In developing economies such as the Dominican one, the increase in the monetary policy rate (MPR) is “the best way to moderate pressures on prices and maintain economic stability.”

However, “it is common for some economic agents to interpret this decision in an erroneous way, coming to think that the increase in the reference rate would lead to higher inflation, when in reality it is the opposite”, two of the main economists explain. thinkers of the Central Bank of the Dominican Republic.

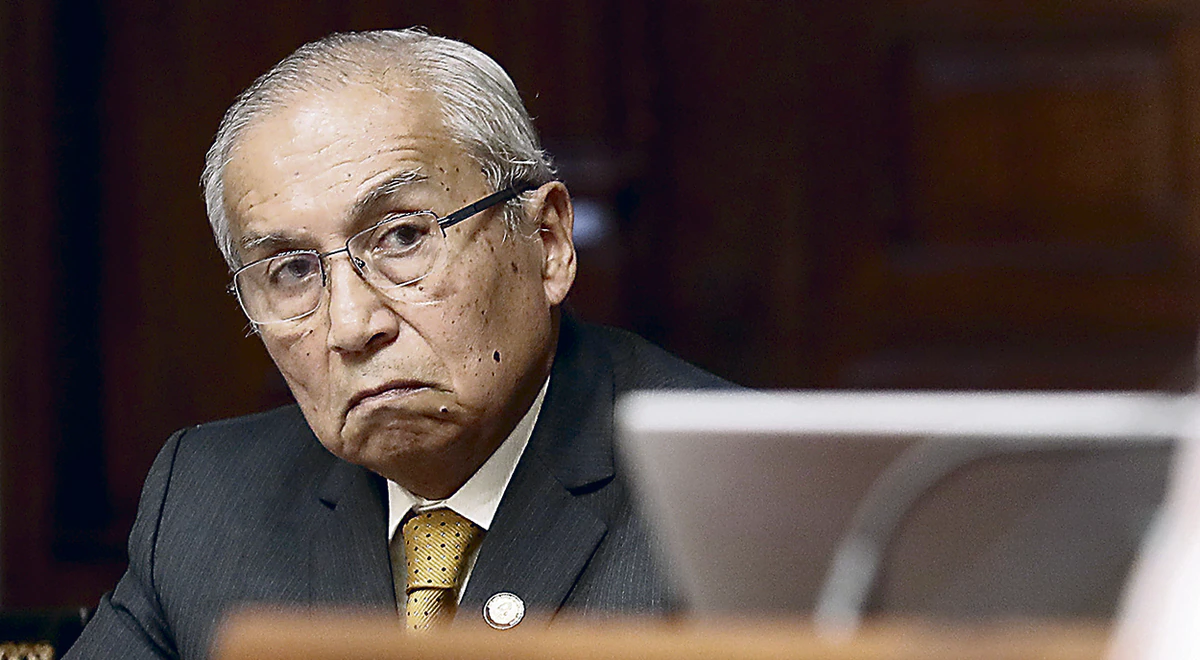

Julio Andújar Scheker and Joel González Pantaleón make an extensive analysis entitled “Why are central banks raising their monetary policy rates?”, which they publish in the Open Page section of the BCRD.

They refer that “central banks around the world are increasing their monetary policy rates (MPR), as part of a normalization process to counteract the inflationary shock of external origin.” In this context, the economists of the Central Bank of the Dominican Republic (BCRD) present an analysis, “with the aim of keeping economic agents and the general public educated to achieve an adequate understanding of the reasons why the issuing entities they modify their reference interest rates”.

They point out that the decisions to increase or reduce the MPR are linked to the conditions facing the economy at a given moment, which can cause potential deviations from the central bank’s inflation target.

Andújar and González indicate in their writing that “most central banks have price stability as their main objective, thus helping to create the conditions for sustainable growth that generates jobs and contributes to economic development. To meet this goal, the central bank uses various instruments, the most important being the MPR. This rate provides a signal about the type of policy that the Central Bank is implementing and serves as a reference for the interest rates of the financial system and the capital market, being a clear indication of the cost of money”.

They cite that, for example, “if an economy is facing upward pressure on inflation and is in a situation of high growth, central banks increase their MPR to encourage savings and avoid overheating of economic activity, helping to balance the demand for goods and services with the capacity of national production”.

They also state that if the economy goes through a period of low growth and absence of inflationary pressures, the monetary institution reduces its MPR to promote a boost in consumption and investment through lower interest rates, which encourages economic agents to opt for more financing.

They point out that the world is currently facing an extraordinary inflationary shock, caused by the disproportionate increase in the price of oil and other raw materials, as well as the higher costs of freight and the uncertainty associated with the war between Russia and Ukraine. “These supply disruptions, initially generated by the Covid-19 pandemic, have caused second-round effects on prices, leading almost all central banks to increase their MPRs,” they add.

In LA, the rate increases have been greater

Andújar and González report that during recent months, among the central banks of advanced economies that have increased their reference interest rates are Canada (125 points), England (90 basis points) and the United States (75 points), with expectations that rate increases will continue for the rest of the year. They explain that in Latin America the increases in the MPR have been higher than those of the industrialized economies, as they face a more rapid deterioration in inflation expectations and greater exchange rate volatility, standing out Argentina (1,100 points), Brazil (1,075 points), Chile (775 points), Paraguay (600 points), Peru (475 points), Uruguay (475 points), Colombia (425 points), Costa Rica (325 points), Mexico (275 points), Nicaragua (50 points) and Guatemala (25 points). They explain that in the case of the Dominican Republic, taking into account these external shocks and the growth of the economy of 12.3% in 2021 and 5.8% during the first four months of 2022, the Central Bank has preventively increased its policy rate rate at 350 basis points, going from 3.00% in November 2021 to 6.50% today.