Credit Engine, Savings and Credit Bank, experiment a growth of 19.1% in its total assets in 2021, closing the fiscal period with a balance of RD$9,455 million, according to the performance report of the banking institution.

The financial entity explained that the credit portfolio increased by 11.23%, ending at RD$7,372.00 million, a level of growth higher than the average of the country’s financial system,

Regarding the delinquency levels of the credit portfolio, the entity reports that it went from 2.9% at the end of 2020, to 1.36% at the end of 2021, this being one of the lowest delinquency levels reported by the institution, and with a coverage of provisions on overdue portfolio of 282.22%.

Profitability levels increased by 41.5%.

Can read: Government orders the sale of eggs at 3 pesos through Inespre

Details

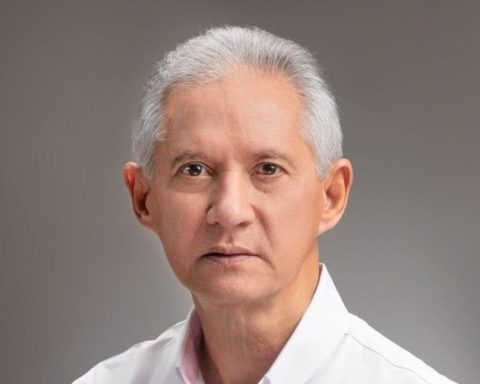

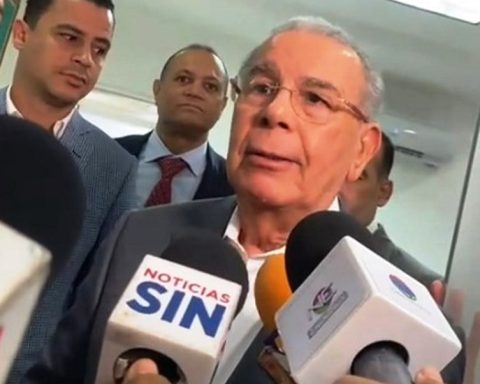

“Profitability levels increased by 41.5%, generating an increase in our equity base, which as of December 31, 2021 reached RD$2,403 million, with a solvency ratio of 18.79%, well above the minimum regulatory limit required” highlighted the president of Motor Credit, Benahuare Pichardo.

On the other hand, he highlighted that the delinquency levels of the credit portfolio, the entity reports, went from 2.9% at the end of 2020, to 1.36% at the end of 2021, this being one of the lowest delinquency levels reported by the institution, and with a coverage of provisions on overdue portfolio of 282.22%.

It should be noted that 2021 was a year of significant progress in terms of innovation for Motor Credit. “During this period we saw a significant increase in the use of our digital channels, such as transactional internet banking, strengthened with the incorporation of a digital token for greater security for our customers. In addition, improvements and simplification in our business and communication processes allow us to provide more agile solutions to our clients”Pichardo added.