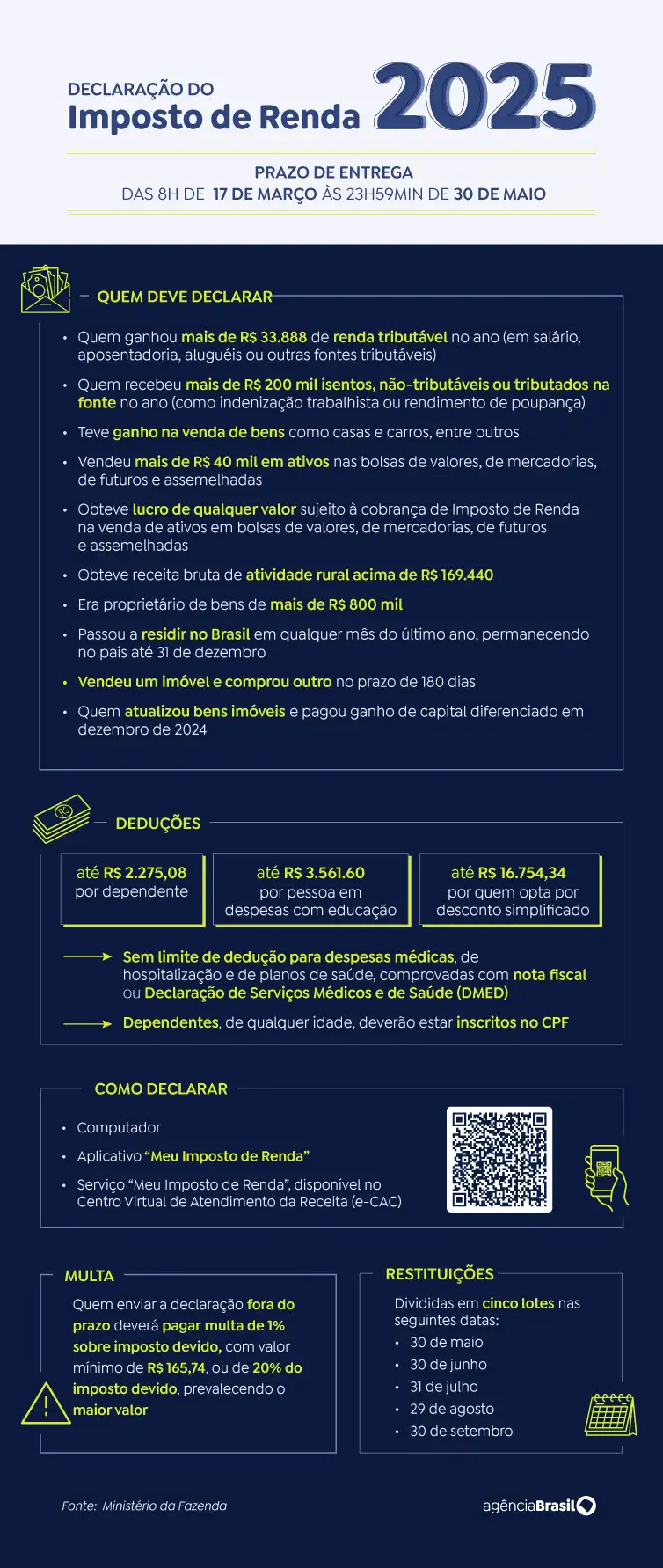

The 2025 Income Tax Declaration period began on March 17. This year, the deadline runs until May 30, and the IRS is expected to be 46.2 million people to submit the statement.

At the time of the income tax return, one of the points that deserves the taxpayer’s attention is that of deductions provided by law. Wrong information can lead to loss of tax benefits or problems with the fine mesh.

There are two deduction models: simplified discount and legal deductions.

“The complete statement is ideal for people who have many deductible expenses in health, education, private pension and dependent. It allows detail all expenses. In the simplified statement, it already applies the standard discount of 20%, without the need to prove my expenses. It is indicated for people who have little deductible expense,” explains Professor Gilder Daniel Torres of the Anhanguera College Sciences course.

In the simplified discount, the taxpayer chooses the sport and the IRS already applies the discount. In the case of choosing legal deductions, some expenses may help the person pay less tax or even return.

“Expenses with doctors, dentists, psychologists, hospitals, health plan, exams, can be deducted without limits, provided that they are proven, both taxpayers and their dependents. Education, which are spending on school tuition, colleges and technical courses.

According to IRS data, 56% of the statements sent last year were in the simplified model, while 44% were sent in the model for legal deductions.

>> Check out all the contents of the IR 2025 Duvid series

Who can be declared as an IRPF dependent?

For those who are upright, the declaration of dependents It is one of the best ways to get a discount when delivering income tax. By 2025, the IRS guarantees a fixed discount of R $ 2,275.08 for each dependent.

In addition, it is possible to deduct income tax amounts by declaring some expenses with them.

Professor Marco Aurélio Pitta, from the Positivo University, explains that the taxpayer can consider spouse or even the partner.

“In the case of their partner, it has to be with whom the taxpayer has a child, or, if he has no child, who has been living for more than five years with this companion. It is also very common to declare dependents as children or stepchildren. In such cases, we have situations up to 21 years or 24 years, if he is attending higher education or any age, if there is any physical or mental disability for work,” he explains.

The taxpayer may also declare brothers, grandchildren, great -grandchildren, or even parents, grandparents or great -grandparents, or even poor, or absolutely incapable person if he is a tutor or healer.

A person cannot be included as dependent on more than one statement. The omission of income from dependents can make the taxpayer fall into the fine mesh.

What is the order of receipt of income tax refund?

The IRS estimates that about 27.7 million taxpayers will be entitled to receive refund in 2025.

This year, the refund of income tax will be paid in five monthly lots:

- May 30

- June 30

- July 31

- August 29

- September 30

The inclusion of the taxpayer’s refund of right will obey the following legal priority criteria:

- Person aged 80 or over

- Person aged 60 years or over, a person with disabilities and serious illness

- Taxpayers whose largest source of income is the teaching;

- Taxpayers who used the pre-named statement and chose to receive refund by pix

- Other contributors

If there is a tie in the criteria, those who first delivered the annual adjustment statement will have priority within the same group.

For the taxpayer to know when he will receive the refund of income tax, he can consult through the IRS page, in the IRS app or check at www.restiticao.receita.fazenda.gov.br, inform the CPF and the date of birth.

The deadline for income tax return runs until May 30. Since April 1st, Pre-named statement is available for all taxpayers.