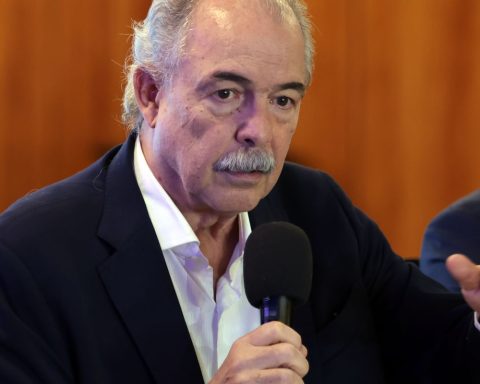

The president of the Central Bank (BC), Roberto Campos Neto, said today (25) that there are still difficulties to control the generalized increase in prices in Brazil and in the world. “We still haven’t won the battle of inflation either locally or globally. It is important to persist”, said Campos Neto, in a lecture during a luncheon promoted by the Brazilian Federation of Banks (Febraban).

However, high inflation seems to be stabilizing, highlighted the president of the Central Bank. “Inflations around the world seem to have reached a peak, or at least a high plateau, and are either flattening out or falling.”

Campos Neto pointed out that, in Brazil, the current scenario makes the market predict new hikes in the basic interest rate to face the problem. “The market expects interest rates to rise again. I think there is uncertainty here regarding the fiscal framework,” he added.

According to the president of the BC, the inflation scenario was caused by an increase in demand during the covid-19 pandemic without an increase in supply, especially of goods, that could keep up with this increase. “A lot of money was put into circulation, and that money made the demand for goods go up a lot”, he pointed out.

For him, the production of goods, associated with changes in energy matrices, ended up putting pressure on energy supply, a situation that was further aggravated by the war in Ukraine.

Furthermore, added Campos Neto, there are structural components that have caused inflationary trends. According to him, historically, governments around the world have sought ways to increase the productivity of economies, which has not been done in recent years. “Productivity drops, and governments react by making reforms, but that hasn’t been the case for the last 10 or 15 years. We have productivity falling with the lowest volume of renovations in history.”

For the president of BC, in the coming months, the pressures should remain, due to the need for spending in the social area. “Governments still need to make different packages understanding that there is a social need, but we cannot have monetary policy on one side and fiscal policy on the other”, he highlighted.