The Economy and Mother’s Day

Data from the Confederation of National Chambers of Commerce, Services and Tourism (Concanaco Servytur) show that Mexicans spend mainly on flowers, clothing, accessories, shoes, jewelry, watches, perfumes, pastries, electronics and appliances.

However, this year Mexicans celebrate their mothers in the midst of one of the highest inflationary environments in two decades.

These figures coincide with those of the Bank of Mexico (Banxico) and the Mexican Association of Online Sales (AMVO), which indicate that the population has increased the number of purchases made in the reference month.

In May 2021, six out of 10 AMVO respondents said they planned to shop for clothes and shoes, as well as flower arrangements.

Services such as massages in spas or some experience in beauty salons. Even 5% of online shoppers said they would give a trip to their mom or someone they love.

card payments

Year after year, hand in hand with the digitization of banking and the offer of products such as credit cards, the number of operations carried out with debit and credit cards has increased.

In May 2021, Banxico registered 734.6 million card operations, 40% more than in 2020 and 23% more than in 2019, when there was no COVID-19 pandemic.

Transactions are usually made more in large surfaces and retail. Despite the fact that payment with cards increases, Mexicans used debit cards more, since they had a growth of 42% in 2021.

Those of credit reached a growth of 37%.

Bankers in Mexico explain that the most notorious growth in debit is due to the fact that after the pandemic and the complex economic environment that was experienced, customers chose to be cautious with credit and when they came to use their card, they became totaleros.

The remittances

The effect of “Mother’s Day” also translates into an increase in the flow of remittances, and makes May one of the months of the year when these resources are received the most.

“This month the Mexican diaspora sends more remittances as a present to mothers (mothers, grandmothers, sisters, aunts, etc.) or to cover the expenses of the celebrations of this date,” considers the BBVA Research team.

In March 2020, in the first month of confinement resulting from the COVID-19 pandemic in the United States, the Mexican migrant population, both documented and undocumented, is estimated to have dropped to 11.5 million people, its lowest level since 2014.

As the months went by, and driven by the strong fiscal stimuli established by the Joe Biden government, the economy of that country began a rapid recovery during the end of 2020 and almost all of 2021.

This economic dynamism, added to the relative scarcity of labor that the United States experienced, became a powerful “magnet” for the flow of migration, mainly from Mexico and other Latin American countries, says Juan José Li Ng, an analyst at BBVA.

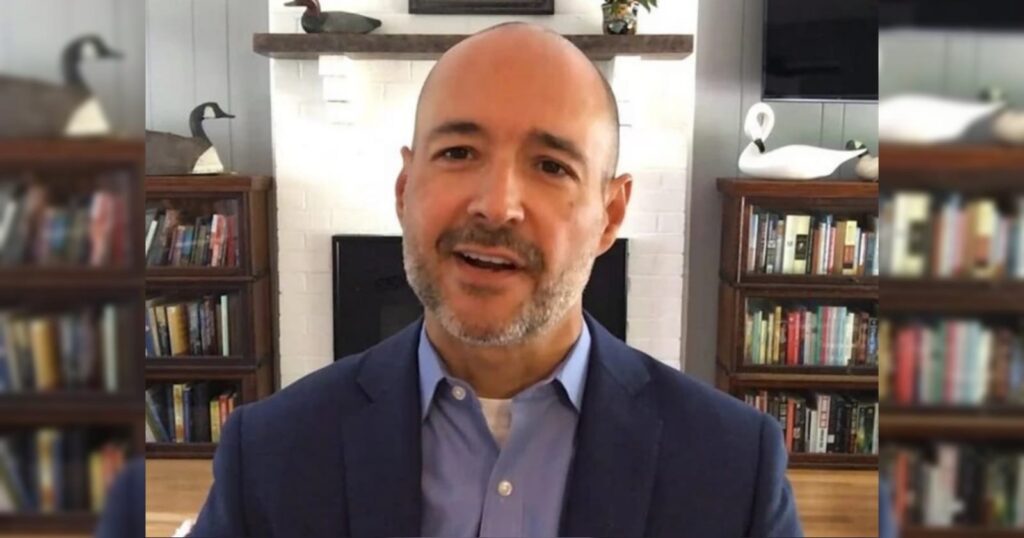

“May 10, Mother’s Day, is one of the most important days for remittance companies because countrymen who are in the US send money either to their wives or their mothers and so the flow is very important,” Patricio Diez Bonilla, CEO of Compartamos Banco, said in an interview.

Gentera, the bank’s parent company, had a remittance company until 2020 that it decided to sell, but he says that in his experience the flow of remittances has an upward trend in the following years.