The modernization of the payment system in Uruguay took an important step last year with the incorporation of instant interbank electronic transfers. They are currently six banks offer the service: Banco República (BROU), Itaú, HSBC, Citi Bank, BBVA and Santander.

In its first three months of implementation —between April and June 2021— 30,965 transactions had been carried out. During the second semester, this type of transfer multiplied by 8 and totaled 245,388 transferswhich explained the 2% of total transfers of the Interbank Payment System in that period, according to data published this Monday by the Central Bank (BCU).

The report explains that 90% of the volume operated under this modality was in local currency and with a average amount of $5,738. Foreign currency operations averaged 234.

In this way, in nine months, 276,083 operations were carried out, with a participation of just over 1% of the total transfers between banks last year. The system works, for now, on business days from 9 a.m. to 5 p.m.

In practice, when users enter the application or web platform of the banks that offer this functionality, they can choose between using the instant or immediate transfer and the common transfer.

Instant transfer allows a person to instruct their financial institution online to send a certain amount of money to an account at another institution in real time. That is, the money is debited from the source account and credited to the destination account in a matter of seconds, once it is processed and confirmed by the receiving bank.

Also, so that the person who makes the instant transfer is certain that it reaches the correct destination account, the identification of the accounts with the “masking” mode has been implemented.

This procedure consists of prior to confirming the transaction, the person can partially view the name of the holder of the destination account. If it does not match the expected name then the person can stop the transfer process before its execution.

BCU

Debit and Credit

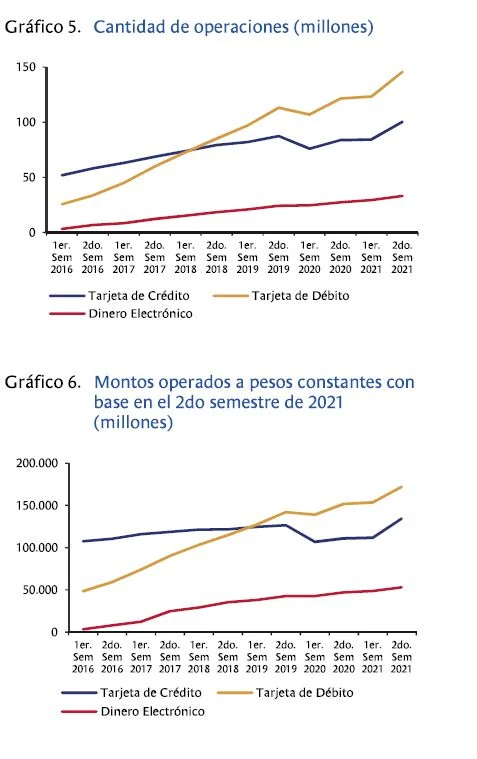

Debit card operations had a total of 146 million operations in the second half of 2021, which represented a growth of 17% compared to the previous semester. The amount operated was $171,802 million (about US$3,938 million).

Meanwhile, transactional volumes with credit cards were 100.4 million, and recovered 19% in comparison with the immediately previous semester. They were also 20% higher than the same period in 2020.

“These data would be indicating the recovery of this indicator, after the fall registered in the first half of 2020. With these figures, the number of credit card operations in the second half of 2021 was above pre-pandemic levels”, highlights the BCU. The amount operated with this means of payment was $134,557 million (about US$3,085 million).

BCU

It also continues to expand the transactional gap that exists in favor of the debit card with respect to the credit card. This was recorded for the first time in 2018, and suggests a marked preference of the public for the use of this electronic means of payment.

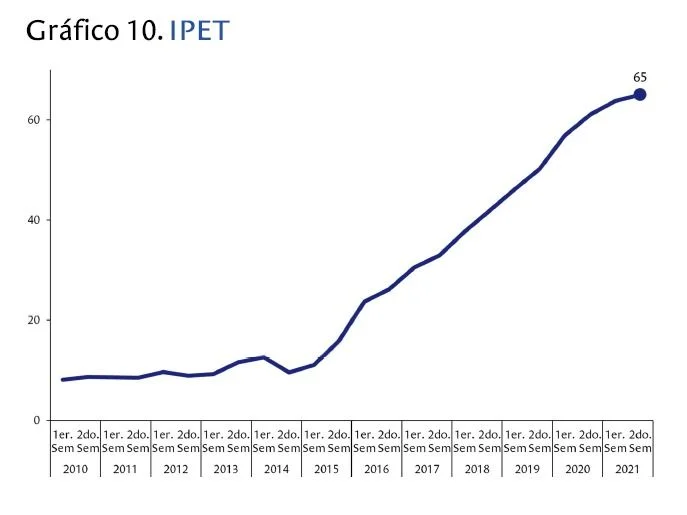

On the other hand, and in terms of amounts operated, 65% of total payments in the economy were made through electronic means. In this way, the participation of these instruments increased by just 1 percentage point compared to the first half of 2021, according to the IPET index. In any case, the participation of electronic media has grown uninterruptedly since 2015 when they represented just 11% of total payments.

BCU