25.4% of older people depend only on their work, 49% on the income of other members of the household, and only 11.3% live on their pension

More than twenty years after the implementation of the new contributory pension system, its coverage has expanded, but it still remains at very low levels, so it is urgent to expand the solidarity system to prevent poverty from increasing among people of retirement age.

The warning was made in a study by ECLAC, authored by Manuel Delgado, Nincen Figueroa and Juan Vila), which reveals that 25.4% of older people depend exclusively on their work, 49% on the income of other members of the household, and only 11.3% live off their pension, so the pension system generates a high level of exclusion, especially among self-employed workers and the most vulnerable people.

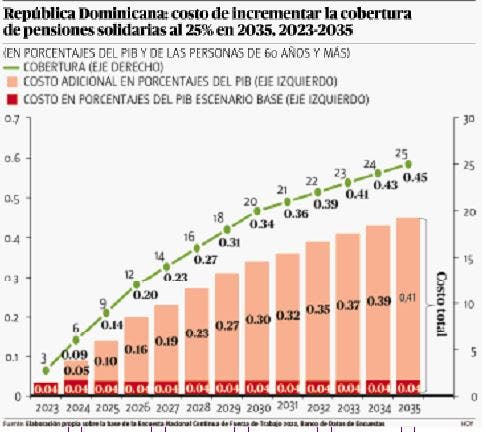

According to the study, the effort that would have to be made in solidarity pensions to ensure that coverage reaches the poorest 25% of people aged 60 and over by 2035 would have a total cost equivalent to 0.45% of GDP, incurring an additional cost of 0.41% of GDP.

Initial coverage in 2019 was 0.1% of people aged 60 and over, and by September 2023 it reached 2.8%, thus increasing fivefold. Public spending on Solidarity Pensions rose from 0.009% of GDP in 2020 to 0.036% in 2023, a sustained increase, but still a small proportion and low in relation to the regional average spending.

Since 2019, the value of the Solidarity Pension has been 6,000 Dominican pesos (117.1 dollars), but it has lost its value by remaining frozen. While in 2019 it represented 47.4% of the average contributory minimum wage, by 2023 it had dropped to 33.4%, a loss of 14 percentage points.

It should be noted that the Solidarity Pension was above the poverty line until 2021. Since 2022, a significant decrease has been observed in the level of sufficiency and in the objective of advancing in the eradication of poverty in old age, as indicated in the ECLAC report, although it differs from official statements.

The Solidarity Pension was above the poverty line until 2021. Since 2022, there has been a significant decrease in the level of sufficiency and in the objective of advancing in the eradication of poverty in old age, always according to the aforementioned ECLAC report.

The study notes that evidence shows that despite the increase in asset coverage, there are still considerable gaps in the system in covering all people and preventing old-age poverty in its population.

It specifies that the pension system does not cover half of the people in the country, which explains the low proportion of people aged 65 and over who have access to a contributory pension. It indicates that the system also does not respond to the challenge of pension exclusion due to gender inequalities, considering the significant gaps that women face in their participation in the labour market, which stands at 50.7% of this population in 2022.

On the other hand, the study questions the fact that no pensioners have been reported under the individual capitalization scheme to date, given that the first members have not yet made the 360 contributions required to obtain a pension, which postpones the analysis of the sufficiency of the benefits of the individual capitalization system until this milestone is met in 2033.

However, the study notes that the projections available from the Ministry of Economy, Planning and Development estimate a low level of replacement rates for contributors to the individual capitalization scheme, creating significant challenges for future sufficiency and fiscal sustainability.

According to the study, another important challenge for the Dominican Republic’s Pension System is to guarantee the economic autonomy of people aged 65 or older.

It is striking that the low coverage of the contributory pension system means that most people aged 65 and over are financially dependent on other members of the household, and therefore lack economic autonomy.

Furthermore, a significant proportion of older people still depend on their work income, especially in the case of men and those living in rural areas.

“In this sense, it is imperative to strengthen the Subsidized Pension System in order to progressively expand the coverage of the non-contributory pension system to guarantee the population the right to a pension and to be free from the risk of poverty in old age,” he said.

The report highlights that the allocation of the Solidarity Pension involves four processes and nine different institutions coordinated through the CNSS. Given the amount of bureaucracy, it is recommended to reduce the number of forms, to simplify the application and access to benefits.