Although the average price recently moved lower for exported beefremains at historically high levels and the Uruguayan export flow does not yield: this year revenues have been generated even higher than those that set a record last year (US$2,989 million).

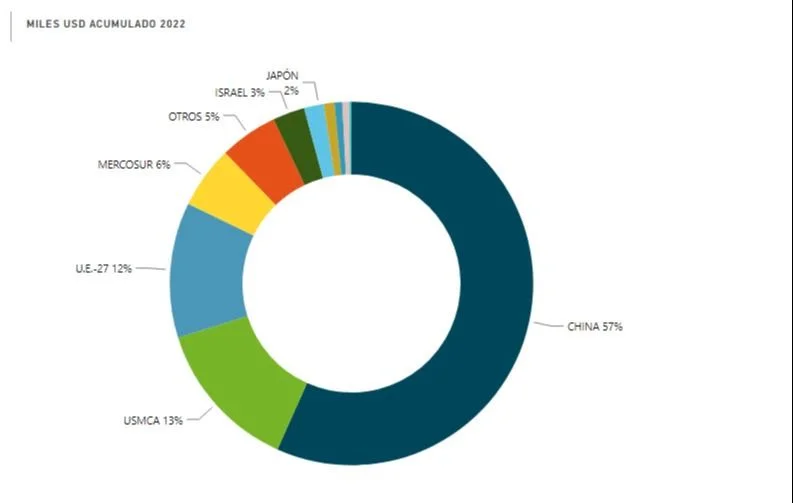

So far in 2022, more has been exported, at a better price, and more foreign currency has entered. And in this scenario, China continues to be –and by far– the main market, reiterating what has been constant in recent years.

China is responsible for 57% of total income, after having captured 65% of beef shipments (and 45% of sheep).

What that market invested in Uruguayan meats had an increase of 27% compared to 2021always considering the first eight and a half months of the year, reaching US$ 1,343 million.

Carlos Pazos

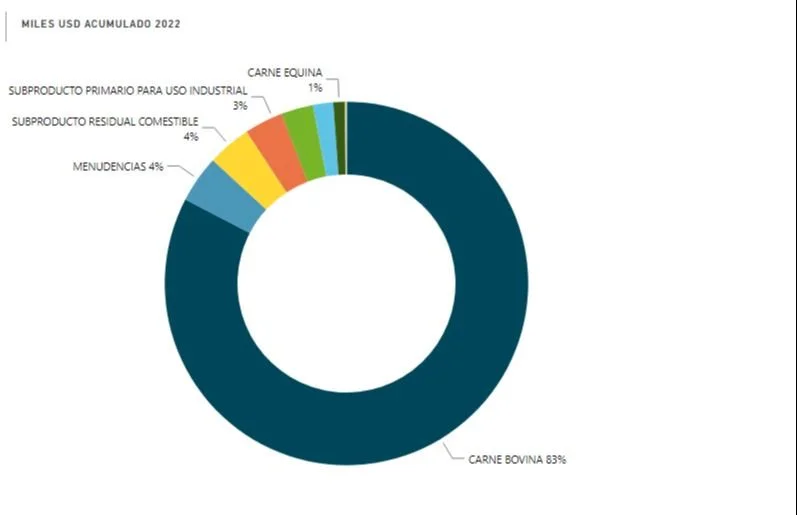

Beef accounts for more than 80% of foreign exchange earnings from exports.

Revenue rose almost 25%

Foreign currency income to Uruguay from meat exports rose by 24.3% in 2022 in the annual accumulated –as of September 17–, compared to what happened in that period of 2021.

so far this year US$ 2,370 million were reached (last year they were US$ 1,907 million).

From the beginning of January to the middle of September 490 thousand tons of shipping weight were shipped (last year there were 473 thousand)with a slight growth in volume, of 3.3%.

It was achieved at the moment (considering all the meat items) an average price of US$ 4,846 per ton, when in the same period of 2021 it averaged US$ 4,026 (with an improvement in that value of 20.4%).

Main markets (all meats)

China 57% (US$ 1,343 million) with a growth of 27% in 2022 compared to 2021.

USA + Canada 13% (US$ 319 million) with an improvement of 24.8%.

European Union 12% (US$ 286 million) with a growth of 14.1%

Mercosur 6% (US$ 131 million) with a growth of 47.5%

Israel 3% (US$ 67 million) with a drop of 9.3%.

Japan 2% (US$ 41 million) with growth of 40.9%.

Beef leads with 83%

Always based on data provided to The Observer by technicians from the National Meat Institute (INAC), Considering exclusively beef exports (they explain 83% of the total foreign currency corresponding to all exported meats), revenues rose from 2021 to 2022 (always on September 17) 27.3% to US$ 1,959 millionwith a growth of 1.8% in volume, reaching 380 thousand tons (carcass weight).

The Average Income from Exports (IMEx) for that export accumulated in the current year is located at US$ 5,145 per tonclearly above the value for the same period last year (US$ 4,113), 25.1% more.

The average price remains firm and in the last week measured, which ended on September 17, it stood at US$ 5,300 per ton of beef.

Carlos Pazos

China is the most relevant destination for Uruguayan meats.

China keeps its gold mesh

Based on carcass weight, always for bovine meat, China continues to be the largest customer, capturing 247 thousand tons (carcass weight), 65% of the total, increasing its demand by 9.8% so far in 2022 in relation to the same period of 2021.

In the rest of the podium of key destinations appear the United States + Canada with 58 thousand tons, 15% of the total, with a drop in this case of 3.3%; and the European Union, which had a drop of 7.6% (28 thousand tons, 7% of the total).