A new weekly closing of activities in the market of the main productive items in Uruguay shows different scenarios: the values are affirmed for the fat cattle and the replacementin a climate market; Caution prevails in soybean marketing, with the lack of water as a major determining factor; Y demand for wool remains firm and prices strengthened in dollars, for the fifth consecutive week.

Limited supply of cattle

The fat market is still very limited in supply. Special cattle are increasingly scarce. The outlook is firm despite the low activity, with slaughter levels well below the two previous years.

Follow the disparity between industries. In general, the tickets are fast, around a week. Some better-bought plant is giving entry for the first half of February and passing values below those that are being handled and closing deals.

Despite the strong dependence on water, prices are between US$3.40 and US$3.50 per kilo in fourth scale for very heavy steers, with specific proposals above that value. Sales of special heifers above US$ 3.40 have been completed. And for a fat cow, US$ 3.20 is reached. It is expected that the rains will help the fat man to continue raising a few more cents.

“The commercial part is very disassociated with the climatic-forage part (…) marking a firm market in everything that concerns beef, with a lot of supply limitations and few expectations that new fats will be produced in the short term, which It speaks clearly of great uncertainty for what the offer may be for the immediate coming months,” said Gustavo Basso, director of Gustavo Basso Negocios Rurales.

John Samuelle

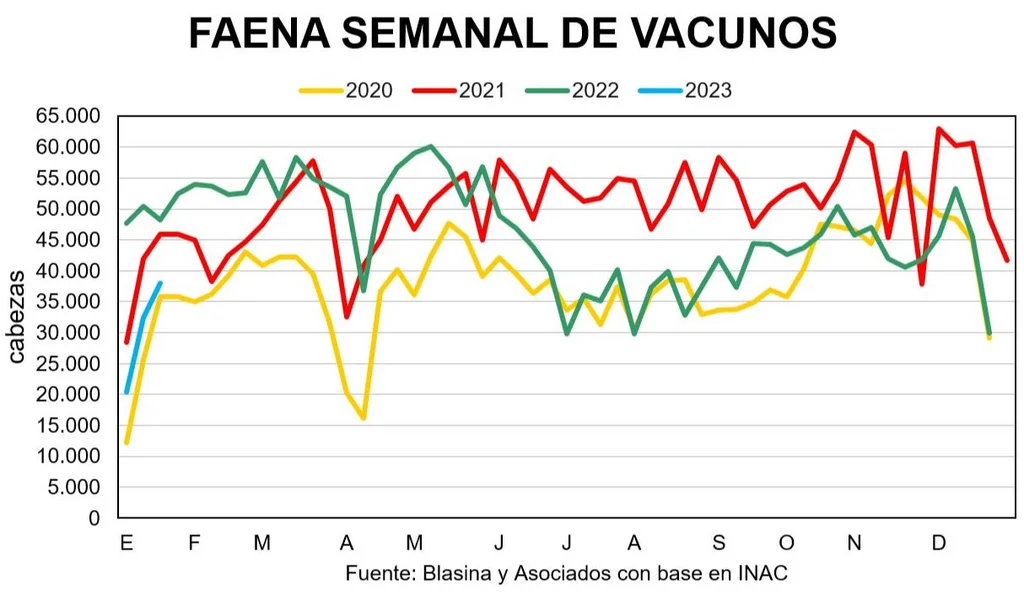

Slaughter, at low levels at the beginning of 2023.

beyond that work is gradually picking up (37,998 cattle last week), the activity of the slaughterhouses so far in January, with 90,970 slaughtered heads, reflects a 36% drop compared to the same period of 2022 and 25% compared to 2021.

Market report.

In foreign markets, there is no news from China amid the New Year celebrations that began last Sunday. In Europe there is a recovery of values for the Hilton cuts and in the US for now there are no major movements.

Last week the export price for beef rebounded, achieving a provisional average of US$ 4,416 per ton, according to INAC data.

In the replacement market, the results of the screen auctions of Lot 21 and Screen Uruguay this week were highlighted. In Lot 21, with a commercialization of 98% of the cattle offered, the calves averaged US$ 2.15 per kilo, just one cent less than in December, with no offer of small calves according to the season and with a bulk price of US $430. In Pantalla Uruguay –with 89% of total sales- calves averaged US$2.21 and US$417 per package, compared to an average of US$2.10 per kilo and US$470 per package in December. In both auctions, operators highlighted the firmness of the demand, in a market from less to more in values and expectation that the market will strengthen as the long-awaited rains materialize.

In wool, the market situation is atypical, with an offer that is totally absorbed, there are no sheep waiting for placements. The market is agile, with a rebound in values. The suckling and heavy lamb are around US$3.10, sheep US$3.05, capons US$2.78 and sheep US$2.60.

“We believe that it can be a good projection for what the next few months may be in terms of market behavior,” Basso considered.

Sheep meat posted its third straight week of rally, averaging $3,998 last week. Likewise, it is still far from the records of last year, with an average of US$ 3,867 so far in January, 31% below the US$ 5,576 reached at the beginning of 2022.

Market report.

Soybean marketing between 10% and 15%

Caution prevails in the commercialization of soybeans, with the lack of water as a major determining factor. with soy on US$ 540 per ton in the local marketbetween 10% and 15% of the expected production has been marketed, with projections between 2.5 and 2.7 million tons.

At first, “the good prices tempted to make sales, because being above US$500 in soybeans is a very good price,” said grain trader and adviser Pablo Della Mea. But the weather has played its game.

Drought has been hitting crops unevenly. The rains registered this week, although irregular, were welcome. “If we had a rainy February and March as well, we might think that some potential might have been lost, but we can aspire to still have quite acceptable yields in most of the soybean farms”said Pablo Engelhardt, director of Nuevo Surco, in Tiempo de Cambio on Rural radio. “I think we could still aspire to an average country yield of 2,000-2,300 kilos per hectare, we’ll see a little later how it behaves.”

Producers have taken some price hedging without committing merchandise, seeking to set a price floor for soybeans.

In corn, the earliest primera are very affected by the lack of water, in everything that is filled with grain, with crops that will not exceed 4,000-5,000 kilos per hectare, Engelhardt considered. A large percentage has been chopped. Prices for dry corn in the local market are over US$310.

The USDA weekly sales report showed significant soybean and wheat sales on Thursday.

Friday closed with negative adjustment for Chicago soybeans and wheat with mixed closes for corn. There is expectation for the continuity of the rains in Argentina, the entry of the soybean harvest in Brazil and the return to the Chinese market after the New Year.

The July soybean contract yielded US$3.1 per ton, closing at US$549.7. It ended the week with a marginal advance of 0.2%. In Argentina, the price that the government would offer in a third chapter of the soybean dollar is already being evaluated.

March Chicago wheat futures fell 90 cents a ton to $275.6, up 1.2% for the week. The best performance was in Kansas durum winter wheat. The March corn position added 20 cents to US$268.9 with a gain of 1% on the week.

Market report.

Wools: best value in seven months

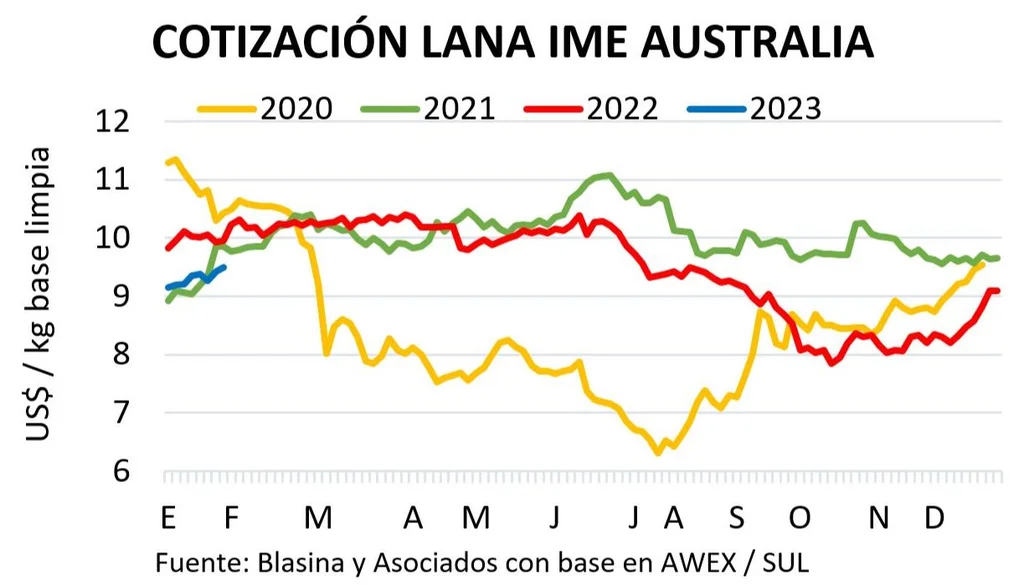

The demand for wool remains firm and prices strengthened in dollars for the fifth consecutive weekwhich begins to be reflected in businesses at the local level, concentrated in fine wools.

The Eastern Markets Indicator (IME) closed the week at US$ 9.50 per clean base kilo, its highest value in seven months. The weekly increase was 2.6% in dollars, although it fell slightly in local currency as the Australian dollar strengthened 2.8%. In its fifth week on the rise, the indicator recovered 15% of its value in US currency.

Sales in the Australian market were concentrated in the highest quality bales and with certifications, while those of lower quality were the majority of the 13.2% of the volume of supply that remained unsold, the SUL noted.

Operations were registered in the local market, mainly in Merino wool of 20 microns and lesswith certifications, as well as higher volume business for Corriedale yarns in the 28 micron axis.

The sale of a Merino lot of 16.7 microns and 7,900 kilos stood out, conditioned with green griffin and RWS certification at US$ 11.10 per kilo fleece.

Another batch of 17.7 microns fetched US$9.5 per kilo.

According to data as of January 26 from the Union of Wool Consignees and Auctioneers of Uruguay, lots of Merino from 18 to 19 microns average US$7.80 per dirty base kilo, US$6.90 for those from 19 to 20 and US$ $6.50 for 20 to 21 microns.

Corriedale yarns from 28 to 29 microns corrected upwards to average US$1.05.

John Samuelle

Better signs in the wool market.