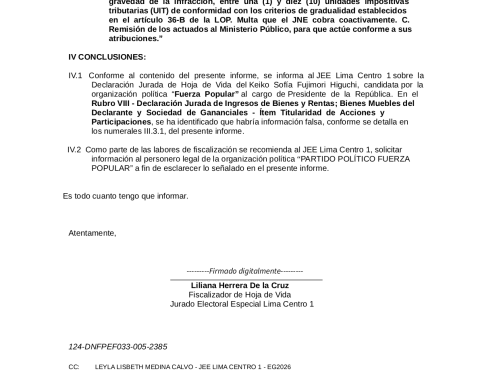

The Minister of Energy and Mines, Jorge Monterohe went to the front to defend the recent authorization of the Ministry of Economy and Finance (MEF) for Petroperú to issue bonds for more than 287 million dollars.

Montero explained that bond emission seeks to refinance debts and guarantee the fuel supply nationwide. In addition, he rejected that it is a “salvage with money from the treasury.”

“There is no emergency decree requiring extraordinary funds for Petroperú, that does not exist. The debt is being impact, which is something else, it is an ordinary mechanism where any company or a private can have impact its mortgage or their debts for their businesses,” he said.

The minister relativized the losses of more than 700 million dollars registered by the company in 2024, ensuring that it is a dynamic of the oil industry:

“Oil businesses have cycles (…) of extraordinary and losses gains, that is typical of business,” he said, comparing the situation with mining.

In addition, the minister emphasized that Petroperú is an integrated super business, but has short -term problems, which are being solved.

“Petroperú moves 5,000 million dollars a year in their business. Debts will be paid with the oil business, obviously, and we will continue,” he added.

Receive your Peru21 by email or by WhatsApp. Subscribe to our enriched digital newspaper. Take advantage of discounts here.