It is considered that there is recession when there is a decrease in economic activity over a period of time. Usually it is understood that it occurs when the variation rate of the gross domestic product (GDP) is negative for two consecutive quarters.

when there is one recession Job losses and difficulties in obtaining job promotions or salary improvements are generated.

The president of the Federal Reserve (central bank of the United States), Jerome Powell, said last week that the objective of the institution is to raise the monetary policy rates without causing a recession.

But a survey last month by the British Financial Times, in association with the Global Markets Initiative at the University of Chicago Booth School of Business, found that nearly 70% of 49 leading academic economists believe the US economy will enter recession next year. Specifically, almost 40% project that it will be declared in the first or second quarter and a third that it will be delayed until the second half of 2023.

The projections are that dominican economy will grow 5% in 2022. But, in the current times of increases in the prices of the family basket, increases in monetary policy by the Central Bank, delays in the supply chain…, is the country at risk of a recession? Free Journal he asked four economists, who presented their opinion.

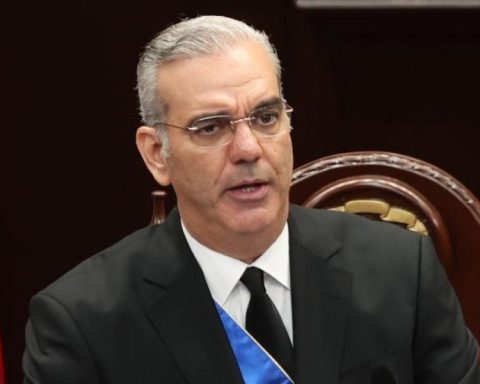

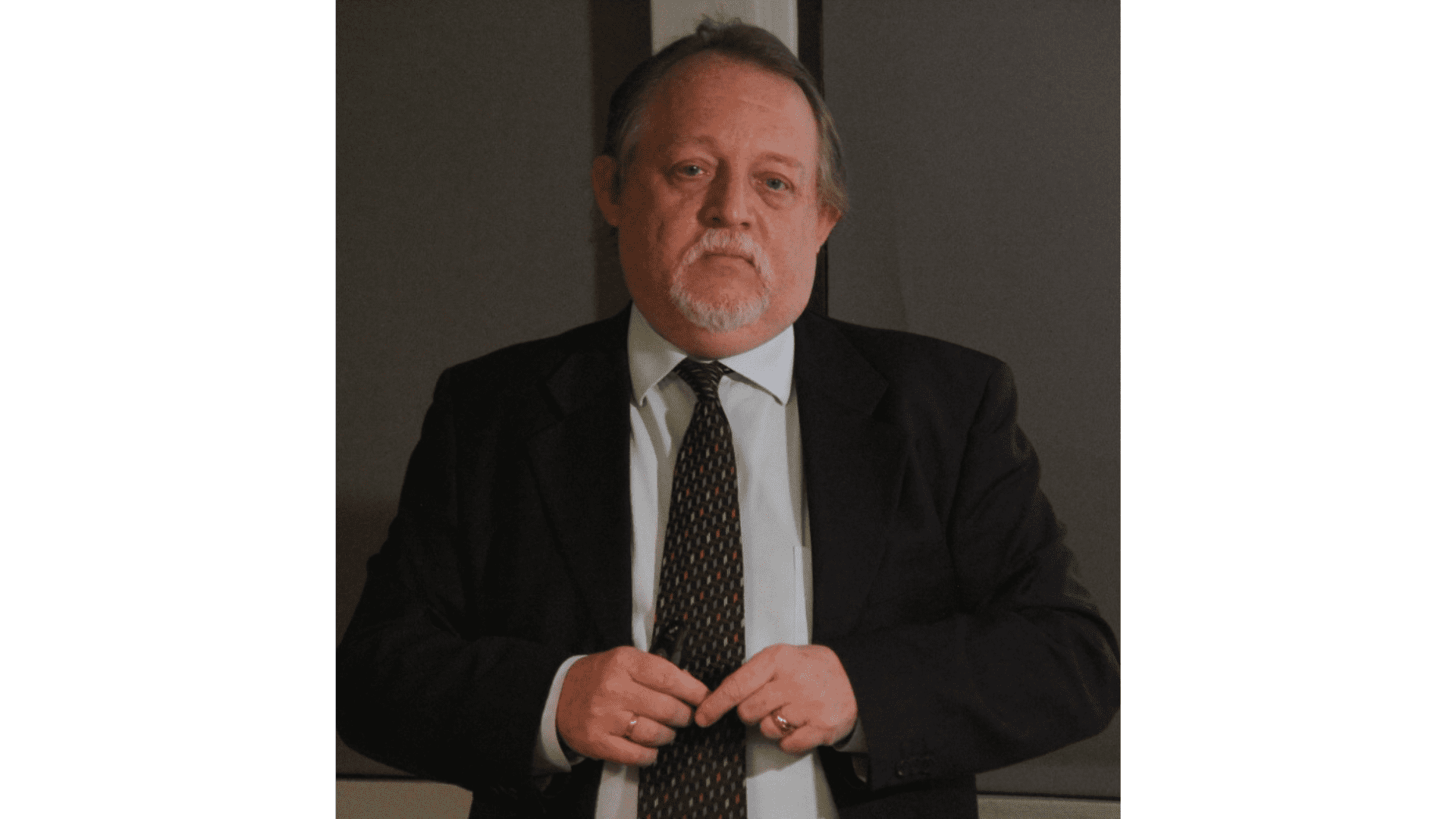

Guillermo Caram, former Governor of the Central Bank

I do not fear recession. The dominican economy It has an enormous capacity to respond, even above the bad economic policies of governments.

In the 56 consecutive years of democratic life -which precisely restarted in the elections of June 1, 1966 in which Joaquín Balaguer was elected-, the dominican economy it has grown, except for a few years due to specific circumstances such as the drought in 1967 until the financial mortgage crisis of 2008. We have had seven presidents and the economy has continued to grow.

What we should fear is the lack of national production that translates into imported demand, due to the low priority given to economic activities that produce primary goods to satisfy fundamental needs such as agriculture. Yet the inflation imported that this would entail (…)

A national crusade is needed to increase production. It is not enough to develop the specific targeted projects that the authorities have announced to implement the presidential declaration to sow even the alleys (…)

It is necessary to modify the subsidy policy to subsidize producers instead of consumers, through, for example, that the State assumes the increase in the interest rate that is taking place as a consequence of monetary policies to contain the inflation.

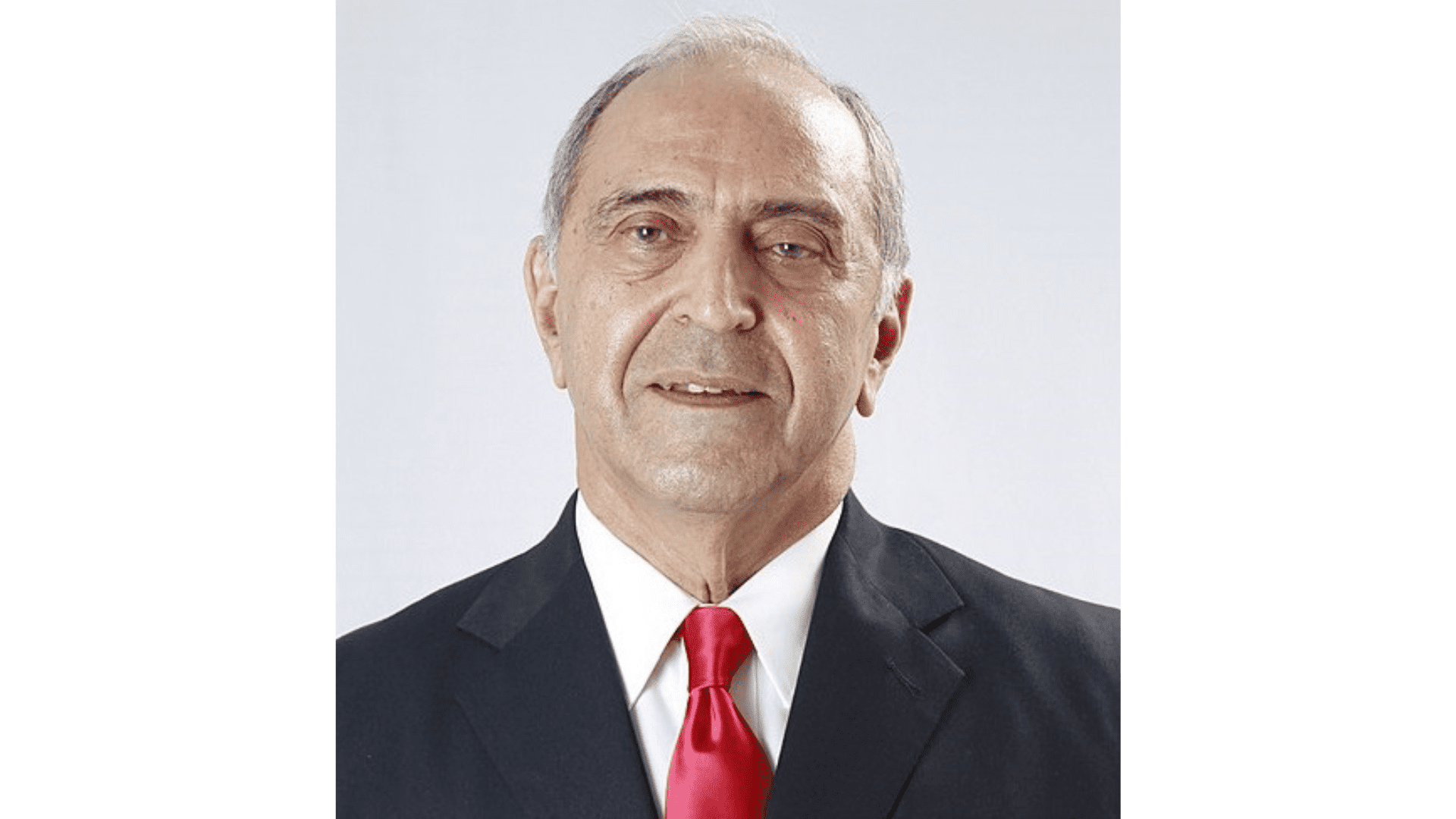

Isidoro Santana, former Minister of Economy

In principle, what can be seen everywhere is a reduction in growth projections, and even this year it is not anticipated recession, except in Russia and Ukraine. But the crisis is hitting hard, mainly the countries of Europe, in particular Germany, which is the most important and, depending on how the conflict continues, it is foreseeable that in 2023 all of Europe will enter recession.

In the countries of America, for now the biggest problem is that of inflation, and since many are fuel and food exporters, high prices benefit them more than harming them. That does not apply to the Dominican Republic, which is a large importer of fuel and some grains, which are essential inputs for the production of chickens, eggs, meat and milk, so none of this benefits us.

The increases in interest rates are going to start to impact us, but not much this year, because the government had already placed the bonds it needed to finance this year’s budget.

And the higher interest rates in the domestic market are going to slow down growth, greatly affecting the construction sector, which is the most sensitive, due to the high component of interest in the monthly installment for families that have mortgage debts or plan to buy a House. In any case, the official projections still do not point to recession.

__________

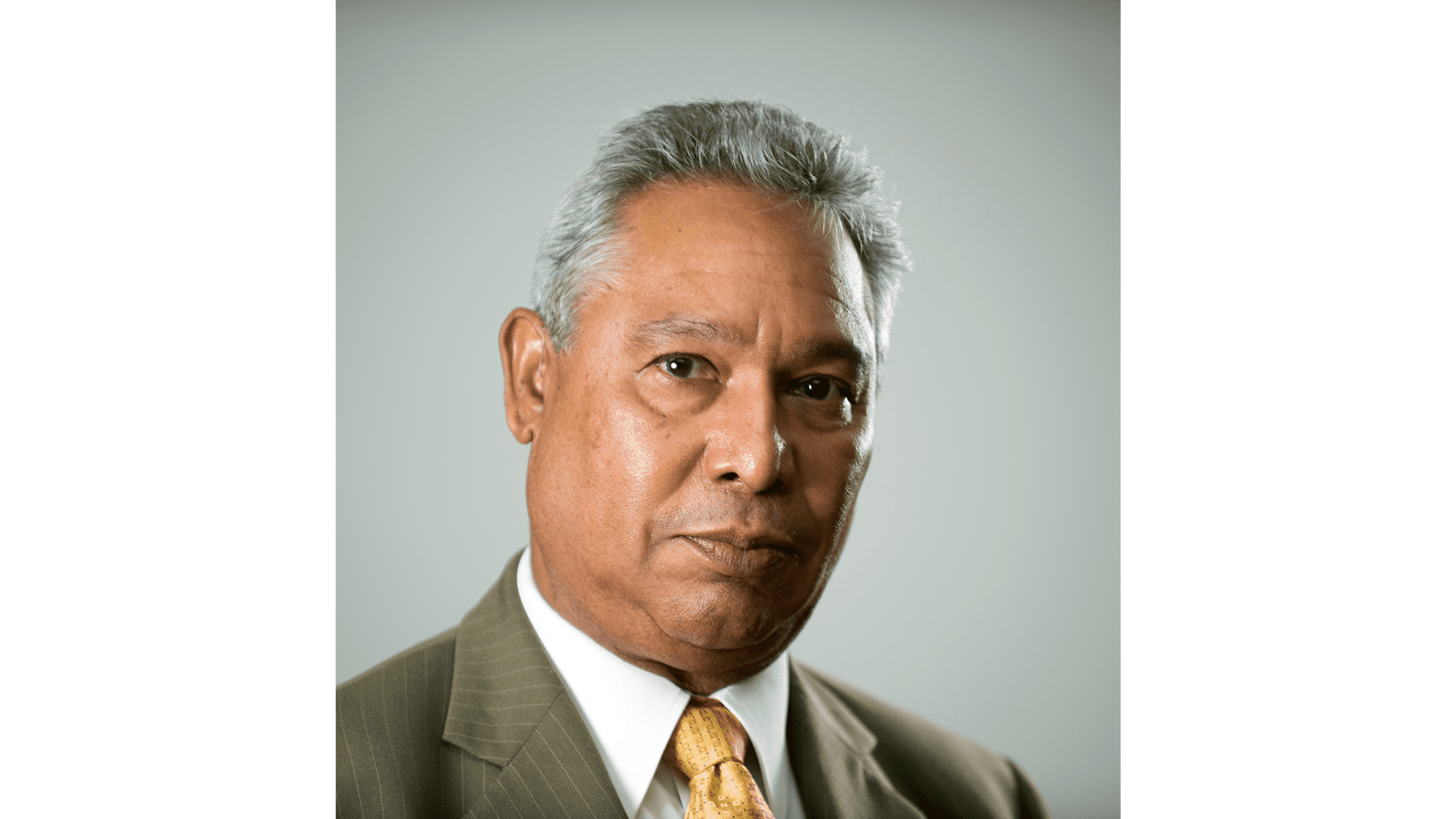

Odalis Marte, Executive Undersecretary of the Central American Monetary Council

According to available information, the world economy continues to grow, only at a slower pace. Indeed, the world economy would grow around 3.6% in 2022, according to estimates by the International Monetary Fund.

For the Dominican Republic, that organization estimates that our economy will grow by 5.5%, which is consistent with official forecasts of around 5% for this year.

Although the international environment relevant to the dominican economy has become more complex than in the years prior to 2019, the country has a series of advantages that make its economy more resilient: macroeconomic stability, credibility in economic policy, political stability, a dynamic private sector willing to invest in new businesses , openness to foreign investment, among others.

In the context of the world economy, the current situation would improve, either because the economy adapts to produce with less use of fossil fuels and more reliable supply alternatives of final consumer goods and industrial inputs are found in international supply chains. supplies. A relatively peaceful resolution of Russia’s war against Ukraine would help stabilize and improve the current situation, but that is unpredictable.

__________

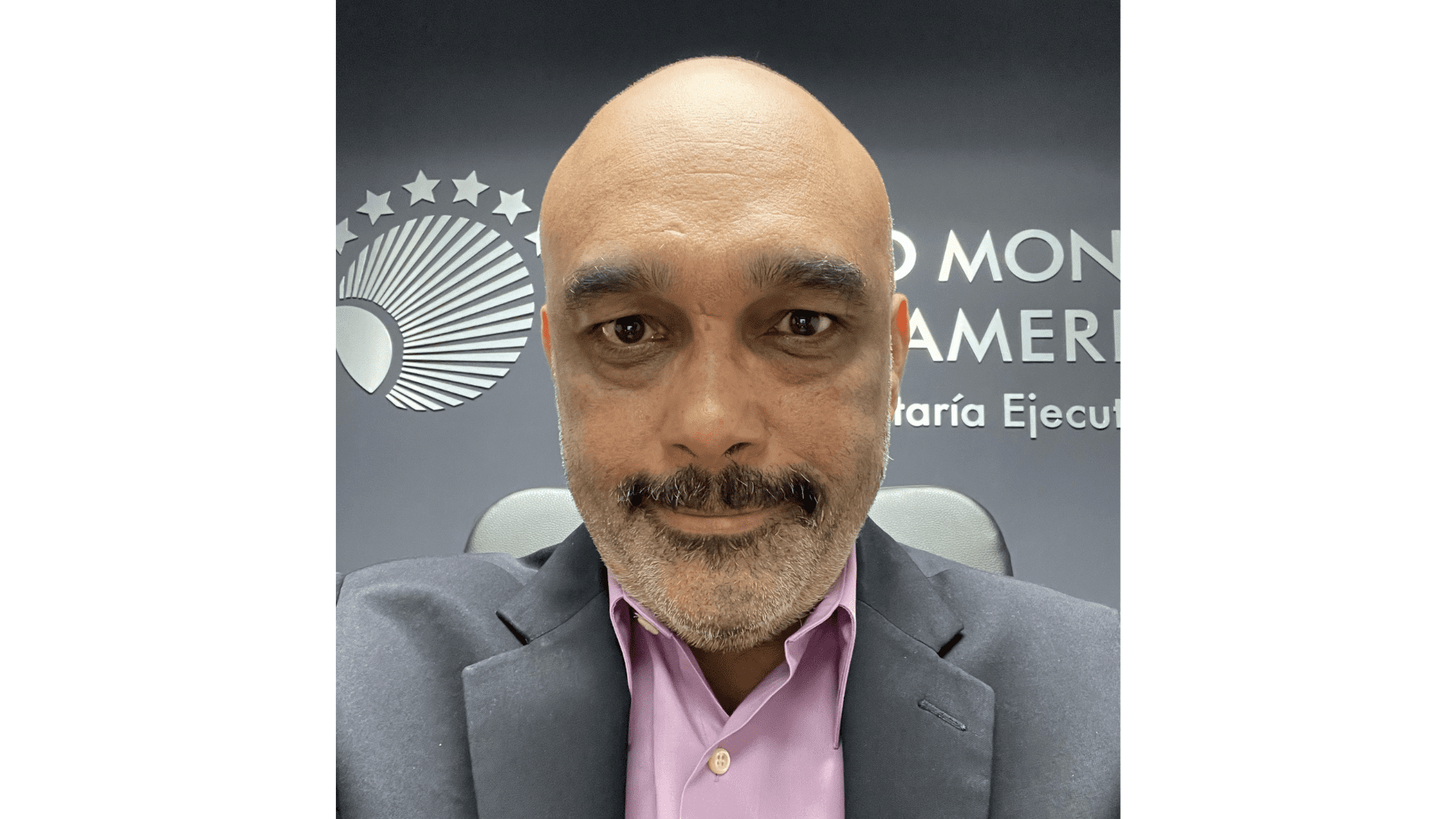

Henri Hebrard, economic analyst and consultant

Traditionally, in developed countries we speak of recession when there has been a fall in the economy (measured through GDP) for two consecutive quarters. Now, in the case of the Dominican Republic, I think it is important to point out that it seems more appropriate to talk about recession if the economy does not grow enough to absorb the new entrants to the labor market; in other words, one could even speak of “recessive growth”.

In the Dominican Republic, it is observed that, on average, the number of jobs grows at a rate roughly equivalent to half the growth of the economy; In other words, if the economy grows by 6%, employment grows by 3%. Hence, it follows that a growth of no less than 4% of the GDP is needed to be able to provide jobs to the 2% that the population looking for work grows annually. This means that, in the Dominican case, growing below 4%, by causing an increase in unemployment, is equivalent to having recessive growth. In the short term, this is out of the question, unless it continues to rapidly slow the US economy.

The greatest risk in the case of the United States is the rise in interest rates (which the Federal Reserve has already initiated), and due to these rate increases it has just seriously revised downwards its growth expectations for the United States to just +1.7% of GDP in 2022. It is considered that for each point that the US economy slows down, the Dominican GDP contracts around 1.70% of GDP.

So far there are no official projections for a recession, nor in the United States and much less for the Dominican Republic. We estimate that, with the increase in the monetary policy rate from 6.50% to 7.25% (its highest level since January 2009), the GDP of the Dominican Republic could close with growth of around 4.7%, and eventually somewhat lower in 2023 ( slightly above 4.0%).