The Plenary of the Congress of the Republic approved by majority -105 votes in favor, two votes against and three abstentions- the rule that strengthens the Municipal Savings and Credit Banks to promote competition for the benefit of consumers.

To this end, the substitute text, which is based on bills 78, 1014 and 1353, empowers microfinance institutions to issue credit cards without prior authorization from the Superintendency of Banking, Insurance and AFPs (SBS), provided that you are after of their third year of operation have assets greater than 75,000 UIT.

About, the head of the Commission for the Defense of the Consumer and Regulatory Bodies of Public Services, Elías Varas Meléndez (PB)commented that “The Peruvian financial market is one of the most concentrated in Latin America, there is no competition, and this translates into high interest rates for loans, and low rates for savings”.

“Thousands of micro-enterprises do not have access to credit from formal banks, and are charged high rates that do not make agriculture, commerce and other productive activities profitable. As long as the cost of credit is very high, there will be no decentralized economic reactivation”, he asserted.

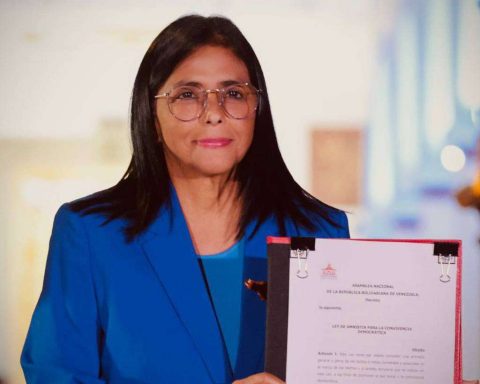

For its part, the President of the Commission for the Economy, Banking, Finance and Financial Intelligence, Rosangella Barbarán (FP)maintained that this initiative enables the entry of multilateral organizations to strengthen the patrimony of the Municipal Savings and Credit Funds, and promotes true financial inclusion.

He specified that said multilateral organizations and private investment funds may enter as temporary third-party shareholders, with voting rights and a participation equal to or less than 49%, different from the municipalities.

Barbarán also pointed out that with this measure the operations of the savings banks are expanded and with this they will become more competitive and, therefore, they will be able to receive demand deposits, issue overdrafts and management checks.

He added that this opinion has the favorable opinion of the corresponding agencies and the observations they raised have been absolved in the substitute text.