The prices of fat cattle and those of replacement cattle rose strongly in Uruguay this week, and the market expects the rains to confirm the trend even more. For grains, the week closes with some stability: Soybeans recovered this Friday as the state of crops in South America deteriorated, including a reduction of two million tons in the crop in Brazil. Wool in Australia fell more than 3% after seven weeks on the rise due to excess supply.

encouraging data

The meat industry stepped on the accelerator and fat cattle prices had a second week of strong price recovery.

The rains -although still insufficient- are arriving irregularly in different parts of the country and seem to reinforce both the cattle market for the field and the replacement, which also showed notable increases this week.

The year started with a steer at US$3.28 per kilo on the fourth scale and this week it crossed US$3.65 for top cattle, of which there is practically no supply. They are 10 cents above the average that the ACG grid marked last Monday for special steers.

A price differentiation is achieved by volume and finishing of very heavy carcasses.

For the cow, the peak prices are around US$3.35 and US$3.40 for the heifer. Tickets are fast, in the course of a week. Slaughter is growing, with purchasing interest beyond the high participation of free-range cattle destined for quota at the closing of the February window.

For the first time since May/June of last year, the slaughter exceeded 50,000 heads for two consecutive weeks.. The latest data was 52,432 cattle, just 2% down compared to the same week last year.

John Samuelle

Farm prices rose.

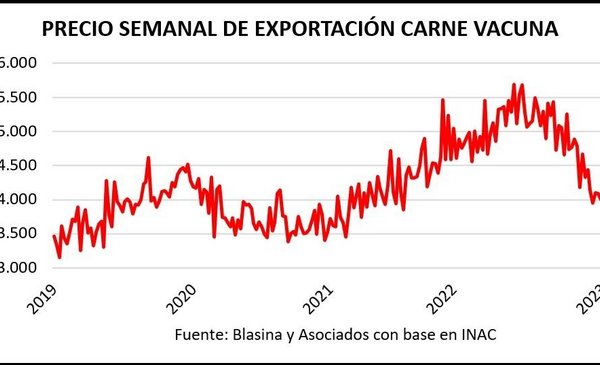

The export price of beef is on the rise. Last week he had an exceptional jump of 23% that took him to US$ 4,946 per ton, its highest value since the beginning of October last yearaccording to preliminary data from the National Meat Institute (INAC).

The 30-day average, which is gradually recovering, reached US$4,263 per ton, the highest value since early December.

The expectation is still set on when generalized rains will arrive, with a forage situation that continues to worsen. The latest data provided by the Agricultural Plan Institute, generated through the National Livestock Information Network, show that 55% of the surveyed producers have a height of natural grass below 3 centimeters, the worst in January, at least, of the last three years. 50% of the producers are supplementing due to lack of grass. And the intention to sow winter greens grows, as stated by 64% of the producers consulted.

Also, with the weather against, the replenishment is accompanying the momentum of fat cattle. The demand is affirmed, as seen in the auctions of Lot 21 and Plaza Rural this week. There was prominence of the calf. The average in Lot 21 jumped 13.5% this Wednesday, from US$2.15 per kilo in January to US$2.44. In Plaza Rural the average was US$ 2.49, 4.5% higher compared to the previous auction, at the beginning of February.

On the one hand, the reactivation of standing exports has had an impact to mark a floor. On the other hand, winter growers see an opportunity given the signals that are beginning to appear from the industry and anticipating that the fat market is going to react.

At the gates of the calf harvest, the recovery of prices of cattle for slaughter and also of cattle for the field generate optimism.

Some positive signs of demand for free-range cattle are beginning to appear, with the possibility of closing business ahead above US$4.30.

The sheep are also on the positive path. There is a good supply but the demand is greater, which continues to stimulate prices. Lamb up to 35 kilos is around US$3.11, heavy lamb US$3.24, sheep US$3.15 and sheep US$2.70. The only category that registered a drop was capon, at US$2.87.

In the last week, the weekly export price of sheep meat jumped 11%, with an average of US$ 4,003 per ton.

Market indicators.

Soybeans at US$ 560

Soybeans maintained the US$560 line in Chicago at the end of the weeka sustained price in the new worsening of the prospects of Argentine crops and the reduction of two million tons of the Brazilian harvest, which still remains above 150 million tons.

The Buenos Aires Grain Exchange reduced the proportion of soybeans in excellent/normal condition from 52% to 44%, compared to 77% at the same time in 2022. Paradoxically The crops in Argentina and Uruguay passed this Friday from the thermal stress of a heat wave to the possibility of receiving frost in the early hours of this Saturday.

On Friday the lowest temperature in history for Uruguay in February was recorded: 8.2ºC.

In Brazil, the consultancy AgRural lowered the soybean harvest in Brazil from 152.9 million to 150.9 million due to losses in Rio Grande do Sul as a result of the drought.

Corn closed the week stablewith upward swings defined by a gradual improvement in US export data, which had slowed down due to strong competition from Brazil and the state of crops in Argentina.

The Buenos Aires Grain Exchange reduced the proportion of corn in excellent/normal condition from 66% to 55%, compared to 74% in the same week of 2022. The bearish forces for corn are evident in the fall in oil and the improvement of the rhythm in the sowing of safrinha corn in Brazil, even with a delay compared to 2022.

Wheat prices rose slightly in Chicagosubject to the forecast of very low temperatures for the next few days in the central United States, which adds to the drought conditions that the area has been going through for months.

Negotiations will begin next week to extend the validity of the Istanbul agreement that enables a safe corridor over the Black Sea for Ukraine’s agricultural exports beyond March.

John Samuelle

Stability in soybean prices.

The wool, on the roof

The price of wool in the Australian market reached a ceiling after seven consecutive weeks of growth. In the Uruguayan market, this week the commercialization of a lot of Merino wool of 12,400 kilos of 15.5 microns at US$ 13.1 per kilo fleece stood out.

Market indicators.

The Eastern Markets Indicator (EMI) was down 3.2% and 1.9% in Australian currency. Demand interest was weakened by overzealous bidding according to Australian dealers, who placed 57,196 bales on auction floors, the largest volume in nearly three years. 83% were sold, a proportion much lower than the 94% of the previous week.

Despite this, the offer for the week would also exceed 57,000 bales and if it materialized it would be the highest biweekly volume offered in the last 12 years.

The wools that fell the most this week were those of 21 and 22 microns, between 3.3% and 4%. At the other extreme, wools of 26 microns and more rose between 1.4% and 2.6%. The average for 28 microns was US$ 2.48 per kilo clean base.

John Samuelle

Value rebound in the wool market.