The statistics on the financial rule of cooperatives in the Dominican Republic they are imprecise. What is certain is that this savings and financing model is strengthened in urban and rural communities, contributing to economic growth. However, the lack of regulation it prevents greater financial inclusion and constitutes a loophole for asset laundering.

To 2016in the country they had registered 860 mutual entities and already for the 2020 they had 1,162. For that year they registered 302 entities additionalwhose status is unknown, indicates the strategic plan for the 2021-2025 period of the Institute for Cooperative Development and Credit (idecoop).

The document highlights that the country needs a census to determine the number of cooperatives existing ones, their flow of operations and number of associated people. Having detailed information on the activities of the sector is decisive to enhance its level of reach, highlights the entity.

However, the Development and Credit Institute develops a strategy to increase the cooperativism at the national level.

The entity approved on time record 808 new entities, from August 2020 to February 2022, according to the latest statistical report published on its website, which highlights the goal of encouraging the training of more than 2,000 cooperatives in four years.

“To form a cooperative, you only need a minimum of 15 people to agree to save together and achieve collective and individual goals that also benefit the town in which they are located”Executive Director of the Association of Rural Savings and Credit Institutions (Airac)

A self-regulating screed

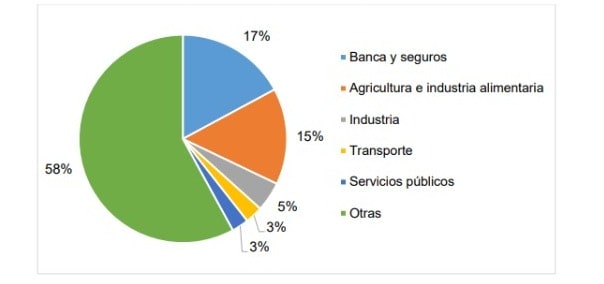

Even though that him idecoop registered 1,162 entities in 2020, for the executive director of the Association of Rural Savings and Credit Institutions (Airac), José Rodríguez, in the country there are approximately 350 active cooperatives –reporting their activities–, of which close to 95% are savings and credit.

He explained that the best performance in the sector cooperatives register in the zones northeast Y East of the country, where traditional banking has less scope, becoming the “hope” of the productive sectors of the rural zones.

“The cooperatives have greater impact in the northwest, where the largest cooperatives of the country: La Sierra, San José de las Matas, Mao, Santiago, Montecristi, Dajabón, Esperanza and Loma de Cabrera”, explained the executive.

To explain the importance of cooperatives in less economically developed areas, Rodríguez indicated that most of these organizations began in municipalities where some type of productive activity is carried out such as agricultural and the craft.

In that order, he explained that one of the reasons why the central bank should consider the regulation of cooperatives rural savings and credit is that, to a greater extent, its members require an account to receive the flows of your savings and, as cooperativesare not authorized to issue products of multiple services.

“We operate clandestinely,” which makes it difficult to financial inclusion of people who contribute to the economy and community development, he acknowledged.

-

Health

-

Education

-

producers

-

Entrepreneurs

-

Social groups

-

workers

-

Among other areas whose motivation for existence has been to support itself financially with savings that generate profits among members

cooperatives urban

The history of cooperativism in the Dominican Republic shows that its potential is exhibited in less developed locations. However, over the years, there has been an increase in the cooperativism in zones urban. Santo Domingo and Santo Domingo Este are the demarcations in which the most cooperatives active there are registered, according to the idecoop.

The fact that sectors of the capital and surrounding areas are forming cooperatives is an indication that people are valuing the economic system of saving and investments together, as a source of income and equitable development, considered the director of the Airac.

“I think the urban cooperatives They are one of the few hopes that the largest provinces have to develop. In addition, the inclusion of cooperatives is positive for executing development plans independent of government actions, ”he stated.

In that order, he specified that the cooperatives can be part of solutions that are needed in the communities of the cities, responding to problems with immediate actions such as road repair, access to basic services and new financing options.