The same level expected for the end of 2024, with respect to GDP, is expected for 2025 with a value of 1.4 trillion pesos, while for the end of this year it is expected to be 1.2 trillion.

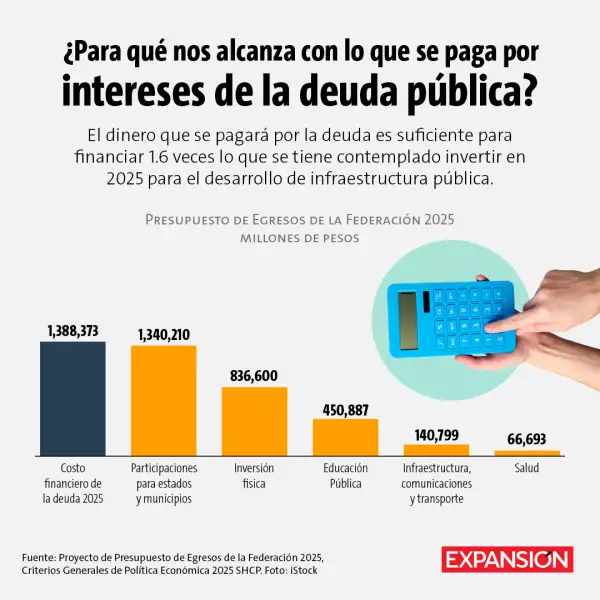

The amount of the financial cost is equivalent to all the resources transferred by the federal government to the states through the Participations.

The financial cost is expected at 3.8% of GDP next year and capital spending at 2.8%, “so we are going to pay more in interest and debt service alone than everything we are going to invest in a year, that is relevant ”, Clavellina explained. Year after year, the financial cost of debt absorbs more of the budget, tightening the margin to allocate resources to other items.

“When you have to pay your debt and interest, the way you can do it is by cutting spending, because what you did by going into debt was sacrificing purchases in the future, in the same way the government doubled the deficit this year, so you will have to sacrifice expenses in other areas to meet liabilities, which are at high interest rates because there is still inflationary inertia that does not allow us to lower rates to the levels that we were accustomed to in previous years,” explained Manuel Herrera, vice president of the National Committee. of Economic Studies of the Institute Mexican Association of Finance Executives (IMEF).

In addition to being a distraction for investment in social and economic infrastructure, the high interest payment on the debt puts more pressure on the rating agencies, “we are on the frontier of being able to generate a change of perspective, like the one Moody’s had last week , or even a change in qualification, if the financial cost indicator rises to a higher percentage than the income.”

Herrera highlighted that a lowering of credit ratings or prospects makes future financing more expensive, in addition to reducing debt payment terms; “That is the consequence of having spent so much in a single year, that is why it is very important to maintain moderate fiscal deficits, to avoid entering into this type of dynamic,” Herrera added.