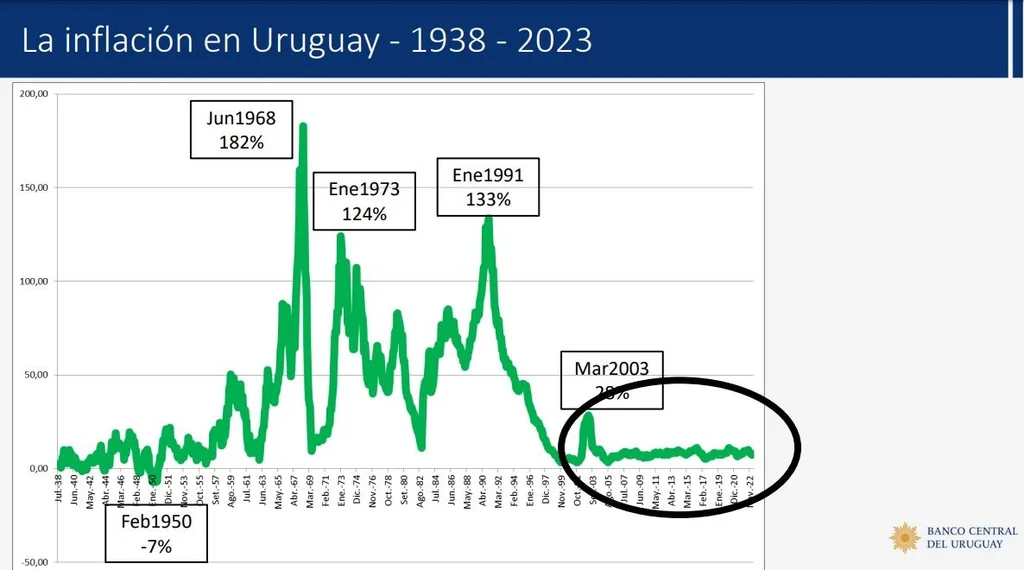

In 1950, when the Uruguayan soccer team was world champion in the Maracana, the country had negative inflation that lasted more than a year.. In June 1968 it reached a record of 182%, at the beginning of 1973 it was 120%, and at the beginning of 1991 it was on the axis of 130%.

The figures stand out in a graph that shows how Uruguayans have lived with different levels of inflation throughout history. This image was chosen by the president of the Central Bank (BCU), Diego Labat, to begin his presentation to businessmen from different sectors of activity on Wednesday night at the Hyatt Hotel in Montevideo.

His example also focused on what has happened over the last 20 years, when the graph becomes nearly straight, leading to the incorrect belief that the problem is under control. When zoomed in, the graph is full of swings that run between 6% and 10%, with a range that most of the time centers around 8%.

BCU

It is the same example that the head of the BCU used days ago in London during a conference with other colleagues from around the world, to say that Uruguayans “live peacefully” with that inflation.

“That’s where everyone was laughing because it doesn’t really close,” Labat recounted. “This thing about living together peacefully seems strange. (…) In general, central banks either fight inflation or have a few wayward people who renege and say they don’t care, and they end up with triple-digit inflation, ”he said.

“I say that we have not only gotten used to living with that 8%, some end up defending the 8% because they say that Uruguay is different and there is no problem. I say that this is what cannot happen.” Labat said at the conference organized by Somos Uruguay.

high inflation

We are Uruguay

The conference at the Hyatt Hotel.

The economist explained in a simple way how high inflation affects long-term growth and negatively affects the daily decisions of companies and all economic agents, who end up making bad decisions or not as efficient as they would like.

“We have to be aware, and I’m sure your companies are beginning to see it, that with inflation of 8% we are beginning to have micromanagement problems. We have to be aware that high inflation is not free”, stressed.

goals and results

After reviewing the pillars of the new monetary policy framework implemented since 2020, the head of the BCU focused on explaining the regime of inflation targeting that the country uses, and that countries from other parts of the world also follow, “with the same or worse difficulties” than those that Uruguay has in some of its markets.

“It has its difficulties, it can be improved, but it is the best tool we have found”, Labat pointed out.

The economist said that “a lot is missing” in controlling inflation, but that “the results are coming.”

The April record placed annual inflation at 7.61%, with a slight increase compared to March, mainly due to increases in fruit and vegetable prices, which was partially offset by the moderation in food and fuel prices.

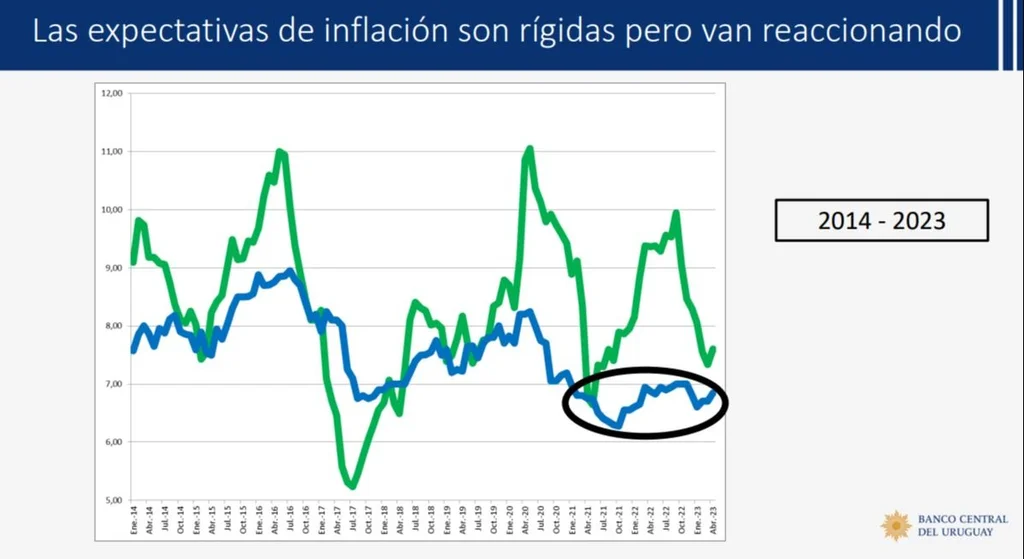

rigid expectations

Regarding the evolution of inflation expectations, the president of the BCU affirmed that “they are very rigid” but that “they are reacting” in the “proper” direction.

“In the first months we had a significant drop, but for a few months we have seen them very rigid and we have not managed to get them to reach the level of the target range (between 3% and 6%). That would be the worrying part of the film that concerns us and occupies us on a day-to-day basis,” he stated.

In this sense, Labat pointed out that although “it is still far from the target range”, in the last 36 months expectations are “well below” the historical average.

“Even with inflation like the one that occurred in the second part of 2021, and a good part of 2022, growing and a lot, expectations rose somewhat, but slightly, and the reaction was much less than on other occasions when there had been these shocks” , he claimed.

BCU

Regarding the Monetary Policy Interest Rate (today at 11.25%), Labat reiterated that it is to be expected that it “will continue to decline”, but that this decline will be “as slow as necessary” for expectations to converge with the objectives.

exchange policy

Regarding the exchange market, Labat referred to the need to “Take care of the free floating”, since it reflects “nothing else than the supply and demand” of dollars, “with the conditions” that the market has at any given time.

“We are very satisfied with the operation that the market is having, and the very healthy behavior. (…) When there was an excess of interventions, the different economic agents ended up having a support, and they already knew that the dollar ended up having a ceiling or a floor. That ended up changing behaviors when they made decisions. (…) We are going to intervene when we really understand that there are disorderly market conditions that make it necessary”, said Labat.