During a podcast by Grupo Financiero Banorte, the official said that the continuous increases in labor costs and international food prices are making rapid convergence towards the 3% inflation objective difficult.

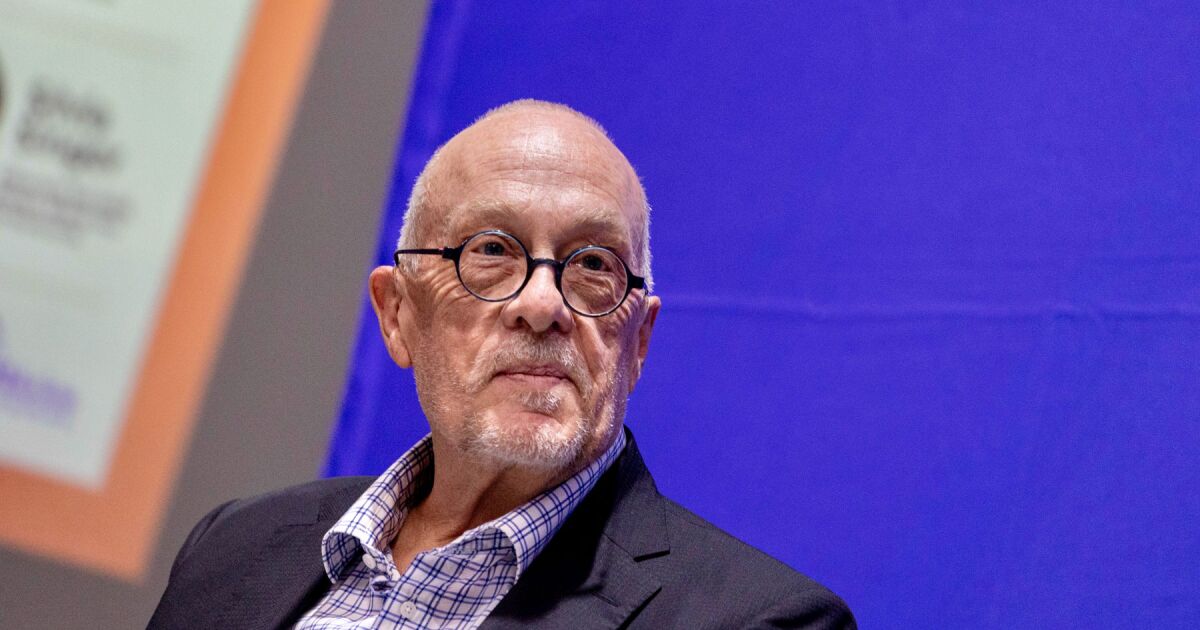

“We should not rush by lowering the rate so aggressively,” said Heath, who stated that although general inflation is below 4%, the underlying index remains high and this demands a more cautious monetary stance regarding cuts in the reference rate.

General inflation was at a 3.76% at annual rate in September while the underlying was at 4.28%.

At the end of September, Banxico reduced the rate of interbank funding by 25 basis points (bp) to 7.5% and said that in the future it will consider additional cuts. The rate has decreased 375 bp since 2024 as part of a readjustment cycle after reaching a record of 11.25%.

“We should do what they are doing in Colombia, be much more cautious and wait to see if inflation could really resume a downward trend,” he said, later adding that he does not believe that inflation will drop to its goal by the middle of next year.

He added that the rate will be in clearly neutral territory if two additional cuts, of 25 bp, are consolidated in the November and December decisions.

With information from Reuters