In a paradox that fuels debate, 76% of Cuban private companies feel optimistic or very optimistic about 2026, although, at the same time, 60% of them predict that the national economy will do somewhat or much worse next year.

According to an independent study with no precedents on the island to which the Spanish agency had access EFEthe apparent contradiction between confidence in one’s own performance and pessimism about the general environment reflects the conflictive reality of MSMEs in a country mired in a polycrisis with no solution in the short term.

The First Business Climate Study for Cuban MSMEs, prepared by the corporate services firm Auge, collected the opinions of 175 managers of private companies with up to one hundred employees, most of them with more than three years of operations.

The report highlights as one of its most revealing findings the marked divergence between the self-perception of companies and the vision of the economic context. “It starkly demonstrates the lack of confidence in the future of the environment in which they operate,” the document highlights.

The authors warn that without trust, the sector’s potential will remain at low levels, investment will be timid, and innovation will be oriented more toward survival than qualitative leaps.

Current and future business expectations and concerns

The majority of respondents foresee an increase in sales volume and profits in 2026, although they are more moderate regarding investment and increasing the number of employees.

Among the most optimistic sectors are communication and information technology companies, wholesalers and retailers, industrial and agricultural producers, as well as gastronomic and accommodation businesses.

The study identifies inflation (60%), poor state infrastructure (43.4%) and limited access to foreign currency (38.9%) as the main problems in 2025.

By 2026, concerns focus on economic instability (68%), new regulations (56.6%), and higher cost inflation (48%).

The results paint a panorama of uncertainty where companies trust in their ability to adapt, but doubt the stability of the macroeconomic environment.

The entrepreneurs surveyed by Auge pointed out three priority areas for the authorities: regulatory stability, real and autonomous access to foreign currency, and recognition of the contribution of the private sector to the national economy.

The report describes a “map of systemic bottlenecks” marked by regulatory volatility, economic unpredictability, high inflation and prolonged daily blackouts. These factors, he warns, harm business dynamism and limit the expansion of MSMEs.

Auge Recommendations

Founded in 2014, the Auge company recommended moving towards greater legal predictability, improving formal access to foreign currency for private MSMEs, institutionalizing dialogue between non-state actors and the Government, and combating inflation.

The study clarifies that its results should be interpreted as a first qualitative approximation to the business climate and not as a statistical generalization for the entire country, since the selection of respondents was not random.

However, the authors consider that the report offers a valuable initial perspective that reflects the experiences and concerns of an active and representative segment of the incipient Cuban private ecosystem.

The rebirth of MSMEs after the revolutionary offensive of 1968

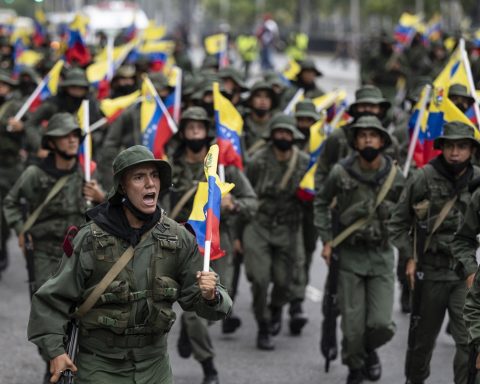

The Cuban Government authorized the opening of MSMEs in September 2021, ending a prohibition that had been in place since 1968, when all private businesses were nationalized, a number close to 55,000 establishments. Since then, some 11,000 small and medium-sized businesses have been created, the vast majority of which are private, as there are cooperative and state modalities.

These companies have emerged as key players in the national economy, offering goods and services in a context of scarcity and high inflation and becoming a source of employment and innovation.

Business optimism contrasts with the serious economic crisis that Cuba is going through. Gross domestic product has contracted 11% between 2020 and 2024, and no growth is expected in the current financial year. An official forecast for 2026 has not been released, but experts do not anticipate a significant change.

Looking ahead to 2026

The covid-19 pandemic, the tightening of US sanctions, now restricting oil trade with Venezuela, and the failed national economic and monetary policies have exacerbated the island’s structural problems and citizen protests.

The country faces shortages of food, fuel and medicine, prolonged daily blackouts, high inflation, a strong public deficit, deterioration of state services, bank decapitalization, growing dollarization and massive migration.

In this context, MSMEs have become a space of resilience and supply, but only for solvent social sectors on the island, where the vast majority survive in a state of poverty and in many cases of destitution.

According to the Economic Study of Latin America and the Caribbean 2025, ECLAC anticipates that Cuba’s GDP will fall -1.5% in 2025 and will barely grow 0.1% in 2026, which is equivalent to virtual stagnation.