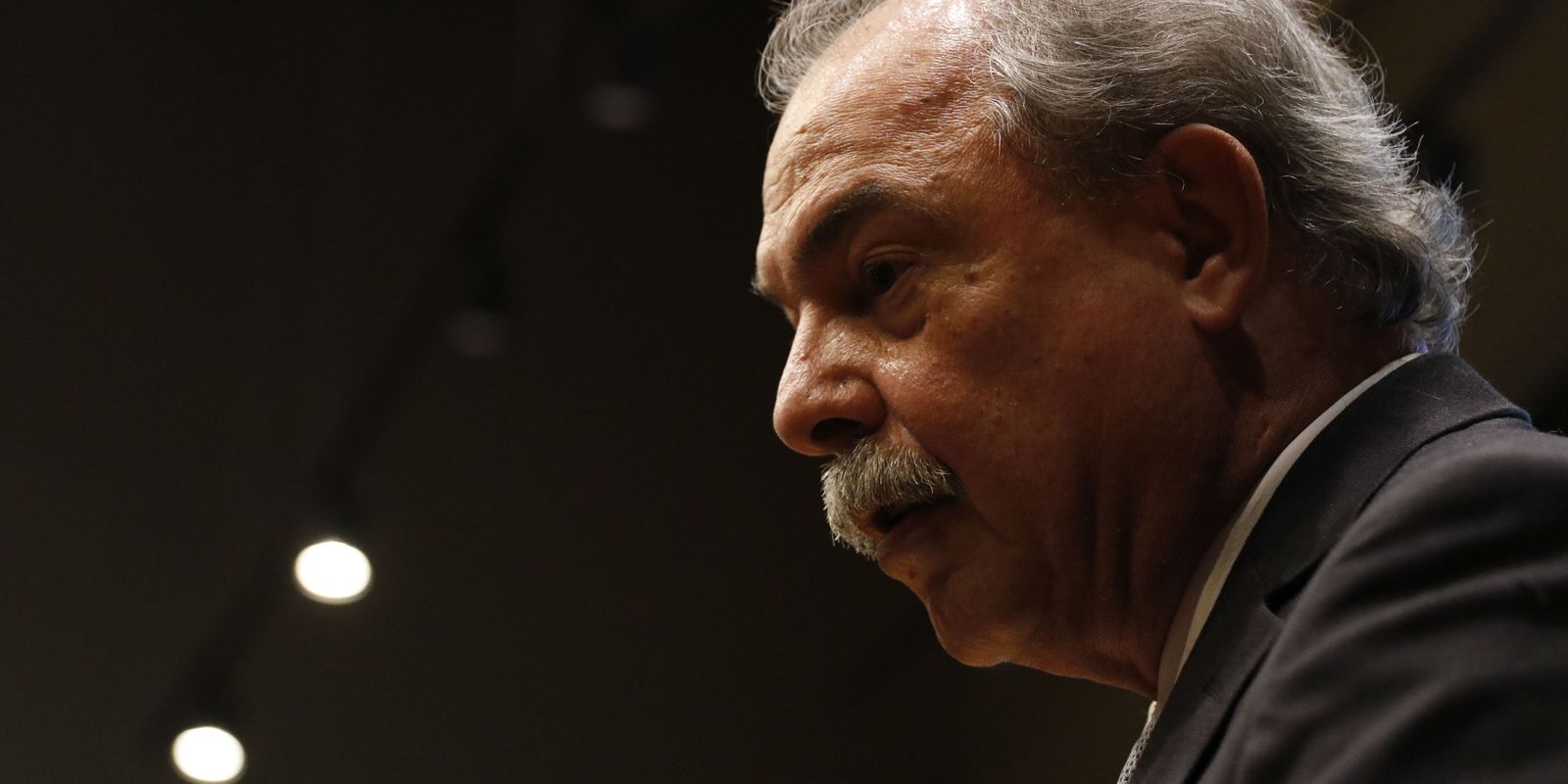

The president of the National Bank for Economic and Social Development (BNDES), Aloízio Mercadante, said that the institution had opened a credit line for Americanas SA in the order of R$ 2.4 billion, but that it does not run financial threats with the company . “They still had a debt of R$ 1.2 billion, but the BNDES was prudent, they had a letter of guarantee that has already been executed, has already been paid. We don’t have a real at risk with Americanas”, he guaranteed, in a press conference, in Rio de Janeiro, this Wednesday (15).

The bank’s president also said that he will not make any decision regarding the company. According to him, it is now up to the Securities and Exchange Commission (CVM) and the Central Bank to rigorously assess what happened, “including because the main partners have a very significant volume of capital to contribute and save the company and, above all, protect the funds of investment, 40 thousand workers and micro and small companies that are suppliers”.

Mercadante participated in a meeting at the bank’s headquarters in Rio de Janeiro, which reinstalled the Amazon Fund Steering Committee (Cofa), in the company of the ministers of the Environment, Marina Silva, and of Indigenous Peoples, Sonia Guajajara.

The President of the BNDES said that he will discuss with the Ministry of Finance and the Brazilian Federation of Banks (Febraban) the opening of a credit line for small and medium-sized suppliers of Americanas, “who are victims of this (alleged) fraud. It was a company where there was a lot of loyalty in the supply and you have to provide an alternative so as not to aggravate the crisis and these companies to be able to continue their activities. They bear no responsibility for the Americanas crisis. She was victims. The signs of fraud on the balance sheet are very serious and are being investigated. Let’s wait”. For him, Americanas’ problem with the bank is solved. “There is no possibility of dealing with the crisis of Americanas. What we had to do we already did: we enforced the bail and recovered our capital”.

corporate hospital

Aloízio Mercadante assured that the BNDES will not go back to being a hospital for companies. He made it clear that the BNDES does not have to compete with the private sector. BNDES can develop new markets and act, especially where the market does not reach. “That is the fundamental role”.

The BNDES president also clarified that the bank cannot treat a small and micro company or a credit union in the same way that it will treat a 35-year-old infrastructure project. “They are two totally different clients, two different situations and we need specific instruments”.

He assured that the historical period of subsidies with the Long-Term Interest Rate (TJLP) from the National Treasury to the bank was behind, because this created instruments for transferring resources from the BNDES to the Treasury. The BNDES cannot continue to be a major financier of the Treasury, said Mercadante. “We have already transferred BRL 678 billion to the Treasury. And that is not the role of the BNDES. It is a development bank. It is a bank to generate jobs, innovation, support micro and small companies, to make the transition to a green economy, to finance the energy transition, to strengthen low-carbon agriculture. This is the historic role of this house for 70 years and it will continue to be so as long as I am here”.

Mercadante also promised that the BNDES will once again debate Brazil, as it did during the time of the late Minister of Planning, João Paulo dos Reis Veloso, in the same way that there will be no more intellectual censorship at the institution. “Each one can have their own vision, their own conception. We want plurality and diversity, but it will debate Brazil and think about the future ”, he concluded.