More than R $ 15.7 billion in old contracts for payroll loans have already been migrateduntil last Tuesday (16), for the New platform for the worker’s credit digital work portfolio.

The information was released by the Secretary of Workers Protection Policies, Carlos Augusto Simões Gonçalves.

According to him, It is expected that R $ 40 billion in old contracts will be migrated until October.

THE Migration to the Digital Work Card appthat hosts the credit of the worker, Go until November.

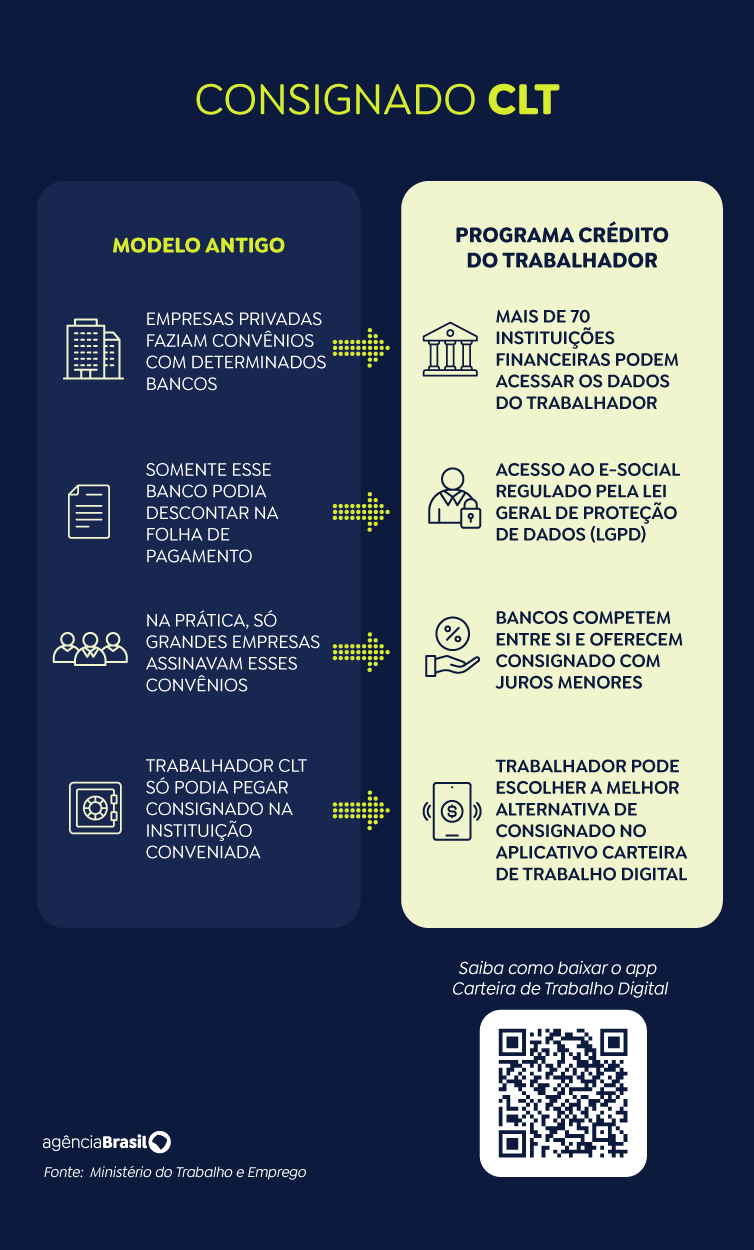

Old contracts belong to employees who work or work in companies that had partnerships with banks to offer discount loans of salary installments. This model will be extinguished in November.

Currently, the new program has 122 qualified financial institutions, of which 64 already perform operations.

“While the interest rate on personal loans remained close to 11% per month, the worker’s credit has an average rate of 3.42% per month,” said Carlos Augusto.

The migration of old operations to the Worker Credit Platform, available in the Digital Work Card app or on the same name on the Internet, will be made by Dataprev, a state hired by the Ministry of Labor and Employment to elaborate the platform.

How it works

In the digital work card app, the worker authorizes sharing his data (such as CPF, company time and available margin).

- Within 24 hours, financial institutions send credit offers;

- The worker chooses the best proposal, with lower interest;

- Installments are discounted directly on the payroll;

- Up to 35% of monthly income can be committed to the loan.

How to order portability

- Verify that the destination bank offers the new payroll to CLT;

- Ask for portability on the institution’s digital channels (website or application);

- From August 21, portability can also be requested in the work card app, with gradual migration until November;

- The new institution sets the previous debt and assumes the credit automatically, with the interest and deadlines of the new line.