Russian capital is concentrated in specific activities. His main interest is in the fuel retail tradeas well as in the sale of lubricating oils and greaseswithout a relevant presence in other productive sectors.

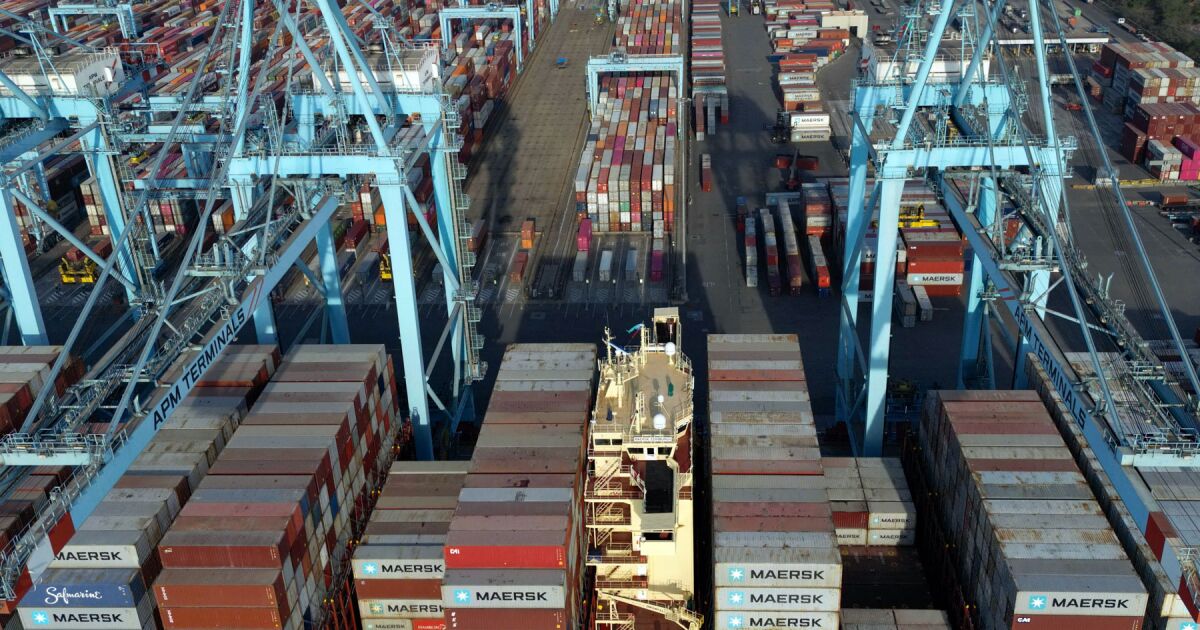

In contrast to investment, trade between both countries is more dynamic, although with a clear imbalance. The balance does not favor Mexico, which registers a deficit of 1,638 million dollars against Russia in 2024.

Mexican purchases from Russia began to expand in 2011, slowed in 2020 due to the pandemic and regained strength in 2021, when they exceeded $2 billion. That level was maintained until 2023. In 2024 the flow decreased and in 2025, until October, it was unable to recover those amounts.

Mexican imports from Russia include chemical fertilizers, metal products and grains, key inputs for local productive sectors.

On the opposite side, Mexican exports to Russia are reduced. In 2014 they barely amounted to 31.6 million dollars and reached their highest point in 2021, with 499 million dollars. Mexico mainly ships coffee, pepper, pharmaceutical products and some foods.

In Latin America, Mexico is Russia’s second trading partner, below Brazil. In contrast, Russia ranks as Mexico’s 17th partner within Europe.

The greater commercial rapprochement with Mexico occurs at a time when Russia seeks to diversify its economic ties in the face of international sanctions derived from the war in Ukraine. Added to this is the reconfiguration of the global energy market, marked by tensions between Venezuela and the United States, which alter traditional supply flows.

Nikolai Shkolyar, senior researcher at the Center for Economic Research of the Latin American Institute of the Russian Academy of Sciences, points out that investment cooperation between Russia and Mexico is not advancing at the same pace as bilateral trade.

In an analysis, he explains that Russian investment in the country remains at practically zero levels, in part because investors from that country have not yet appreciated the long-term potential of the Mexican market, which offers foreign capital an attractive risk-return relationship.

Mexico in Russia’s sights

According to what the Russian ambassador to Mexico, Nikolay Sofinskiy, told TV BRICS, opportunities are identified to expand the bilateral relationship in several sectors. Energy occupies a central place. Companies from that country participate in offshore oil exploration and production projects, in the modernization of refining facilities and in the supply of specialized equipment.

Russia also highlights its lithium extraction technologies, which it considers useful in light of Mexican interest in developing local deposits. Cooperation in nuclear energy continues and there are prospects for collaboration on projects linked to the energy transition.

In June 2025, the Russian embassy indicated that the country is ready to supply liquefied natural gas to Mexico and to share technologies throughout the energy sector production chain. Russian Energy Minister Sergei Tsiviliov stated that both sides are already working on this agenda and highlighted his country’s willingness to transfer LNG technologies, as well as oil extraction methods in complex geological conditions and solutions to improve processing efficiency.

The following month, Lavrov met with the Mexican Foreign Minister, Juan Ramón de la Fuente Ramírez, within the framework of the BRICS summit in Rio de Janeiro.

The agricultural sector also appears as a relevant axis. Russia represents an important part of wheat exports to Mexico and sees room to expand the supply of other products. Added to this is the interest in strengthening cooperation in the pharmaceutical and chemical industries, information technologies, mechanical engineering and artificial intelligence.