US$ 6,078 million will be allocated to road, energy, telecommunications, sanitation, ports or rail transport works

Uruguay will invest close to 7.2 billion dollars in infrastructure projects between 2022 and 2024, according to a report published Monday by the investment promotion, exports and country image agency Uruguay XXI.

This is indicated based on data collected as of December 2022 in the document entitled “Construction and real estate sectors in Uruguay”, which also details that the construction sector had an expansion of 6% in 2021 and highlights the “good dynamism” of the sale of homes in the country in the last two years.

Regarding investment in infrastructure projects, the agency points out that in the period 2022-2024, 6,078 million dollars will be allocated to road, energy, telecommunications, sanitation, ports or rail transport works, while some 1,098 will be invested in housing. additional millions.

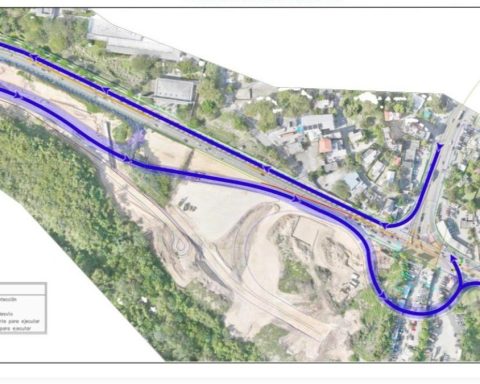

«Among the most important are road infrastructure works; It is expected to reach an investment close to 3,300 million dollars in the five-year period”, the report underlines.

On the other hand, the document highlights that, although Uruguay is “an important producer and exporter of wood”, the use of this as a construction material “has historically been relegated” in relation to other construction methods with heavy materials, for which reason now we are working to enhance it.

“As currently 1% of the promoted homes built in Uruguay are made with this material, the roadmap aims to reach 20% by 2032,” highlights the Uruguay XXI report.

The document stresses, on the other hand, that the boost in construction in the country in the last two years “is mainly explained by the works associated with the UPM 2 pulp mill”, the second pulp mill of the Finnish company UPM, which led to the construction of the so-called Central Railway, as well as other associated works.

“On the other hand, in April 2020 the national government modified the investment regime related to housing and projects of great economic dimension. The changes sought to make the regime more flexible and reactivate investment in the sector, which meant a positive impact on the amounts of investment in housing, “adds the text.