple banks.

In a press release, the ABA reported that the volume of debit card transactions in ATMs of multiple banks reached 91.5 million operations to October 2022, with a projection at the end of 2022 of 109.8 million operations.

This would represent a 10.6% increase In relation to what was registered in 2021 of 99.3 million transactions.

The volume of cash deposits in ATMs of multiple banks reached almost 8 million operations to October 2022 and with a projection of 9.6 million operations by the end of 2022, indicated the ABA.

He stated that this would represent a 14% increase in relation to the registered in 2021 of 8.3 million transactions.

The ABA maintained that, thanks to the technological adaptations implemented by multiple banks to make these operations possible, customers can make their deposits at any authorized ATM, without having to go to the teller area, which results in time saving when seeking the service.

Limit amount to withdraw

The ABA specified that customers can make withdrawals in ATMs from up to 50,000 pesos daily in several transactions and in a single operation the amount fluctuates between 10,000 and 20,000 pesos, depending on the financial institution.

The union pointed out that the sector continues to bet on investment in this type of service in order to meet customer demand, although there is a greater tendency of citizens to use the digital channels for your transactions.