On the night of this Wednesday, November 27, a circular began to circulate on social networks, supposedly signed by the Superintendent of Banks, Luis Ángel Montenegro, which addresses the “general managers of supervised agents”, in which it refers to the Sanctioned Law and the measures that national banking institutions should take to avoid the catastrophe that is already anticipated.

In the communication, the Sandinista official, who also It has also been sanctioned by the United States since November 15, 2021.adds as a reference to “Instructions on compliance with Law No. 1224, Law for the Protection of Nicaraguans from External Sanctions and Aggressions, with respect to international contractual regulations.”

In the document, identified with the code DS-DS-3882-11-2024/LAME (the last four letters seem to be the initials of Luis Ángel Montenegro Espinoza), the bank superintendent sends two instructions. On the one hand, it says that «Financial institutions must maintain compliance with regulations against Money Laundering and Terrorist Financing»although none of that is said in the Sanctioned Law that Ortega ordered to be approved last Monday, November 25 and public that same day in the afternoon in the official newspaper La Gaceta.

In a second point of the circular, Montenegro tells “financial institutions (that) they must establish intensified due diligence measures for clients designated on (sanctioned) lists and must report them to the Financial Analysis Unit (UAF).”

It must be verified, the superintendent of banks insists, “that the provision of international financial services for “these clients” corresponds to international contractual regulations.”

At the end of the note, the sanctioned official warns the bankers that “this Superintendency will follow up on compliance with the above instructions, in accordance with the applicable legal framework,” without specifying whether that legal framework includes the new Sanctioned Law. o Law 1224, with which the Sandinista dictatorship, of which Luis Ángel Montenegro himself is a part, intended to circumvent the pressures of the North American Department of the Treasury and the Office of Foreign Assets Control (OFAC), which prohibit any institution or person that is based in the United States from doing business with people or entities that are designated by Washington as international criminals.

¿Ortega backs off or plays lively?

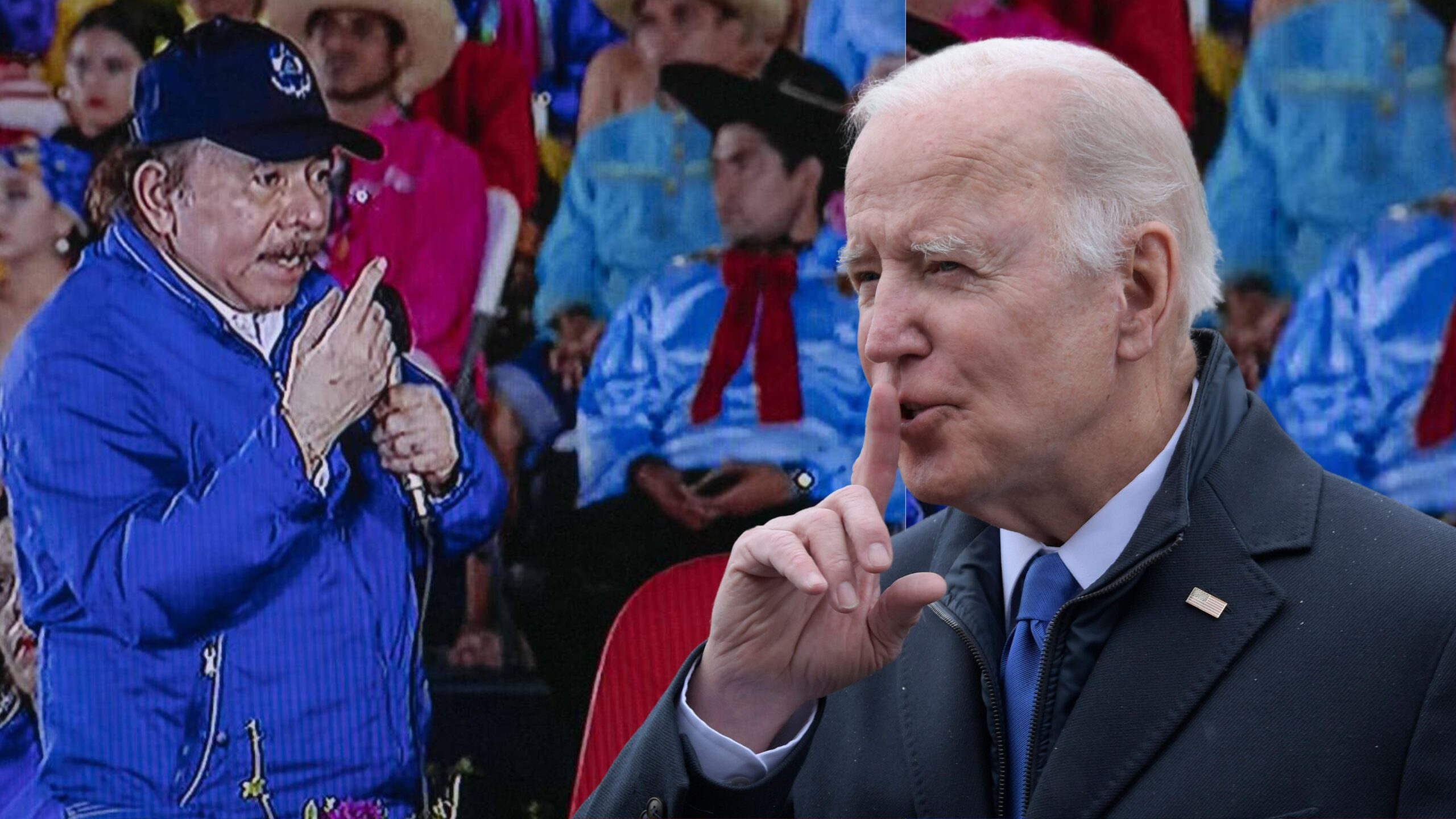

The bank superintendent’s circular has been interpreted by some people as a setback by Daniel Ortega in his attempt to circumvent the sanctions, because he was convinced that trying to ignore the maneuvers of the United States was going to end up liquidating the national bank and By doing so you would be shooting yourself in the foot; However, the wording of the second point of this “instruction” also reveals the possibility that it is an artifice of the dictatorship to ensure that in the end the bank reopens the accounts of its sanctioned accomplices, without having consequences with OFAC.

“…that the provision of international financial services for “these clients” corresponds to international contractual regulations,” says the note, which could be interpreted as the regime always trying to get banks to reopen the accounts of its sanctioned criminals, although They are limited only to keeping their money and internal transactions; but not force bankers to have to carry out international transfers and operations that put the banking institutions of Managua in direct conflict with their international correspondents.

After the publication of this note, which the dictatorship has not published in any of its government propaganda media, speculation also gains strength: that issuing such an ambiguous circular could be part of a negotiation between the Ortega regime and the bankers. . It remains to be seen whether or not, even with this note from the Superintendency of Banks, the Penalties Law motivates any measure in the White House.

The weight of the correspondent banks with which the Nicaraguan bank has ties

In the specific case of Nicaragua, according to a review that the team of Article 66 made on the websites of the seven financial institutions, authorized and regulated by the Superintendency of Banks, at least five of them have public their relationship with correspondent banksdistributed in 15 countries.

In total, we identified 54 connections of national banks with correspondent banks: 17 are in the United States; 8 in Panama; 7 in Spain; 3 in Germany; 3 in Guatemala; 3 in El Salvador; 3 in Mexico; 2 in Canada; 2 in England; and a correspondent in each of the following countries: Switzerland, Colombia, Brazil, France, Costa Rica and Nicaragua.

He Bank of Finance (BDF) maintains correspondents with four foreign banks: in the USAits correspondent banks are Bradesco Bank (Bradesco Bank) and Ocean Bank (Banco del Oceano), to receive and send transfers in dollars. In Europeits connection is with Banco Sabadell SA. and CaixaBankboth from Spain, to receive and send transfers in euros.

For its part, the financial institution Lafise Bancentro maintains correspondents for international transfers in dollars with Citibank (City Bank of New York) and JPMorgan Chase & Coconsidered the largest bank in the United States, in terms of market capitalization. To transfer euros, Lafise works with European banks Commerzbank, considered the fourth largest bank in Germany and with Banco Bilbao Vizcaya Argentaria SA (BBVA) of Spain.

Meanwhile, the Avanz bankowned by the Pellas Group, maintains correspondents in the United States with Bradesco Bank (Banco Bradesco), and with Terrabank, both from Miami, Florida.

For its part, the Production Bank (Banpro)part of the Promerica group, makes its international transfers through correspondents with Deutsche Bank Trust Company Americasbased in New York; Bank of AmericaFlorida; JPMorgan Chase & Co.

Also, with Commerzbank Representative Office PanamaSA; with Terrabank from Miami: with Banco Bilbao Vizcaya Argentaria (BBVA), based in Madrid, Spain; and finally with International Bank of Costa Ricawith an office established in Panama City, Republic of Panama.

While the bank Ficohsaone of the smallest entities in Nicaragua, maintains correspondents with 37 banking entities in 15 countries around the world.