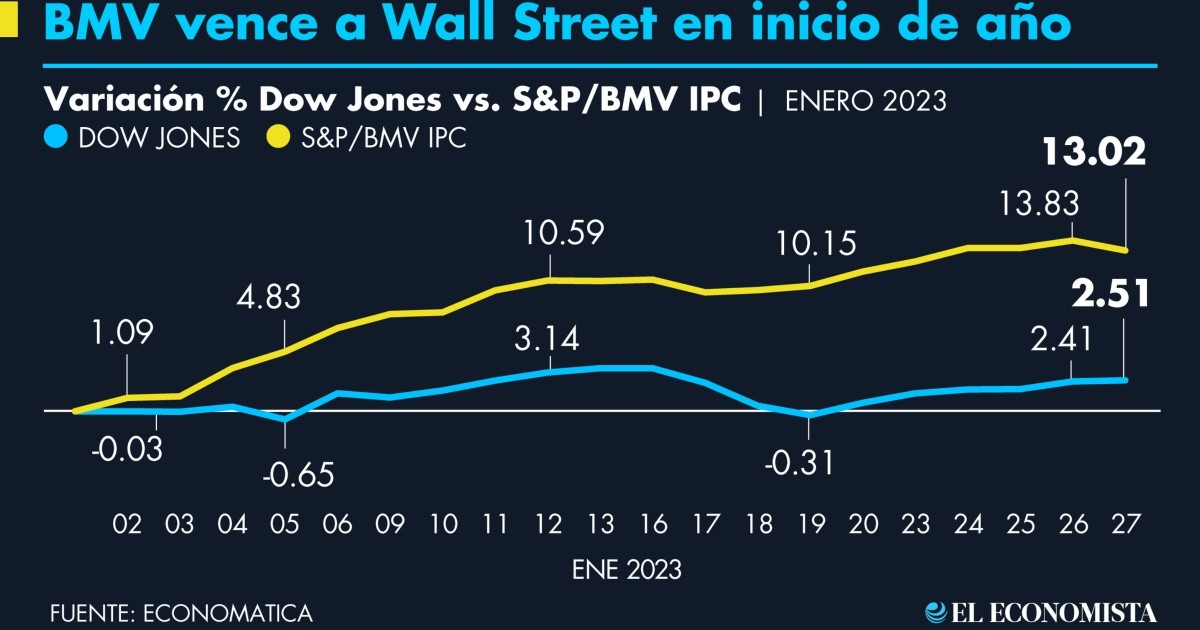

So far this year, the referential index of the Mexican stock exchange (BMV), the S&P/BMV CPI, accumulates a profit of 13.02 percent. With 17 sessions in the green against 20 total so far in 2023, optimism is evident in the local stock markets.

But investors in USA they seem not yet to share the optimism observed in the local market. What is happening in the NYSE it is still not a clear advance; the index Dow Jones It has risen 2.51%, between ups and downs.

While both performances are good for just four weeks, they speak to two ways of understanding the current context. On the one hand, ours is a market more accustomed to uncertain times and on the other, Wall Street is more afraid of a recession.

In the middle of the earnings season, the numbers presented by large companies in the market have been mixed, with some warnings from giants such as Microsoft Corp.but also pleasant surprises as happened with Tesla’s report.

The economy of USA continues to offer signs of resilience and, while the inflationary pressure is reduced, the analysts anticipate that the Federal Reserve (Fed) will further moderate interest rate hikes to just 25 basis points.

But investors on Wall Street aren’t so confident when the word recession is at stake, said economist, financier and independent analyst Víctor Carmona. “A period of low growth is more common in Mexico,” he added.

That is why the market is cautious, prior to the announcement of the Federal Reserve’s monetary policy, a calm that has been moderating but is still perceived in the market. The Dow Jones rose only 0.09% in the last session of the week.

“The high valuations that tech companies reached during the pandemic make investors more fearful of rates. Local broadcasters are not usually valued as high and recent falls had them at opportunity prices.”

Jorge S. Soto, a Master in Finance from the Universidad del Valle de México, agrees with this description. The also institutional operator affirms that the prices on Wall Street show that the vision in the United States for now is not in the short term.

“There are opportunity purchases in the Mexican market because the prices lend themselves to it. But it is still too early in the year to see a clear trend, especially since we are still seeing negative indicators,” warned Jorge S. Soto.