Sources of income

According to data provided by Infonavit, employers’ tax collection between 2019 and August of this year was 1.6 billion pesos, while between 2013 and 2018 the collection was 1.1 billion pesos.

In addition to the salary increases that occurred during this six-year period, and the greater employer contribution – a result of the Infonavit reform in 2020 – the institute’s income comes from other sources.

One of these sources of income, Martínez Velázquez explains, has to do with tax collection options for companies that have fallen behind on their payments.

As of July of this year, Infonavit has received income of 7,867 million pesos, 5,647 million for the current year and 2,221 million from overdue accounts, while in 2018 the income was 5,665 million pesos, 3,414 million for the current year and 1,751 million from overdue accounts, according to data from the institute.

There has also been an increase in over-the-counter payments, that is, by workers who do not have an active employment relationship and pay through the extraordinary amortization regime (REA), adhering to one of Infonavit’s social collection options.

Over-the-counter payments total 129.7 billion pesos during this six-year period, with 2023 being the best year with 26.4 billion; until July of this year, over-the-counter payments reached 16.2 billion.

For the general director, another important point is the management of the Infonavit investment fund, which is at levels of 760,000 million pesos, when they received it with 146,000 million, around 29% of Infonavit’s assets.

The investment fund is long-term – with a diversified portfolio with 54% in government debt and the rest in variable income, Fibras, among other instruments – explains Martínez Velázquez, which can be used once the securities mature.

“The investment fund is recognized not only for its growth – multiplied by more than five times – but also for our ability to diversify and maintain it internally,” boasts the general director, while pointing out that previous administrations outsourced it. “What we did was build internal capabilities, train personnel to operate it,” he adds.

In the short term, he says, “as long as there is an upward wage policy, there will be no need to use the investment fund. As long as there is more income than expenditure, there will continue to be a surplus, which can be used for construction,” he says.

According to the institute’s projections, it is estimated that between 40 and 50 billion pesos can be allocated for housing construction next year “without dissolving the investment fund.”

“At the time, for example, of (Vicente) Fox and (Felipe) Calderón, they didn’t have money to lend, so they ‘securitized’ the mortgages – between 2010 and 2015. They sold the loans to the stock market to continue lending. Today there is enough money to lend, to build and to maintain the investment fund,” he points out.

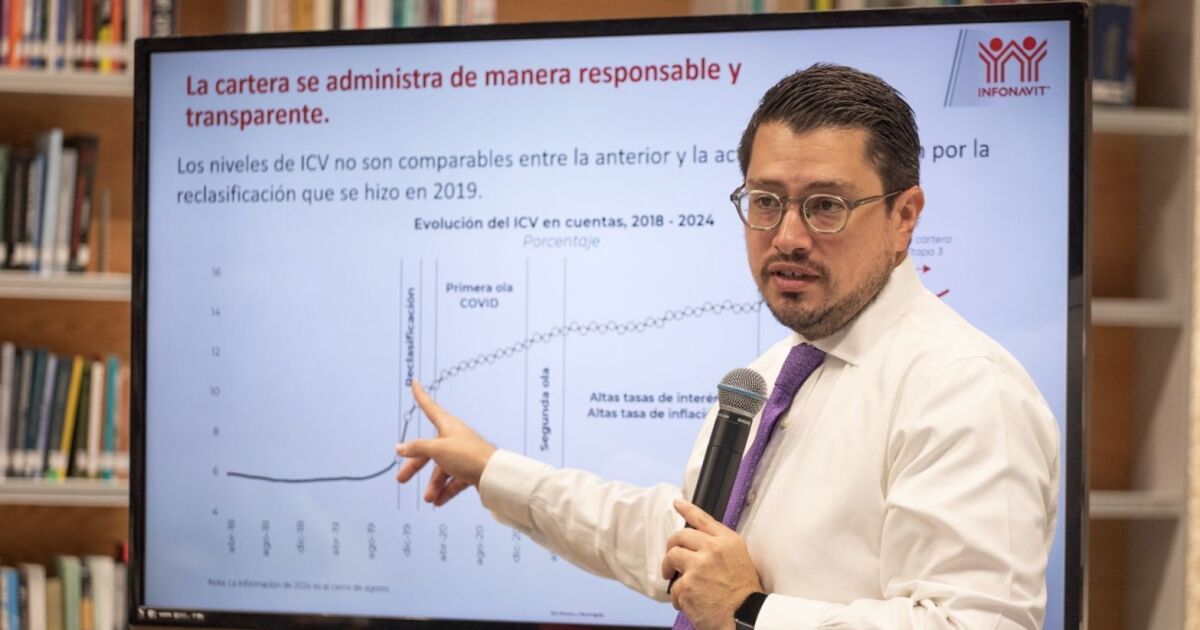

No worries about the overdue portfolio

Regarding the delinquency rate, known as overdue portfolio, the general director of Infonavit believes that “it is not worrying.”

Currently, the default rate is around 18%, a level that will decrease as loans are converted from minimum wages (VSM) to pesos and “old” loans are closed.

The non-performing portfolio of loans in pesos is at 9%, while that of loans granted in VSM is at 25%. “Hence the importance of converting them.”

He estimates that the non-performing loan portfolio will remain at similar levels to the current one over the next two years.

“I don’t want to blame him, but the loans that were generated with (Felipe) Calderón were bad loans, very expensive and in remote places. Who is going to pay them? It was torture,” said the outgoing director of the institute.