In recent years, the transportation sector has decreased its interaction with fossil fuels by 1.4%, to make way for the new era of renewable energy. The investment in lithium closed last year with a growth of 55% compared to 2021, reflecting the aggressive search by automakers for new supplies of lithium, the main component of batteries, as demand for all-electric vehicles soars throughout the world.

Currently, Chinese companies account for 56% of the EV battery market, followed by Korean companies with 26% and Japanese manufacturers with 10%. As reported elements.

Likewise, the Asian giant has a manufacturing capacity for “white gold” batteries of more than 77% of the monopoly in the metal mining sector with 893 companies and increasing the exploration of lithium corresponding to the transition cycle to clean energy.

A third of the world’s electric vehicle batteries come from Chinese company Catl, supplying silver ion batteries to brands like Tesla, Peugeot, Hyundai, Sling, bmw, Toyota, Volkswagen and Volvo.

The global scenario is complex, the West has implemented its best strategies to enter the sector with alliances to expand their extraction. Albemarle ALB earlier this year signed large deals with the US Department of Energy to build a lithium facility in North Carolina and a massive processing plant in Arizona.

According to analysts, Albemarle is expected to post 600% earnings growth in the fourth quarter, just as earnings season kicks off this year. On January 12, the company’s shares closed at $243.21.

The ETF Global X Lithium & Battery Tech investment fund, specialized in monitoring the global lithium producer index, has traded between $35 and $45 from January 2022 to January 2023.

Besides, General Motors struck a $650 million extraction deal with the world’s third-largest mine located in Nevada that will enable the creation of 1 million electric vehicles and provide jobs for more than 11,000 employees, according to the company.

Meanwhile, Latin America has all the minerals needed for the production of green technologies, but most are exported without added value to China where there is already an energy transformation process.

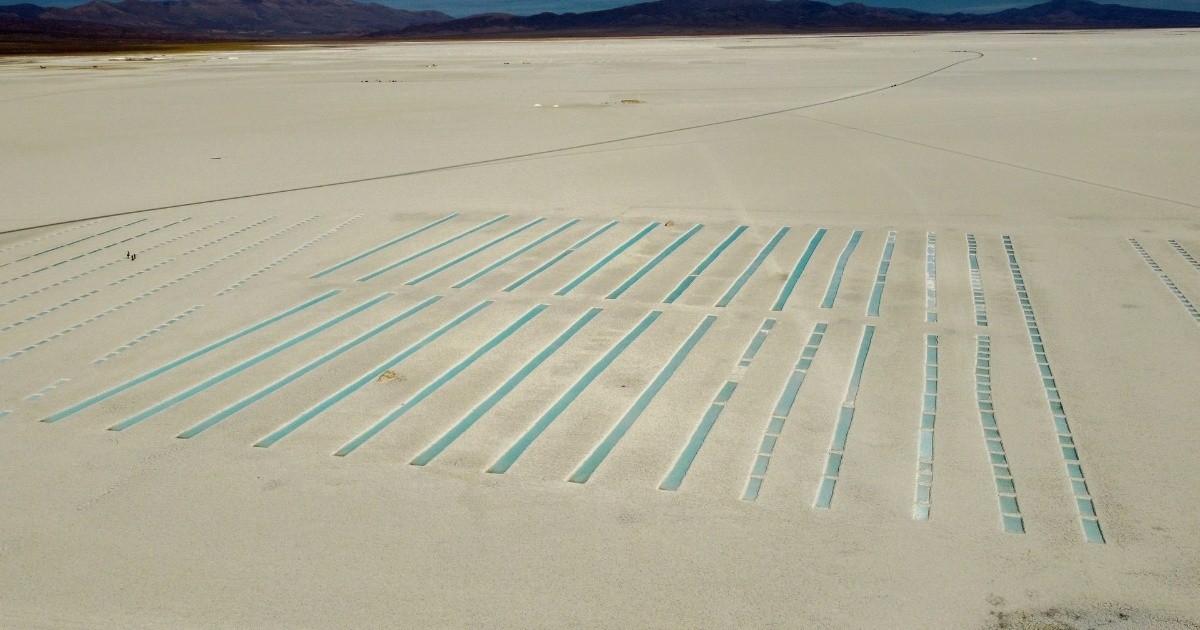

The mining operations in Argentina The US and Chile are in the Atacama salt flat, which is the largest salt deposit in Chile and the place where the Chilean multinational SQM extracts lithium and other minerals. Its sales skyrocketed 144% thanks to market growth and around 45% of SQM’s exports in 2021 were destined for Asia.