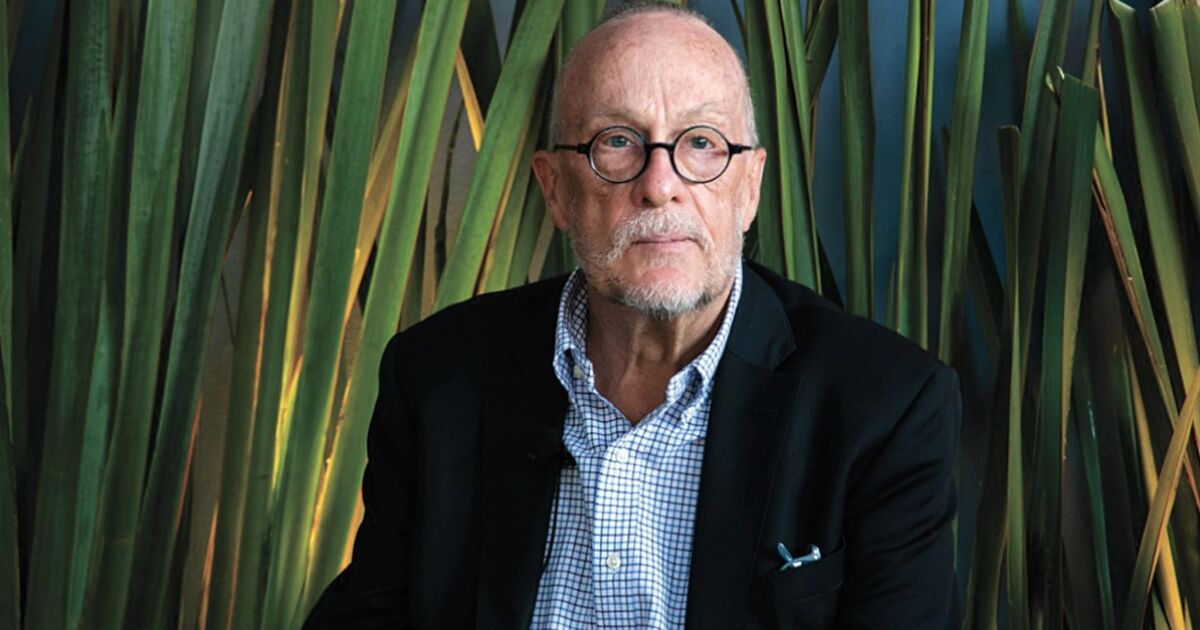

The deputy governor of Banxico pointed out that there is not much difference between his vision of the inflationary outlook and that of his colleagues on the central bank’s Governing Board. “We are very satisfied with what has progressed so far, but we have to give the last push.”

For Heath, this latest push has to do with maintaining a restrictive monetary stance for “a little longer” until we see concrete results in the disinflationary trajectory. He added that although the central bank’s projections indicate that inflation will converge to the 3% goal in the second half of next year, he sees it as difficult to achieve due to the behavior of the services component.

For a few weeks now, analysts consulted by Expansion They have said that the central bank’s inflation forecasts are “optimistic” and Jonathan Heath highlighted that this was another reason why he voted to keep the reference rate unchanged.

“Precisely for that reason it is one of the reasons why I voted for better to pause and with a little more caution, caution from now on. I think all the analysts are seeing that core inflation basically went down to where it could go down and that between now and the end of next year it will not go down any further and I believe that what they are seeing is that it is not clear that we will be able to break the persistence of prices,” he assured.

Services inflation has been above 5% for 25 months, putting pressure on core inflation.

“We have to begin to see a downward trajectory in the prices of services, which we do not see yet. We have to have a little more patience, we are not in a hurry, and wait to see that we begin to break that persistence to ensure that we can meet our goals by the end of next year,” he added.

The deputy governor considers that the persistence in services is derived from labor costs that have increased in recent years and that the average contribution of workers affiliated with the Mexican Social Security Institute (IMSS) increased in August 4.5% at a real rate.

When asked about the impact of the salary reform proposed by the president, which establishes that salary increases cannot be below inflation, Heath explained that 6 or 7 years ago there was “a lot of room” to increase salaries. minimum without consequences but now, these increases could complicate the disinflationary process.

“The average wage and the minimum wage are already much closer than they had been before and that means that an increase in the minimum wage is now very likely to have an important influence on average wages,” he said.

It is expected that in 2025 the minimum wage will increase by 11%, which will put pressure on labor costs.

Regarding the next movements that the central bank will make to the interest rate, Hetah said that the decision will be in accordance with the evolution of the data.

“If we see that the persistence of services is already beginning to break and we see that general inflation continues to fall in line with our forecasts and not those of financial analysts, then perhaps we could see a unanimous decision in the sense of continuing with this cycle of cuts in the rate,” he pointed out.