Because Peru has a large part of its economy dollarized, it is important for companies to get a exchange rate competitive for the different economic commitments that they maintain in this badgesuch as: office rental, payments to suppliers, purchase of merchandise, loans, among others.

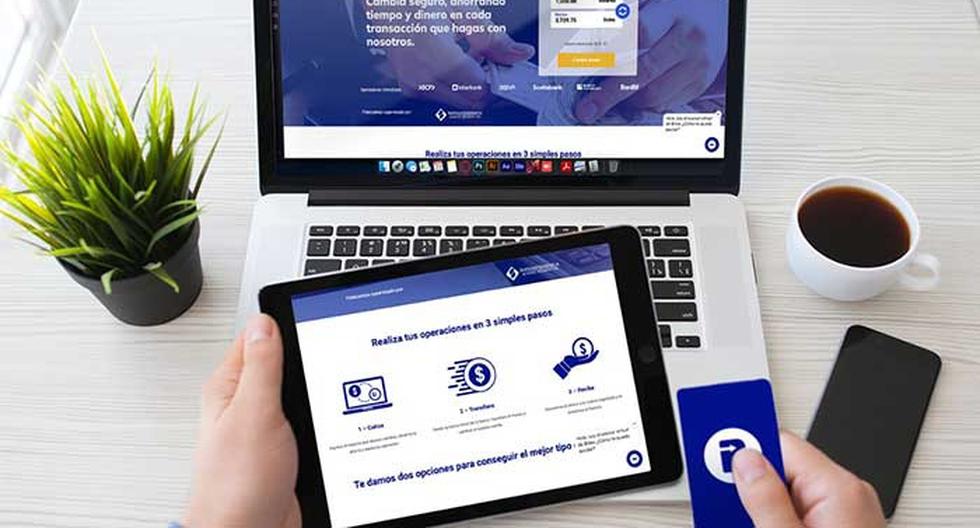

Taking into account that the price of the dollar in 2021 faced high volatility reaching a historical peak of S/4,138; and that this year also the greenback has had some considerable ups and downs, Billexa Peruvian platform that -through a trust- connects people and companies to buy and sell dollars, becomes the first fintech to launch an innovative service that allows companies to negotiate their exchange rate and have the possibility of transferring up to two days later, regardless of whether it goes up or down.

“At Billex, we are constantly looking for the best solutions for all those companies that must carry out a currency exchange. Thus, now they can negotiate the exchange rate of the day and set it on our platform with the option of settling it in up to two business days, for this, we only require that you previously confirm the day that the settlement will be made. In this option, companies have a way to fix their exchange rate in advance and thus avoid the risks of high volatility.”, said Javier Pineda, General Manager of Billex.

With this new benefit, unlike online exchange houses, the user does not need to immediately deposit the money to be exchanged, but can transfer it during the day. What is necessary is that the client previously communicates before the operation, to fix the exchange rate.

“The user does not have the pressure to make the transfer immediately, but we give them the facility that they can, for example, close the operation in the morning and make the deposit during the afternoon or, if applicable, up to two days. after”, adds Pineda.

It should be noted that, during the month of August, the fintech has carried out operations for more than two million dollars, with companies that have been setting their exchange rate for the next or subsequent day, mostly those that have foreign trade activities. and they have funds in transit (waiting for payments from abroad), such as agro-exporters, mining companies, among others.

RECOMMENDED VIDEO

:quality(75)/cdn.jwplayer.com/v2/media/9iFcDbmu/poster.jpg)