The official DANE figure defines the economic adjustments that households must assume in 2026.

News Colombia.

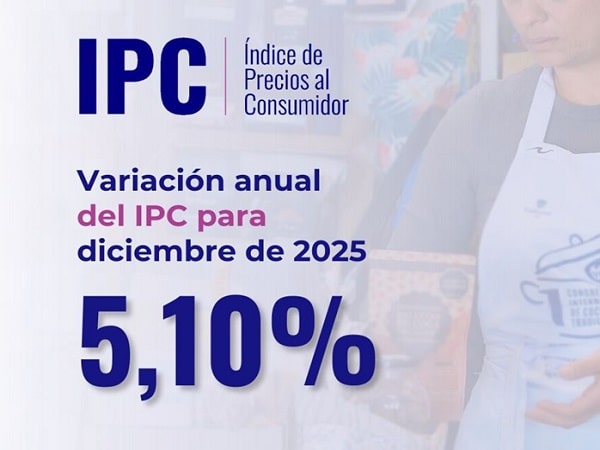

He National Administrative Department of Statistics (DANE) reported that the annual variation of Consumer Price Index (CPI) of 2025 was located in 5.1%a figure that reflects the behavior of the cost of living in Colombia at the end of the year. This indicator is key to measuring inflation and serves as a reference for multiple economic adjustments.

See: “To protect public transport and the pockets of families” Minenergía, on the end of the diesel subsidy for private vehicles

The CPI data shows how the prices of basic goods and services that are part of the daily spending of Colombian households evolved, such as food, housing, transportation and public services. Although the figure represents a slowdown compared to years of higher inflation, it continues to have a direct impact on the pockets of millions of citizens.

One of the most immediate effects of the CPI is on housing rents, which by law can be adjusted based on annual inflation. With 5.1%, a rent of 1,000,000 pesos will cost 1,051,000 pesoswhich means a monthly increase of 51,000 pesos for tenants.

#IPC | In December 2025, the Consumer Price Index registered an annual variation of 5.10%, while the monthly variation was 0.27%. pic.twitter.com/5ZUCssxmYT

— DANE Colombia (@DANE_Colombia) January 8, 2026

This increase, although moderate in percentage, represents an additional burden for families that already allocate a significant part of their income to paying for housing. In major cities, where rental costs tend to be higher, the adjustment may be felt more strongly in monthly budgets.

In addition to leases, the CPI also influences other contracts and rates that are indexed to inflation, such as some services, fees, royalties and commercial agreements. For this reason, the DANE data becomes a mandatory reference for both households and companies.

The closing of the 2025 CPI at 5.1% makes it clear that, although inflation shows signs of control, the cost of living continues to increase. For citizens, the challenge continues to be balancing their personal finances in the face of adjustments that, accumulated, end up significantly impacting the family economy.

You may be interested in: