Intel Shares Jumped Significantly on Friday Following Reports that the Trump Administration is in Discussions to take a direct equity stake in the stuggling semiconductor giant. The News, First Reported by Bloomberg, Ignited Investor Optimism, Sending The Company’s Stock Up by As a lot of 7% in a single session.

The potential government investment is reported Aimed at Shoring Up Intel’s Delayed and Highly Ambitious chip manufacturing hub in ohio. While The Size and Structure of A Potential Deal Remain Under Discussion, The Move Signals a Willingness by The White House to take a More Interventionist Approach To Securing the Domestic Technology Supply Chain.

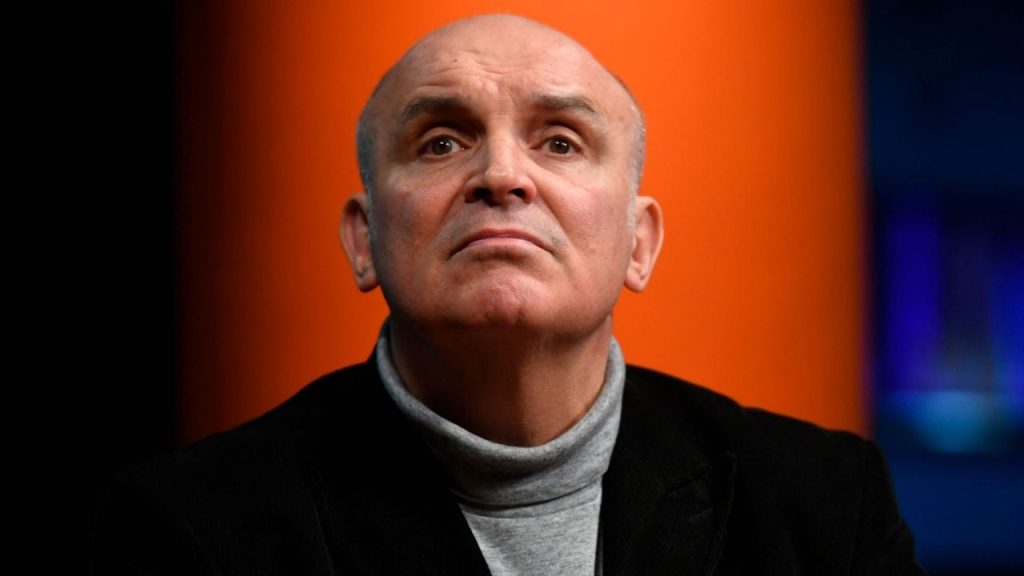

This Development follows a Recent Meeting Between President Donald Trump and Intel Ceo Lip-Bu Tan. The Talks Represent Remarkable Shift in Tone, Coming Just Days after The President Had Publicly Calleed For Tan’s Resignation, Citing Concerns Over Past Business Tiess to China.

For Intel, A Direct Government Investment Coul provides Critical Lifeline as It Navigates to Difficult Turnoound and Faces Intense Competition in the Advanced Chip Market. The Company Has Struggled To Advance ITS Foundry Business, and The Federal Backing Coul provides Much-Needed Capital and Confidenze to Support Is Domestic Manufacturing Goals.