The High Court of Justice in London ruled this Tuesday in favor of the Republic of Cuba in the lawsuit filed by the investment fund CRF I Limited, although the case continues against Banco Nacional de Cuba. Judge Sara Cockerill has notified the parties of the sentence this morning, that she considers that the fund does not have the legal capacity to claim the debt from the State, estimated at 72 million euros (78 million dollars).

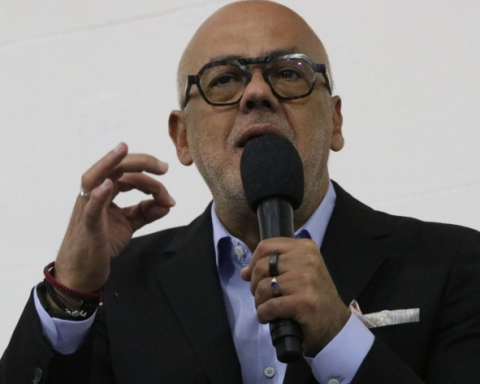

The news has been disseminated by the official press, which had access to the resolution, in which the Cuban side is right, stating that there were irregularities committed by officials of the Banco Nacional de Cuba. Also, point to the text. signed According to regime spokesman Humberto López, Cuba is immune from the jurisdiction of the United Kingdom and is not obliged to respond with its assets for the lawsuit.

“According to the sentence notified this morning, CRF is not a creditor of the Cuban State, which means that the Republic of Cuba is out of the lawsuit. From now on the process will continue only against the Banco Nacional de Cuba, which will have the right to establish the claims allowed by English law,” the note states.

The litigation began at the end of January in the London court after the venture capital fund CRF I, founded in 2009 and based in the Cayman Islands, sued the Island for considering itself the largest sovereign debt holder of the Island.

The BNC is today a commercial bank, but until 1997 – when the current one was created – it acted as Banco Central de Cuba (BCC). The BCN continued to be responsible for the registration, control and servicing of the debt it had placed until the creation of the BCC, which is why it is a defendant.

“From now on the process will continue only against the Banco Nacional de Cuba, who will have the right to establish the claims that English law allows”

The debt originated from two credits that Cuba closed in 1984 with the European banks Crédit Lyonnais and L’Istituto Bancario Italiano, with the BNC as guarantor. Three years later, Fidel Castro declared his country’s debt “unpayable” – and in general that of all former colonies – and the Island stopped complying with its creditors until Raúl Castro, in 2006, changed this policy.

Cuba renegotiated its debt with the Paris Club, but not with the London Club, to which CFR I belongs, which claims to have received no response from Havana in the seven years during which it tried to contact. For the regime, the fund, which it describes as a “vulture,” is not a legitimate creditor, since it obtained this debt illegally, bribing a BNC employee who was convicted of bribery on the island and had to testify in the trial.

In addition, the Cuban defense claimed that the established procedures were not followed: obtaining two signatures and government authorization.

CFR I rejected the bribery charge and doubted the veracity of the imprisoned official’s testimony. He further claimed that he acquired the debt correctly and is, therefore, a legitimate creditor.

Dozens of opponents went to London during the trial to protest at the gates of the court against the Cuban regime and urging the judge to force the Government to pay, although what was being resolved in court was not that issue, but the legitimacy of the fund as a creditor.

________________________

Collaborate with our work:

The team of 14ymedio He is committed to doing serious journalism that reflects the reality of deep Cuba. Thank you for accompanying us on this long road. We invite you to continue supporting us, but this time becoming a member of our newspaper. Together we can continue transforming journalism in Cuba.